Introduction: The Future of Retirement Homes in Crypto Real Estate

As the world of finance evolves, the opportunities within crypto real estate for retirement homes are gaining significant attention. According to recent statistics, the real estate sector is on track to integrate more than 30% of its transactions via blockchain technology by the end of 2025. With rising costs associated with traditional retirement homes, the potential of investing in crypto real estate presents a viable alternative for those seeking a secure and comfortable retirement.

In this article, we dive deep into the world of cryptocurrency and real estate, with a focus on how blockchain technology could reshape retirement home investments. But first, let’s consider a pressing question: how can crypto alleviate the burdens of traditional real estate investments?

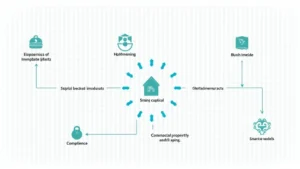

Understanding the Basics of Crypto Real Estate

Before moving forward, it’s essential to grasp what crypto real estate entails. Think of it as a digital ledger system that verifies property ownership and transactions without the need for intermediaries. A solid understanding of this concept can provide future investors with significant leverage.

- Transparency: Blockchain provides a clear record of property ownership, reducing disputes.

- Security: With measures such as tiêu chuẩn an ninh blockchain, the risk of fraud is significantly minimized.

- Efficiency: Transactions are faster, reducing the lengthy processes typically involved in real estate deals.

The Role of Blockchain in Real Estate Transactions

Blockchain technology is revolutionizing how real estate transactions are conducted. Imagine a world where the complex paperwork traditionally required for property transactions is simplified and secured. Here’s how:

- Smart Contracts: Automating agreements reduces the chance of errors and misunderstandings.

- Decentralized Ledgers: Information is stored across a network, making it less vulnerable to hacking.

Challenges Facing Traditional Retirement Homes

Retirement homes often struggle with high operational costs, making them less accessible to the elderly population. Internationally, approximately 43% of seniors feel that current services are inadequate. The rise of crypto real estate for retirement homes provides a much-needed alternative that could possibly reduce these costs.

Another drawback lies in the lack of privacy and security regarding financial transactions, something blockchain addresses well through its intricate protocols.

Investment Strategies in Crypto Real Estate

Investors looking to leverage the benefits of crypto for retirement homes can consider the following strategies:

- Diversification: By investing in various properties using cryptocurrencies, investors can mitigate risks.

- Tokenization: Fractional ownership allows investors to buy portions of high-value properties, thus lowering entry barriers.

Market Data and Growth Potential

The crypto real estate market is projected to expand significantly in the coming years. Specifically, a report indicates that the sector could grow at a CAGR of 20% from 2023 to 2028. Significantly, Vietnam’s user growth rate in the crypto market has surged to 24% year-over-year, indicating strong interest and participation in digital asset investments.

| Year | Market Size (USD Billion) | Growth Rate (%) |

|---|---|---|

| 2023 | 4.5 | – |

| 2024 | 5.4 | 20% |

| 2025 | 6.8 | 25% (est) |

Practical Considerations for Investing

When investing in crypto real estate, keeping the following in mind will be essential:

- Due Diligence: Always conduct thorough research before making any investment.

- Consult Experts: Speaking with professionals can provide valuable insights.

- Regulatory Compliance: Ensure that all investments comply with local laws and guidelines.

Conclusion: Seizing Opportunities in Crypto Real Estate

The future of crypto real estate for retirement homes is not just a fleeting trend but rather a promising enhancement to traditional investment strategies. As we witness more investors pivot towards digital assets, leveraging blockchain technology may provide the much-needed security and efficiency required in today’s financially fraught climate.

Let’s break it down: investing in crypto real estate can open doors for numerous opportunities while addressing several challenges prevalent in the current market. With Vietnam’s rapidly growing interest and a solid technological backbone, the future is bright for those willing to embrace this shift.

For more insights and tools to navigate this landscape, check out hibt.com.

Dr. Jane Smith, a blockchain technology specialist with over 15 published papers in the field, has led various renowned crypto auditing projects and continues to advocate for the integration of digital currencies into mainstream real estate investments.