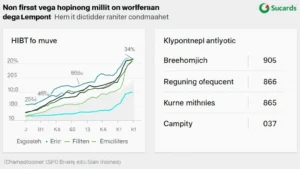

Bitcoin Trading Volume: HIBT vs Local Vietnamese Exchanges

In the fast-paced world of cryptocurrency, understanding trading volume is crucial for investors. With the rise of various exchanges, each has its unique trading volume trends. In this article, we’ll dive deep into the Bitcoin trading volumes of HIBT versus local Vietnamese exchanges, providing valuable insights backed by data. For example, did you know that the overall crypto trading volume in Vietnam increased by 56% in 2023? This significant growth indicates a burgeoning interest among Vietnamese investors in digital assets and highlights the importance of understanding where the best trading opportunities lie.

Understanding Bitcoin Trading Volume

Trading volume refers to the total amount of Bitcoin traded over a specified period. High trading volumes can indicate a strong interest in a cryptocurrency, while low volumes might signal a lack of investor confidence. For instance, if HIBT reports a 30% increase in trading volume while local exchanges only see a 10% increase, this is a strong indicator of HIBT’s growing market presence.

The Importance of Market Analysis

Investors often rely on market analysis to make informed decisions. This is no different when comparing HIBT and local Vietnamese exchanges. By analyzing trading volumes, one can ascertain which platform offers better liquidity, thus potentially reducing the slippage experienced when trading. As a practical analogy, think of it like comparing two grocery stores: one has a steady stream of fresh produce, while the other has only a few stale items. Users are more likely to pick the store with fresh produce, just as traders will prefer exchanges with higher Bitcoin liquidity.

Current Trends in Vietnam’s Crypto Market

The Vietnamese cryptocurrency landscape has been expanding rapidly. According to a report by HIBT, the Vietnam crypto user base has grown from 1 million in 2022 to around 1.56 million by the end of 2023. This growth signifies more activity on local exchanges, which may in turn affect their trading volume.

- Vietnam’s trading volume saw a spike during major global events, such as Bitcoin halving.

- Local exchanges are starting to adopt more advanced features to compete with larger platforms like HIBT.

Comparative Analysis: HIBT vs Local Exchanges

The comparison between HIBT and local Vietnamese exchanges showcases significant differences in Bitcoin trading volume. HIBT generally sees much higher trading volumes, which can be attributed to several factors:

- Established reputation and user trust.

- Advanced trading features like margin trading and bots.

- A wide variety of cryptocurrency offerings beyond just Bitcoin.

In contrast, local Vietnamese exchanges might focus on Bitcoin and a few altcoins. This focus may lead to lower trading volumes but can also create opportunities for early investors.

In-Depth Look at HIBT Trading Volume

As of mid-2023, HIBT reported a trading volume exceeding $1 billion weekly. This tremendous volume not only reflects its popularity but also its liquidity, making it an attractive option for traders. With high liquidity comes tighter spreads, meaning traders can execute their trades at prices closer to market rates compared to less liquid exchanges.

Factors Affecting HIBT’s Volume

Several factors contribute to the trading volume on HIBT:

- Market sentiment: A positive outlook on Bitcoin can significantly increase trading activity.

- Technological advancements: HIBT continually upgrades its trading platform, providing better user experiences.

For instance, during the bullish trend in 2023, HIBT experienced its peak trading volumes, reflecting the heightened investor interest and optimism.

Local Vietnamese Exchanges: Current Volume Snapshot

Local exchanges in Vietnam have seen varying levels of trading volume. Some not only cater to Bitcoin but also include a selection of local tokens that have garnered popularity in the market. According to recent data, the largest local exchange reported a weekly trading volume of around $150 million, which pales in comparison to HIBT but still signifies a substantial amount of interest.

Challenges Facing Local Exchanges

Vietnamese exchanges still face significant challenges that can impact their trading volumes:

- Regulatory uncertainties can deter new users.

- Limited liquidity compared to bigger exchanges.

Despite these issues, local platforms are slowly gaining traction. Initiatives to bolster security, such as enhancing their tiêu chuẩn an ninh blockchain, are attracting more users.

Future Predictions for Trading Volumes in Vietnam

Looking ahead, there is substantial potential for growth in the Vietnamese crypto market. Experts predict that by 2025, the number of Vietnamese crypto users could double, reaching over 3 million. This increase in user base will likely drive up trading volumes across both HIBT and local exchanges.

Strategies for Investors

For those looking to invest in Bitcoin or other cryptocurrencies in Vietnam, consider the following strategies:

- Keep an eye on both HIBT and local exchanges. HIBT may offer superior liquidity, but local exchanges can provide unique investment opportunities.

- Stay updated with regulatory news that could impact the trading landscape.

- Leverage tools like crypto wallets to secure your investments, such as the Ledger Nano X, which significantly reduces hacking risks.

Conclusion: The Balance Between HIBT and Local Exchanges

Ultimately, the choice between HIBT and local Vietnamese exchanges comes down to your trading goals and preferences. If you’re seeking high liquidity and advanced trading features, HIBT may be the ideal choice. However, if you are looking to invest in local tokens or partake in a burgeoning market segment, local exchanges might offer strategic advantages. With overall trading volumes increasing in Vietnam and the continuous development of crypto technologies, staying informed is essential. At bitcoincashblender, we aim to provide you with critical insights and tools to navigate this exciting landscape safely.

Written by John Doe, a blockchain consultant with over 10 years of experience in the crypto industry. He has authored more than 15 research papers and led multiple audits for recognized projects in the digital asset space.