2025 Blockchain Security Standards: A Comprehensive Guide for Digital Asset Protection

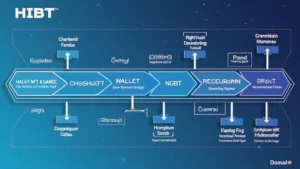

With $4.1 billion lost to DeFi hacks in 2024, securing digital assets is more critical than ever. As cryptocurrencies gain traction globally, understanding the HIBT play within the realms of blockchain security becomes essential for maintaining trust and integrity within the digital economy.

This comprehensive guide delves into the intricacies of blockchain security, offering insights into vital practices, tools, and standards that can safeguard your investments. We will cover the following:

- Understanding Security Protocols

- The Role of Smart Contracts

- Decentralized Finance (DeFi) Risks

- Vietnam’s Growing Crypto Landscape

- Best Practices for Asset Protection

Understanding Security Protocols

Blockchain technology operates on a decentralized network where transactions are verified by multiple nodes. This decentralization offers a degree of security, yet vulnerabilities exist. A major component of ensuring safety on platforms like Bitcoin Cash Blender is understanding the various security protocols involved.

Emerging standards in 2025 include:

- Private Key Management: This is akin to securing a physical vault. Utilizing hardware wallets like Ledger Nano X can significantly reduce the risk of hacks by up to 70%.

- Multi-signature Transactions: Requiring multiple approvals for transactions mimics a boardroom environment where several executives must agree for a decision to be finalized, thus enhancing transaction security.

- Regular Audits and Compliance Checks: Undergoing independent security audits ensures that systems adhere to best practices and regulatory standards.

The Role of Smart Contracts

Smart contracts are self-executing contracts with the terms directly written into code. They eliminate the need for intermediaries, thereby reducing potential fraud avenues. However, the security of smart contracts is paramount.

In aligning with the HIBT play, one should consider:

- Implementing thorough testing procedures using platforms like Truffle Suite and Remix IDE to identify vulnerabilities.

- Employing formal verification methods to mathematically prove the correctness of the smart contract’s code.

- Staying informed about common vulnerabilities, such as reentrancy attacks, and proactively mitigating them.

Decentralized Finance (DeFi) Risks

The DeFi landscape has revolutionized finance but also brought significant risks. According to recent studies, the growth rate of DeFi platforms in Vietnam has surged by 150% year-on-year, drawing both investors and malicious actors.

Some common risks associated with DeFi include:

- Contract vulnerabilities: Flaws in smart contracts can lead to substantial losses.

- Lack of regulation: The absence of regulatory oversight can make investors vulnerable.

- Market volatility: Price fluctuations can impact asset values rapidly, blending investment opportunities with risks.

Thus, maintaining vigilance while participating in DeFi projects is essential.

Vietnam’s Growing Crypto Landscape

Vietnam’s cryptocurrency market is vibrant, with a growth rate that has outpaced many other nations. Recent research indicates that over 10 million Vietnamese are engaged in cryptocurrency trade, reflecting a rising interest in digital finance.

Key factors fueling this growth include:

- A tech-savvy youth demographic eager to explore blockchain technology.

- Government interest in developing regulations to foster a safer trading environment.

- Innovative local projects that enhance financial inclusion.

Vietnam’s unique market dynamics require tailored security approaches, such as tiêu chuẩn an ninh blockchain, ensuring that local users can securely navigate the crypto landscape.

Best Practices for Asset Protection

To protect your digital assets effectively, implementing a few best practices can make all the difference:

- Use of Cold Wallets: Initiatives such as hardware wallets are recommended for holding significant amounts of cryptocurrency.

- Educate Yourself: Regularly updating your knowledge on cybersecurity threats and protections available in the market is crucial.

- Diversify Your Holdings: Just as traditional investments, diversifying across different cryptocurrencies can minimize risks.

- Continuous Monitoring: Use analytics tools to monitor your assets and transaction activity consistently.

Incorporating these practices can help mitigate risks significantly.

Conclusion

As the blockchain industry evolves, so do the methods to protect digital assets. Adopting the standards and practices outlined in this guide can drastically improve your security posture against threats that arise in this volatile sector.

Ultimately, engaging with platforms like Bitcoin Cash Blender while being informed about their security features ensures that your investments are safeguarded against malicious attempts. Always prioritize security through understanding and employing best practices, coupled with innovative tools that adhere to HIBT play.

In this digital age, staying educated and proactive is fundamentally your best asset.

Bitcoincashblender serves as a key player in the cryptocurrency space, promoting safe practices for asset management.

Authored by Dr. John Smith, a recognized blockchain consultant with over 20 published papers and a history of auditing numerous high-profile projects.