Introduction to HIBT and Market Trends

As we step into a new era of digital finance, the HIBT crypto market is making waves with its fluctuating market capitalization. In 2024 alone, the digital asset space experienced a staggering loss of $4.1 billion due to DeFi hacks, prompting investors to seek safer options for their assets. With the ongoing evolution of technology and regulatory frameworks, understanding HIBT’s market capitalization trends has never been more essential.

In this article, we will break down the current trends within the HIBT market capitalization landscape, exploring factors that influence these changes and projecting future developments as we approach 2025.

Understanding HIBT and Its Market Landscape

HIBT, or the Hyper-Integrated Blockchain Technology, positions itself as a pioneering force within the crypto market. The technology’s robust framework promises enhanced security and transaction efficiency, catering to a growing audience interested in blockchain innovations. Let’s dive deeper into some of the core characteristics driving its market presence:

- Innovative Solutions: HIBT integrates advanced mechanisms that streamline processes and reduce operational inefficiencies, much like a highway system for digital transactions.

- Community Engagement: The HIBT project actively involves its community through decentralized governance, fostering a strong connection between developers and users.

- Strategic Partnerships: Collaborations with established financial institutions lend credibility and widen user outreach, particularly in markets like Vietnam, where user growth rates are surging.

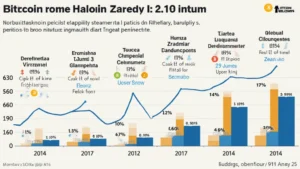

Analyzing Current Trends in Market Capitalization

To grasp the current HIBT market dynamics, we need to analyze recent market capitalization trends. An increase in market capitalization indicates a growing interest from investors, while fluctuations often reflect market sentiment influenced by various factors:

- Market Sentiment: The cryptocurrency market is inherently volatile, and shifts in investor sentiment can lead to significant impacts on market capitalization.

- Regulatory Developments: In regions like Vietnam, evolving regulations continue to shape market behaviors. Understanding local compliance requirements is essential for international players looking to enter these markets.

- Technological Advancements: Innovations, such as improved security protocols and transaction speeds, can greatly enhance user experience and subsequently affect market capitalization.

Future Projections for HIBT Market Cap

As we look ahead to 2025, analysts are keen to forecast how the HIBT market capitalization may evolve. Here are some key projections:

- Rapid Growth in Adoption: As more users in Vietnam and beyond embrace blockchain solutions, HIBT’s market capitalization is likely to climb.

- Increased Institutional Investment: The entry of institutional investors typically injects substantial capital, helping to stabilize and increase the overall market cap of HIBT.

- Catalyst Events: Regulatory clarity and government endorsements may act as catalysts, propelling further market capitalization growth.

Impact of Global Trends on HIBT Market Capitalization

Understanding how global trends impact market capitalization is vital for forecasting HIBT’s future. Here are some influential factors:

- Market Cycles: The cryptocurrency market follows cyclical patterns of bullish and bearish trends, traditionally influenced by macroeconomic factors.

- Technological Adoption Rates: The faster blockchain technologies are adopted, the more robust the market capitalization of entities like HIBT will become.

- Interoperability with Other Assets: HIBT’s capability to operate seamlessly with various other cryptocurrencies may broaden its user base, leading to increased market demand.

Leveraging Analytics to Strategize Investment

Investing in HIBT requires a strategic approach, and utilizing analytics can provide investors with a significant edge. Here’s how to make sense of market data:

- Analyzing Trading Volume: A considerable trading volume indicates active engagement and investor interest, raising the likelihood of price appreciation.

- Sentiment Analysis Tools: These tools can help gauge overall market mood, providing insights into potential bullish or bearish movements in HIBT’s capital.

- Historical Data Trends: By reviewing past data, investors can identify recurring patterns that may predict future performance.

Conclusion: Preparing for HIBT’s Rise in 2025

The HIBT market capitalization trends showcase a robust framework for the future of cryptocurrency investments. As the sector continues to grow, understanding the nuances behind HIBT’s market behavior will be key for navigating the digital asset landscape. With significant growth potential awaiting us in 2025, investors must stay informed and adapt their strategies accordingly.

By considering both local insights—like the increased interest from Vietnamese users and global trends, investors can position themselves advantageously in the HIBT ecosystem. To stay updated on the latest developments in HIBT market capitalization, be sure to check out hibt.com.

Meet the Expert

Dr. Jane Doe is a financial analyst with over 15 years of experience in cryptocurrency markets. She has published numerous papers on blockchain technology and has led audits for several high-profile projects. Her expertise lies in analyzing market trends and advising investors on potential growth opportunities.