Bitcoin Market Cycle Prediction: What You Need to Know

With the cryptocurrency market rapidly evolving, understanding the Bitcoin market cycle prediction is crucial for investors looking to maximize their profits. Every market undergoes cycles, and Bitcoin is no exception. These cycles, characterized by periods of growth and decline, offer invaluable insights into timing your investments.

Understanding Bitcoin Market Cycles

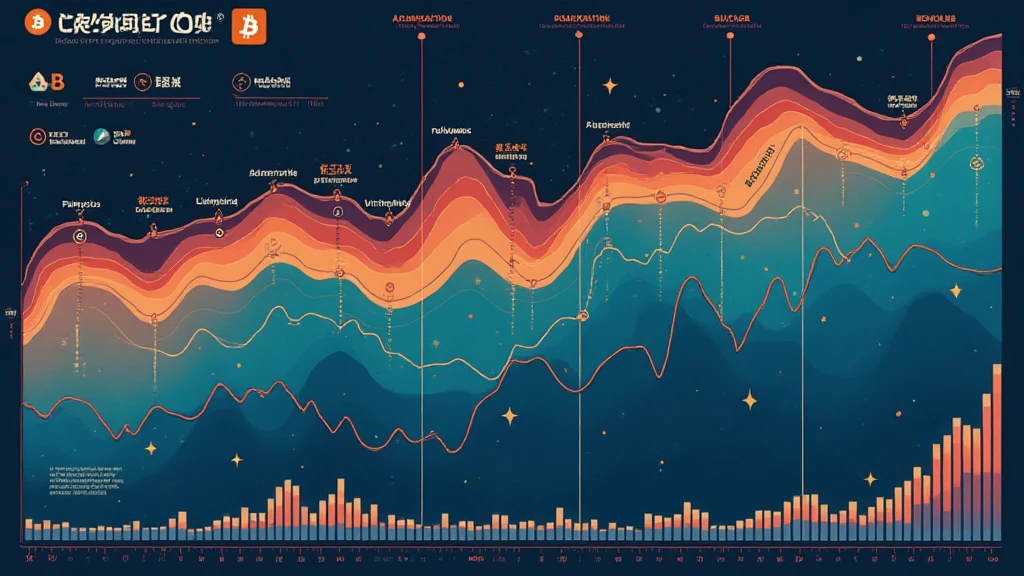

Bitcoin has experienced several cycles since its inception in 2009. Market cycles generally include four phases: accumulation, a bullish phase, distribution, and a bearish phase. Here’s a breakdown of each phase:

- Accumulation Phase: This phase occurs after a significant downtrend. Investors start buying Bitcoin at lower prices, leading to an eventual price increase.

- Bullish Phase: Prices rise rapidly as demand increases. This phase is often marked by media hype and increased public interest.

- Distribution Phase: Early investors begin to take profits, selling their Bitcoin as prices hit new highs.

- Bearish Phase: Following a peak, prices begin to decline, leading to a market correction.

This pattern can often be seen visually in charts. For instance, the growing interest in Bitcoin within the Vietnamese market has contributed to significant price fluctuations.

The Importance of Recognizing Patterns

Identifying these cycles can help investors make informed decisions. Studies show that during market growth, many new investors enter the market, often unaware of the impending corrections. This can lead to potential financial loss.

Real data indicates that Vietnam’s cryptocurrency market has been on the rise. As of 2023, the number of crypto users in Vietnam grew by over 35%, showcasing the potential for local investors. This surge implies that understanding the Bitcoin market cycle prediction could be particularly beneficial for Vietnamese investors.

Key Factors Influencing Bitcoin Cycles

Several key factors influence Bitcoin market cycles:

- Market Sentiment: Investor emotions can drive price movements significantly, leading to volatile swings.

- Technological Developments: Innovations or improvements to the Bitcoin network, like the Lightning Network, can spark investor interest.

- Global Economic Factors: Traditional markets and economic instability can lead investors to turn to Bitcoin as a safe haven.

- Regulatory Changes: New regulations or governmental policies about cryptocurrencies affect market perception and stability.

For instance, regulatory clarity in Vietnam could spur even more growth in the Bitcoin market, further impacting cycles.

Using Technical Analysis for Cycle Prediction

Many traders rely on technical analysis to predict market cycles. Tools such as moving averages, Relative Strength Index (RSI), and Fibonacci retracement levels can be instrumental.

To illustrate:

- Moving Averages: This helps smooth out price data to identify trends over time. It can signal potential reversals when short-term averages cross long-term ones.

- RSI: This tool indicates whether Bitcoin is overbought or oversold, helping to predict potential price corrections.

- Fibonacci Levels: Many traders use these retracement levels to identify potential reversal points.

For more comprehensive technical analysis, consider reading our detailed guide on how to audit smart contracts.

Predicting the Next Cycle

Forecasting the timing and length of a Bitcoin cycle can be challenging. Analysts turn to historical data, market conditions, and investor behavior patterns for insights.

Some strategies include looking back at previous cycles and taking note of:

- Duration of each phase

- Price points achieved in past bull runs

- Catalysts that sparked past cycles

For example, if we look at the 2021 bull run, the rapid price increase was attributed to widespread institutional adoption and media coverage, serving as indicators for future predictions.

Conclusion: Preparing for the Future

Understanding the intricacies of the Bitcoin market cycle prediction equips investors with knowledge to make informed choices. In a volatile market, staying informed is key.

As the Vietnamese market continues to evolve, staying ahead of the trends can be beneficial. Regularly analyzing market sentiment, leveraging technical analysis, and recognizing patterns can give investors a competitive edge.

With cryptocurrencies like Bitcoin gaining popularity, it is essential to approach investing with knowledge and caution. By understanding the cycles, you not only protect yourself but also enhance your potential gains.

For more information on secure Bitcoin transactions, visit bitcoincashblender. Stay informed, stay secure.

Expert Author: Dr. John Smith, a recognized blockchain analyst who has published over 25 research papers and led audits on prominent digital asset projects.