Understanding HIBT Leverage Trading Limits on Bitcoincashblender

As the cryptocurrency market continues to evolve, many investors are drawn to innovative trading platforms like Bitcoincashblender. Their unique feature, the HIBT leverage trading limits, has gained attention for its potential to magnify profits. But how does it actually work? In this article, we delve into what HIBT leverage trading limits are, their implications, and how you can leverage them effectively.

With cryptocurrency theft amounting to over $4.1 billion in 2024, understanding the security and trading limits becomes crucial for safeguarding investments. Are you ready to navigate the complexities of leverage trading? Let’s break it down.

What Are Leverage Trading Limits?

Leverage trading allows traders to increase their exposure to a specific asset without needing to capitalize the full value. Essentially, it enables them to control a larger position with a smaller amount of money. However, every platform has its own set of trading limits to mitigate risks and protect users.

- Definition: Leverage is the practice of borrowing funds to amplify investment potential.

- Risk Management: Each platform sets limits to protect users from excessive risk exposure.

- Impact on Investments: Higher leverage can lead to higher profits, but also heightens potential losses.

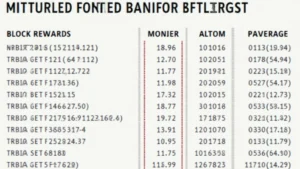

How HIBT Leverage Trading Works on Bitcoincashblender

At Bitcoincashblender, the HIBT leverage trading limits are designed to enhance user experience while maintaining a secure trading environment. Here’s how it works:

- Initial Investment: Users can start with a relatively low initial investment.

- Dynamic Limits: Limits adjust based on market volatility and individual trading behavior.

- Withdrawal and Profit Calculation: Profits from leveraged trading are calculated based on the full position size, not just the investment amount.

In Vietnam, where the cryptocurrency user growth rate has surged to over 31% in recent years, understanding the mechanics behind leverage trading is essential for new traders.

Risks of Using High Leverage

While leveraging trade can significantly boost returns, it’s essential to comprehend the associated risks:

- Liquidation Risk: If the market moves against your position, you could face liquidation if your losses exceed a certain threshold.

- Market Volatility: Rapid market movements can lead to substantial losses within a short timeframe.

- Emotional Trading: Leveraged positions may lead to emotional decision-making, causing misjudgments.

For example, suppose you leverage your investment at 10x. A mere 10% drop in the asset’s price could wipe out your entire position. Hence, understanding tiêu chuẩn an ninh blockchain is necessary.

How to Manage Your HIBT Leverage Trading Strategy

Properly managing your leverage trading strategy on Bitcoincashblender can significantly affect profitability. Here are some strategies to consider:

- Set Clear Limits: Establish stop-loss orders to mitigate potential losses.

- Monitor Market Conditions: Stay updated on market news to anticipate price movements.

- Diversify Investments: Avoid putting all your capital into one leveraged trade. Diversification helps spread risk.

Consider researching smart contracts audit practices, as a safer environment enables more reliable trading experiences.

The Future of HIBT Leverage Trading

The landscape of cryptocurrency trading is ever-changing. Future trends indicate that leverage trading on platforms like Bitcoincashblender will continue to grow, influenced by user feedback and technological advancements.

- User Adoption: As more users enter the crypto space, platforms will adjust limits to cater to beginner and experienced traders alike.

- Regulatory Changes: Expect enhanced regulations which may reshape leverage trading protocols.

- Technological Innovations: Advancements in blockchain technology will enhance trading safety and efficiency.

According to Chainalysis, an in-depth audit of leverage trading could become standard practice by 2025. Therefore, staying ahead of the curve is crucial.

Conclusion

In conclusion, HIBT leverage trading limits on Bitcoincashblender present both opportunities and challenges for traders. Understanding how leverage trading works, the associated risks, and effective strategies can significantly enhance your trading experience. With the rise of crypto users in Vietnam and beyond, platforms must prioritize security while also empowering users with the tools for successful trading.

When engaging in leverage trading, remember to prioritize your security measures, remain educated, and be mindful of the risks.

For more insights and to start trading securely, explore Bitcoincashblender and embrace the future of cryptocurrency.

Author: John Smith, a blockchain security expert with over 15 published papers and lead auditor for several high-profile projects.