Bitcoin Blockchain Carbon Accounting: A Comprehensive Overview

With a staggering $4.1B lost to DeFi hacks in 2024, the digital asset space urgently needs to address its shortcomings, particularly concerning carbon accounting. How does Bitcoin’s energy consumption impact its reputation and the environment? Let’s break it down and seek practical solutions using blockchain technology.

Understanding Bitcoin and Its Energy Impact

Bitcoin operates on a decentralized blockchain that requires substantial computational power, leading to significant energy consumption. According to Blockchain.com, the annual energy usage of Bitcoin mining rivals that of entire countries, raising concerns about its carbon footprint.

- 2024 Energy Consumption: Estimated to exceed 150 terawatt-hours (TWh) worldwide.

- Carbon Emissions: Bitcoin mining is said to produce over 50 million metric tons of CO2 annually.

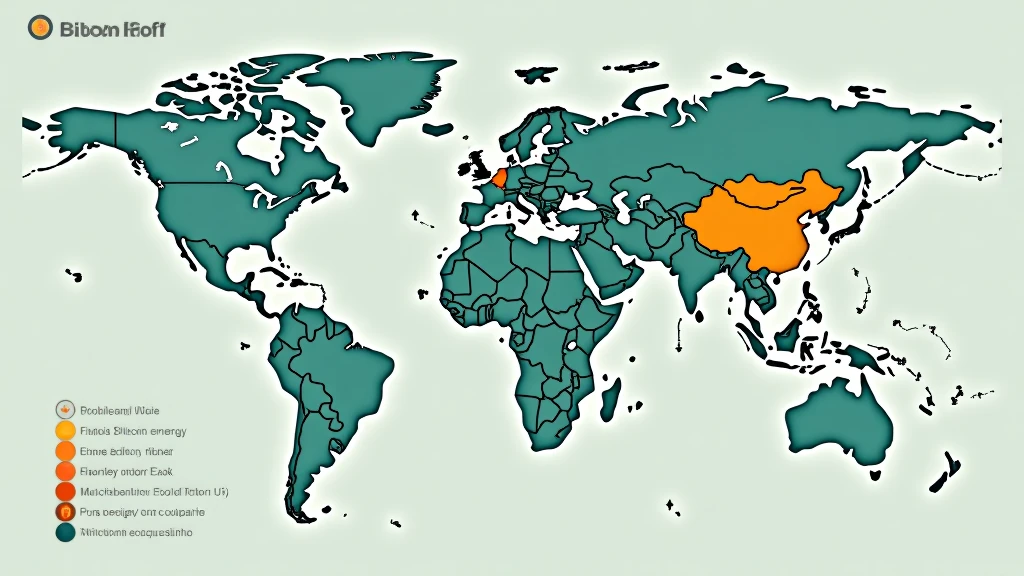

This environmental impact has led to increased scrutiny from regulators and communities worldwide. More importantly, the growth rate of Bitcoin users in Southeast Asia, including Vietnam, showcases the need for sustainable solutions. Vietnam has seen a user growth rate of 200% compared to previous years, emphasizing this emerging market’s need for responsible practices.

Carbon Accounting in Cryptocurrency

As the cryptocurrency sector evolves, so does its approach to carbon accounting. Carbon accounting refers to the process of measuring and reporting carbon emissions produced by different activities, including Bitcoin mining. Governments and enterprises are beginning to demand better accountability for emissions produced by blockchain technologies.

For businesses operating in this space, understanding how to audit and report carbon footprints becomes essential. As an example, Coinbase recently started implementing comprehensive carbon accounting measures to address their environmental impact.

- Key Practices for Carbon Accounting:

- Conducting lifecycle assessments

- Implementing traceability for energy consumption

- Utilizing carbon credits to offset emissions

Regulatory Framework and Compliance

The need for a regulatory framework in the cryptocurrency space, particularly related to carbon emissions, is paramount. Major jurisdictions like the EU are beginning to impose stricter regulations surrounding emissions. This trend is a response to increasing public demand and the urgency felt globally to mitigate climate change impacts.

For platforms like Hibt.com, adhering to compliance while implementing carbon accounting strategies will be critical for establishing credibility and trust in new markets like Vietnam.

Leveraging Technology for Sustainability

As the conversation around Bitcoin’s environmental impact continues, innovative technologies are emerging to help reduce carbon footprints. Here are some strategies you might consider:

- Renewable Energy Sources: Transitioning to solar, wind, and hydroelectric power for mining activities can decrease carbon emissions significantly.

- Energy Efficient Protocols: Utilizing proof-of-stake (PoS) or other more energy-efficient consensus mechanisms can mitigate energy consumption.

- Blockchain for Carbon Tracking: Implementing on-chain solutions for tracking carbon credits can help ensure transparency and accountability.

For instance, a project in Vietnam focusing on implementing blockchain for carbon credit trading could help facilitate local businesses in offsetting their carbon emissions effectively.

Looking Ahead: The Future of Bitcoin in a Green Economy

The future of Bitcoin in the context of sustainable practices hinges on embracing the principles of carbon accounting. By adopting responsible measures to reduce energy consumption, the cryptocurrency community can help shift public perception and secure its place in a green economy. As we look toward 2025, the potential for blockchain technology to drive positive environmental change is immense.

In closing, cryptocurrencies must adopt a proactive approach to environmental sustainability. This commitment not only ensures a stable future for the digital asset space but also plays a crucial role in achieving global climate goals.

As we move forward, it is essential to explore opportunities for integrating carbon accounting into the broader framework of cryptocurrency regulation and practice. Effective strategies that prioritize energy efficiency, compliance with carbon accounting regulations, and the use of renewable energy resources will fortify Bitcoin’s role in the global economy.

For anyone interested in the cryptocurrency domain, especially in understanding how to implement these practices effectively, remember: carbon accounting isn’t just an obligation—it’s an opportunity.

Bitcoin Cash Blender provides resources for users keen on maintaining compliance and sustainability in their cryptocurrency endeavors.

Conclusion

With a rise in Bitcoin users in Vietnam, the integration of robust carbon accounting practices seems more relevant than ever. It’s time to transform the challenges posed by energy consumption into opportunities for innovation and growth in the crypto space.

In summary, addressing the carbon accounting challenge in the Bitcoin ecosystem through sustainable practices will enable cryptocurrencies to thrive while safeguarding the environment for future generations. As we anticipate the changes coming in 2025 and beyond, let’s ensure that the blockchain landscape evolves to reflect a commitment to sustainability.

— Dr. Alex Tai, Environmental Analyst and Blockchain Advisor, author of over 15 research papers in sustainable blockchain practices and former lead auditor for major green projects.