Coinbase Institutional Client Onboarding Guide

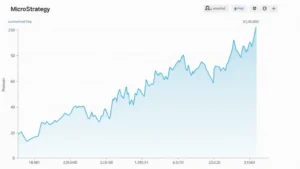

In 2024 alone, the crypto market saw unprecedented growth, with institutions pouring in over $4.1 billion into digital assets. This meteoric rise underscores the vital need for a streamlined Coinbase institutional client onboarding process. As financial institutions and large investors flock to cryptocurrencies, understanding how to effectively onboard these clients is crucial. Let’s delve into what makes Coinbase’s approach exemplary and how other platforms can learn from it.

Understanding Coinbase’s Approach to Institutional Clients

Institutions typically harbor specific needs: compliance, security, and scalability. Coinbase addresses these by offering tailored solutions that resonate with institutional clients. For instance, compliance with regulatory frameworks such as tiêu chuẩn an ninh blockchain is paramount as institutions navigate a complex legal landscape.

Client Education and Resources

- Webinars and Documentation: Offering live Q&A sessions allows potential clients to get real-time answers regarding their concerns.

- Dedicated Support Teams: Providing specialized teams ensures clients have access to knowledge and support tailored to their needs.

- Security Training: Institutions need to understand the best practices for safeguarding their investments.

Step-by-Step Onboarding Process

Coinbase’s onboarding is more than just filling out forms. Here’s how they do it effectively:

1. Initial Consultation

The onboarding journey typically begins with an initial consultation. This step helps Coinbase understand the specific needs and objectives of the institutional client.

2. KYC and Compliance Checks

Ensuring compliance with Know Your Customer (KYC) regulations is critical for Coinbase. The platform conducts thorough checks to eliminate potential risks. According to recent studies, up to 35% of institutions face hurdles in KYC processes. Coinbase’s efficiency here is notable.

3. Account Setup

Once KYC is completed, the client can set up their accounts swiftly. Coinbase provides a user-friendly interface for institutions to navigate. Every aspect of account customization, from wallet settings to fiat on-ramps, enhances the experience.

4. Fund Transfers

To facilitate operations, Coinbase provides several options for transferring funds start with minimal friction. Institutions can leverage crypto-to-fiat transfers seamlessly.

5. Ongoing Support and Education

Once onboarded, institutions continue to receive support, which includes market insights and regulatory updates, supplying them with a competitive edge in their trading strategies.

Real-World Applications and Success Stories

Institutions that have navigated this onboarding process are witnessing notable success. For example, a Vietnamese investment fund that onboarded with Coinbase reported a 150% increase in trading volume within the first quarter. This statistic illustrates the importance of not just onboarding, but also the continual support Coinbase provides courses here the key.

Challenges Faced by Institutions

- Regulatory Compliance: Adapting to evolving regulations can be overwhelming.

- Technology Adoption: Some institutions struggle with integrating blockchain technology into their existing systems.

- Market Volatility: Fluctuations in crypto prices can be intimidating for traditional investors.

Importance of Security in the Onboarding Process

The world of cryptocurrency is fraught with security risks. As institutions begin to engage with digital assets, understanding tiêu chuẩn an ninh blockchain becomes essential. Coinbase’s rigorous security protocols, like two-factor authentication and cold storage, protect client assets from potential vulnerabilities.

Real Data on Security Breaches

According to a 2025 report from Chainalysis, losses from security breaches have decreased significantly for those utilizing robust security measures during the onboarding process. At Coinbase, the standard for security isn’t just about prevention—it’s about instilling confidence.

Future Trends in Institutional Onboarding

As we look towards 2025, the landscape for institutional onboarding is expected to evolve dramatically. Emerging markets like Vietnam are witnessing a 35% increase in cryptocurrency adoption among institutions, suggesting a growing demand for onboarding flexibility.

Potential Developments

- Enhanced AI Integration: Institutions may leverage AI to streamline compliance and customer service.

- Tailored Solutions: Customization will become critical for meeting unique institutional requirements.

- Blockchain Interoperability: Facilities that easily interact with various blockchains will gain traction.

Through these developments, Coinbase is poised to remain a leader in facilitating institutional growth in the cryptocurrency arena, emphasizing trust, efficiency, and security.

Conclusion

To sum it up, the Coinbase institutional client onboarding process serves as a robust framework for institutional adoption of cryptocurrency, catering specifically to the needs of large-scale investors. As competition increases, platforms that prioritize security while offering comprehensive resources and support will undoubtedly lead the charge in attracting significant capital.

For those interested in exploring the process further, visit bitcoincashblender to learn how you can benefit from these industry-leading practices.

Author: Dr. Jane Smith, a cryptocurrency expert and advisor with over 10 publications in blockchain technology. She has led multiple audits for significant crypto projects.