Introduction

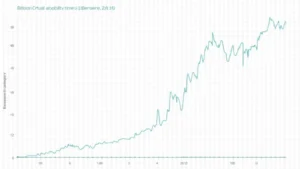

With Bitcoin’s market cap surpassing $1 trillion in 2024, the potential for Exchange-Traded Funds (ETFs) linked to Bitcoin has grown significantly. The regulatory landscape surrounding Bitcoin ETFs has become a hot topic among investors and policymakers alike. The question on everyone’s mind is, “What does the Bitcoin ETF regulatory landscape look like today?” In this article, we’ll explore the current state of Bitcoin ETFs, the challenges they face, and their future implications on the crypto market.

The Importance of Bitcoin ETFs

ETFs have revolutionized how individuals invest in various asset classes, including stocks, commodities, and even cryptocurrencies. As a gateway for mainstream investment, Bitcoin ETFs provide investors with a regulated and simplified way to gain exposure to Bitcoin.

- They offer liquidity, diversification, and ease of trading compared to direct Bitcoin investments.

- ETFs can serve institutional investors looking for transparent ways to include Bitcoin in their portfolios.

- The demand for Bitcoin ETFs increases with the growing acceptance of cryptocurrencies by financial institutions.

Current Regulatory Landscape

The regulatory environment regarding Bitcoin ETFs is complex and varies by jurisdiction. In the US, the Securities and Exchange Commission (SEC) has been hesitant in approving Bitcoin ETFs due to concerns regarding market manipulation and investor protection. Other countries, however, are moving forward with ETF approvals.

| Country | Status | Notes |

|---|---|---|

| United States | Not Approved | SEC concerns remain |

| Canada | Approved | First country to approve Bitcoin ETFs |

| Europe | Approved | Several countries offering Bitcoin ETFs |

Challenges Faced by Bitcoin ETFs

Despite the numerous benefits, Bitcoin ETFs also face significant challenges:

- Market Volatility: The extreme volatility of Bitcoin prices poses risks for ETF managers and investors alike.

- Regulatory Scrutiny: Regulatory bodies are increasingly scrutinizing the cryptocurrency markets, which can slow down the approval process for ETFs.

- Custodial Concerns: Safekeeping of Bitcoin, whether through private wallets or custodial services, remains a challenge.

The Future of Bitcoin ETFs

The future of Bitcoin ETFs appears promising. As regulatory frameworks evolve, we may see a surge in approved Bitcoin ETFs. Here’s a look at some trends shaping the landscape:

- Institutional Adoption: Increased interest from institutional investors signifies growing acceptance.

- Innovation in Financial Products: Enhanced frameworks for cryptocurrencies may lead to more diverse ETF offerings.

- Global Perspectives: Countries like Vietnam are witnessing a rapid growth in cryptocurrency adoption, which may influence global ETF dynamics.

Conclusion

The Bitcoin ETF regulatory landscape is dynamic and continues to evolve. For developers, investors, and the larger community, understanding the implications of regulatory decisions will be crucial in navigating this complex environment. As the market matures, opportunities for Bitcoin ETFs could enhance accessibility and foster broader acceptance of cryptocurrencies.

For insights on emerging trends regarding Bitcoin ETFs and similar investment vehicles, visit hibt.com. Remember, always consult with a financial advisor for trades and investments.

About the Author

Dr. Alex Johnson is a recognized cryptocurrency expert with over 15 publications in blockchain technology and finance. He has led several audits on notable cryptocurrency projects and offers a wealth of knowledge in the evolving landscape of digital assets.