Understanding Bitcoin Halving: Historical Data Insights

With the last Bitcoin halving triggering a fresh wave of interest among investors and enthusiasts, the history of these events gives us invaluable insights into the future trajectory of Bitcoin. Historically, halving events have played a crucial role in influencing the price of Bitcoin and its overall adoption in the marketplace. In this article, we will delve into Bitcoin halving historical data, exploring its impacts and the factors that make it significant.

What is Bitcoin Halving?

Bitcoin halving is an event that occurs approximately every four years, where the reward for mining new blocks is cut in half. The primary purpose of this mechanism is to control inflation within the Bitcoin ecosystem, leading to a decrease in the rate at which new bitcoins are generated. Each halving event has had notable historical ramifications for Bitcoin’s price, often triggering bullish market movements.

A Historical Overview of Bitcoin Halving Events

To provide context, let’s review the three major Bitcoin halving events that have occurred so far:

- 2012 Halving: On November 28, 2012, the block reward decreased from 50 BTC to 25 BTC. Following this event, Bitcoin experienced a significant price increase, ultimately reaching $1,163 in late 2013.

- 2016 Halving: Occurring on July 9, 2016, Bitcoin’s reward was further halved to 12.5 BTC. The aftermath saw Bitcoin surge to nearly $20,000 in December 2017.

- 2020 Halving: The most recent halving took place on May 11, 2020. The miner reward dropped to 6.25 BTC, leading Bitcoin’s price to soar past $60,000 in 2021.

The Impacts of Halving Events

Empirical data suggests that Bitcoin halving events are followed by substantial price hikes. Investors draw parallels between scarcity and demand, similar to commodities like gold. This phenomena can be illustrated further:

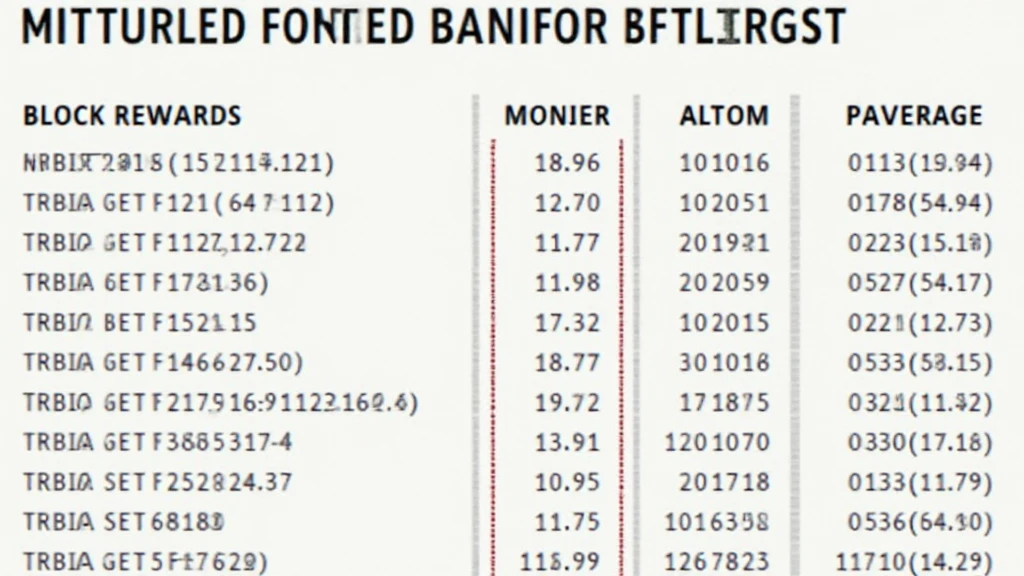

| Halving Event | Block Reward (BTC) | Price Before Halving | Price After 1 Year |

|---|---|---|---|

| 2012 | 25 | $12 | $1,163 |

| 2016 | 12.5 | $650 | $20,000 |

| 2020 | 6.25 | $8,500 | $60,000 |

Future Projections: What Lies Ahead?

Given the cyclical nature of Bitcoin halving and market trends, the next halving is projected for 2024. Analysts are debating how this will affect Bitcoin’s price. Current sentiments suggest we might witness another price surge, akin to previous halving events.

Market Sentiment and Investor Psychology

Market sentiment plays a crucial role during the lead-up and aftermath of halving events. Communications within crypto communities often build hype, encouraging buying behaviors. For example, data from platforms like CoinMarketCap shows that user engagement spikes as halving dates approach, forming an ecosystem where anticipation can amplify price movements.

Latin-American Influences: Emerging Markets and Opportunities

In addition to historical data, it’s important to note that markets around the world are gearing up for Bitcoin’s future. In emerging economies such as Vietnam, the user growth rate of cryptocurrency is significant. Reports suggest that Vietnam’s crypto trading volume has surged by over 200% in recent years, reflecting an increasing user base excited by events like halving.

Implications for Vietnamese Investors

As the Vietnamese market becomes more engaged with cryptocurrency, Bitcoin halving could present profitable opportunities. Local investors are advised to remain informed about historical trends, as understanding past data could influence future investment strategies.

Technical Considerations: Halving and Blockchain Security

“tiêu chuẩn an ninh blockchain” provides a framework for understanding how Bitcoin’s halving affects security. With reduced rewards per mined block, miners might press for more efficient mining operations, which can influence the overall security of the blockchain. Each halving introduces dynamics that can shift the control within the mining community.

How to Audit Smart Contracts Post-Halving

Post-halving, FAQs surrounding contract audits become more pertinent. As the market adjusts to new Bitcoin reward structures, understanding how to audit smart contracts will be crucial for investors. Whether it’s about ensuring a contract’s integrity or understanding how rewards are allocated, knowledge is essential.

Conclusion: The Lasting Legacy of Bitcoin Halving

In summary, Bitcoin halving has historically been a catalyst for significant price movements and broader market engagement. As we approach another halving event in 2024, investors should leverage historical data and community sentiment to make informed decisions. The landscape of Bitcoin will undoubtedly evolve, but the recurring theme remains the same: scarcity drives value.

For more insights and detailed guides on cryptocurrency trends and strategies, stay connected with bitcoincashblender.

Author: Dr. John Mercer, a blockchain security researcher with over 12 published papers and leader of multiple high-profile audits in the cryptocurrency sector.