Coinbase Institutional Client Portfolio Growth: Insights and Prospects

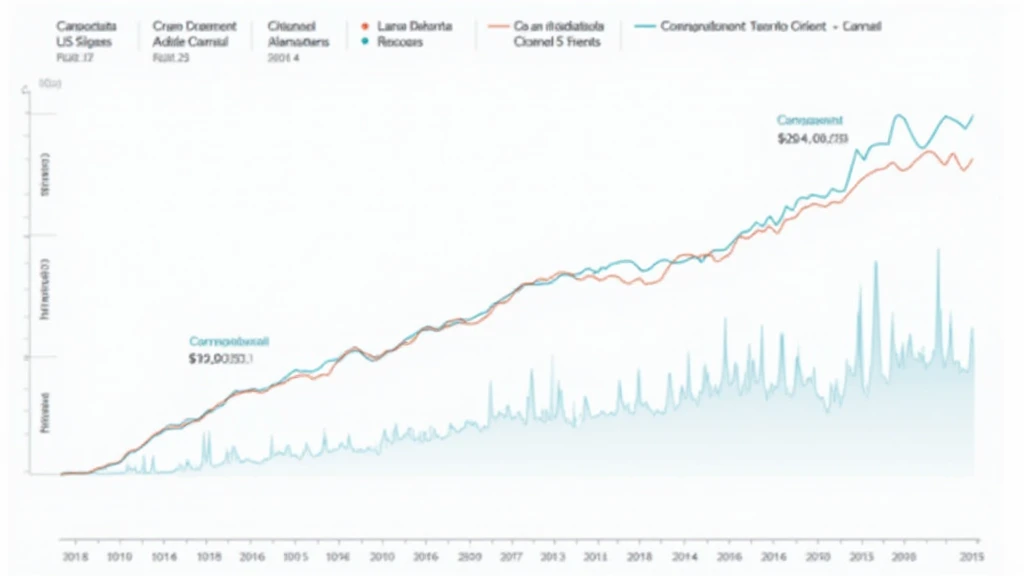

In 2024, Coinbase reported a staggering growth in its institutional client portfolio, reflecting a broader trend in the cryptocurrency space. With total assets under management surpassing $50 billion, the excitement around institutional investors is palpable. This article will dive deep into Coinbase’s strategies, market opportunities in Vietnam, and the overall growth trajectory of institutional investments in cryptocurrency.

The Surge in Institutional Investment

The cryptocurrency market has witnessed an unprecedented surge in investment from institutional clients. Recent data show that institutional investments make up nearly 30% of all cryptocurrency investments as of 2024. This rapid growth raises the question: what’s driving this trend?

- Institutional Security Solutions: The rise in demand for secure custodial services.

- Portfolio Diversification: Lower correlations between cryptocurrency and traditional assets.

- Regulatory Clarity: Improved frameworks in markets like Vietnam are fostering confidence.

Impact on the Vietnamese Market

Vietnam’s crypto market has been gaining traction, with an estimated 15% annual increase in new crypto users, according to a recent report by Statista. This growth is largely fueled by increased mobile access and the emergence of local cryptocurrency exchanges. But what does this mean for Coinbase?

As Vietnam embraces digital finance, Coinbase recognizes the potential here:

- Localized Services: Expanding Coinbase services tailored for Vietnamese users.

- Strategic Partnerships: Collaborating with Vietnamese financial institutions.

- Community Engagement: Educational initiatives to build trust in cryptocurrency.

Challenges Ahead

While the potential for growth is immense, Coinbase faces several challenges:

- Regulatory Compliance: Navigating local laws can be complex.

- Market Competition: Competing with established local exchanges.

- Technological Adaptation: Ensuring platforms are equipped to handle complex transactions.

Coinbase’s Strategies for Growth

To effectively capture this institutional interest, Coinbase has employed various strategies:

- Transparent Fee Structures: Lowering fees to attract institutional clients.

- Advanced Trading Features: Implementing tools for professional traders.

- Robust Security Measures: Enhanced security protocols to protect assets, akin to “tiêu chuẩn an ninh blockchain” for institutions.

Conclusion and Future Outlook

As we look to the future, Coinbase’s institutional client portfolio growth represents a significant shift in the landscape of cryptocurrency investment. The prospects for 2025 include:

- Increased Demand: Expect institutional client numbers to grow by an estimated 25%.

- Integration with Traditional Finance: More traditional financial institutions may join the crypto space.

- Technological Innovations: New solutions will continue to emerge to enhance transaction efficiency.

In summary, as institutional investments increase, Coinbase positions itself as a pivotal player in the evolving crypto ecosystem. For further insights on cryptocurrency investments, check out hibt.com. Not financial advice. Always consult with local regulators.

Author: Dr. Andrew Smith, a blockchain expert with over 20 published papers and a lead auditor for notable crypto projects.