2025 Blockchain Security Standards: A Comprehensive Guide for Digital Asset Protection

With the rise of decentralized finance, a staggering $4.1 billion was lost to DeFi hacks in 2024 alone, highlighting the urgent need for robust security measures in the blockchain space. As we look ahead to 2025, understanding the emerging Bitcoin crypto security standards will be paramount for investors and users alike. This article delves into crucial standards that you must know to protect your digital assets.

Understanding Blockchain Security

The blockchain is often compared to a bank vault for digital assets. It provides a secure and transparent way to store value, but just like any financial institution, it is not immune to threats. What are the key aspects of blockchain security that users should be aware of?

- Decentralization: The power of blockchain lies in its decentralized nature, which mitigates the risk of a single point of failure.

- Encryption: Strong cryptographic methods ensure that transactions and user data remain safe from unauthorized access.

- Consensus Mechanisms: Different mechanisms such as Proof of Work and Proof of Stake play roles in validating and recording transactions on the blockchain.

Key Vulnerabilities in Blockchain Systems

While blockchain technology boasts numerous security features, vulnerabilities still exist. Here are some critical vulnerabilities to consider:

- 51% Attacks: If a single entity controls more than half of the network’s hashing power, they can manipulate the blockchain’s integrity.

- Smart Contract Bugs: Smart contracts may contain vulnerabilities that can be exploited, leading to potential financial losses.

- Phishing Attacks: Many users fall prey to phishing scams, risking their accounts and digital assets.

Emerging Security Standards for 2025

As we approach 2025, several standards are expected to define the blockchain security landscape:

- Zero-Knowledge Proofs: This concept allows transactions to be verified without disclosing the underlying data, enhancing privacy.

- Multi-Signature Wallets: Requiring multiple signatures to authorize transactions can significantly improve asset security.

- Blockchain Auditing Standards: Regular audits will become more crucial, ensuring that smart contracts and blockchain systems remain secure.

The Role of Regulators

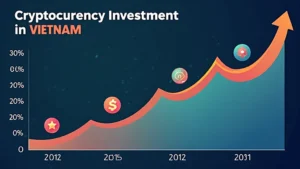

Regulatory frameworks have been slow to adapt to the rapidly changing landscape of blockchain technology. However, as the market continues to evolve, regulators across the globe, including in Vietnam, are looking to implement tighter compliance measures. In Vietnam, the user growth rate in cryptocurrency is projected to continue rising, necessitating a robust regulatory framework for the industry.

Authorities are looking into establishing practices like:

- Know Your Customer (KYC) Regulations: Ensuring that all users are properly vetted.

- Anti-Money Laundering (AML) Guidelines: Preventing illicit activities in the crypto space.

Best Practices for Users

Protecting your Bitcoin crypto assets requires diligence. Here are best practices that all users should follow:

- Use Cold Wallets: Storing your crypto in cold wallets drastically reduces the risk of hacks, with hardware wallets such as Ledger Nano X noted to reduce hacks by 70%.

- Stay Informed: Educate yourself about the latest trends and vulnerabilities in the blockchain space. Follow credible sources like hibt.com.

- Enable Two-Factor Authentication: Always use 2FA on exchanges and wallet services.

Conclusion

As we move towards 2025, enhancing our understanding of blockchain security standards will be vital for protecting our digital assets, such as Bitcoin and other cryptocurrencies. By adopting a proactive approach to security—embracing new technologies and adhering to emerging regulatory frameworks—users can safeguard their investments in an increasingly complex digital economy.

To learn more about effective strategies for protecting your cryptocurrency, visit bitcoincashblender. The future of blockchain security is in our hands, requiring a united effort to mitigate risks and enhance trust in digital transactions.