Introduction

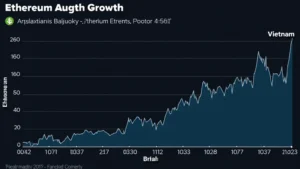

Vietnam’s digital asset market is witnessing unprecedented growth, with 1.5 million crypto users reported in 2023, an increase of 200% from the year before. As we approach 2025, understanding the implications of Vietnam crypto tax planning becomes essential for investors and traders alike. Navigating the complexities of tax regulations in the realm of cryptocurrency can be daunting, but by 2025, there will be unique opportunities and challenges arising from regulatory developments.

Understanding the Landscape of Crypto Taxation in Vietnam

In Vietnam, cryptocurrency is viewed as a legal asset rather than currency. This classification means that capital gains from crypto transactions are subject to taxation. The government is increasingly focused on implementing robust regulations surrounding digital currencies, leading to potential changes in the taxation landscape. By 2025, the attention on crypto tax compliance will be critical for anyone engaging in digital asset trading.

Regulatory Framework and Changes Expected in 2025

The Vietnamese government has proposed a legal framework that could significantly alter the taxation of cryptocurrencies. Key elements include:

- Standardized Tax Rates: Proposed tax rates may range from 15% to 20% on capital gains.

- Reporting Requirements: Mandatory disclosures on blockchain transactions may be instituted.

- Tax Exemptions: Potential exemptions for small-scale transactions to promote mass adoption.

Staying updated on these regulations is crucial for ensuring compliance and optimizing tax liabilities.

Crypto Tax Planning Strategies for 2025

Given the anticipated tax environment in 2025, strategic planning is essential. Here are notable strategies that can be employed:

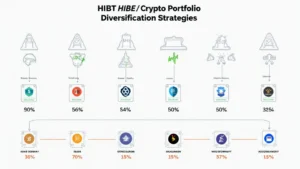

Diversification of Crypto Investments

Just like diversifying a portfolio of stocks, diversifying your cryptocurrency assets can mitigate risks and optimize returns. Consider allocating your investments across:

- Established currencies like Bitcoin and Ethereum

- Emerging altcoins (consider exploring 2025’s most promising altcoins based on market research)

- Stablecoins for stable returns

Documenting All Transactions

To ensure compliance, meticulous record-keeping of all transactions is vital. This means tracking every buy and sell transaction with accurate records, including dates and amounts. Here are tools that help:

- Crypto tax software such as CoinTracking or CryptoTrader.Tax

- Spreadsheets for manual entry and tracking

Utilizing Tax Loss Harvesting

Tax loss harvesting involves selling assets at a loss to offset capital gains. This can significantly lower your tax liability in a year where you’ve realized gains. For instance, if you’ve made gains from Bitcoin but also had losses in other altcoins, you could sell the underperforming coins to balance your taxable income.

Consult with Local Experts

Navigating the Vietnamese tax laws around cryptocurrency requires expert guidance. Consider consulting with local tax advisors or legal professionals who specialize in Vietnam crypto tax planning. Their insights can provide clarity on:

- Local tax obligations

- Potential deductions available

- Best practices for compliance

Impact of Blockchain Technology on Taxation

Blockchain technology itself offers transparent transaction records, simplifying the compliance process. Vietnamese authorities can benefit from using blockchain to track transactions and enforce regulations better.

As a comparison, much like authorities use surveillance cameras to monitor public spaces, blockchain can serve as a digital ledger that ensures transparency and interconnectivity between various stakeholders in the crypto ecosystem.

Future of Cryptocurrency in Vietnam

As we dive deeper into 2025, the crypto landscape in Vietnam is poised for transformation. Here are trends to watch:

- Regulatory Clarity: An increasing number of regulations will likely drive more users into the crypto space.

- Institutional Adoption: Companies in Vietnam may begin accepting crypto payments, further legitimizing the market.

- User Growth: Based on recent trends, Vietnam’s crypto users are expected to grow steadily, giving rise to a more dynamic market.

Conclusion

As we look forward to Vietnam crypto tax planning in 2025, it becomes evident that navigating this intricate landscape requires careful consideration and strategic action. From understanding regulatory frameworks to adopting practical tax strategies, staying proactive can ensure that investors and traders are well-prepared for the challenges ahead.

For ongoing updates and expert insights, head to hibt.com for comprehensive guidance on managing your crypto tax responsibilities in Vietnam and beyond. Remember, it’s important to consult professionals familiar with Vietnamese regulations to maximize your tax planning efficiency.

This article is not financial advice. Always consult with a local tax authority or a financial expert regarding your specific situation.

Author: Dr. Nguyen Minh Tuan, a renowned blockchain analyst, has authored over 30 papers on cryptocurrency regulations and has led audits for several prominent blockchain projects in Asia.