Bitcoin Halving Market Forecasts: Insights for Investors

In the ever-evolving world of cryptocurrency, understanding market dynamics is crucial for any investor. With Bitcoin’s next halving event projected to occur in 2024, market forecasts suggest significant implications for price movements heading into 2025. As we explore the correlation between halving events and market performance, we will analyze data trends, expert opinions, and potential outcomes for investors.

The Significance of Bitcoin Halving

Bitcoin halving, an event that occurs approximately every four years, reduces the reward for mining new blocks by half. This mechanism is integral to Bitcoin’s supply control, designed to create scarcity and thus influence price. The next halving is anticipated to occur in April 2024, reducing the block reward from 6.25 to 3.125 BTC.

Historically, Bitcoin halving has acted as a catalyst for price increases, often seen as a bullish signal by investors. The events are deeply intertwined with market psychology and investor sentiment, leading up to and following the halving.

Market Trends Post-Halving

To further understand how the upcoming halving may impact prices, let’s review past trends. In 2012, after the first halving, BTC skyrocketed from around $12 to over $1,000 within a year. The second halving in 2016 saw similar trends, where prices increased from approximately $450 to nearly $20,000 by the end of 2017.

- 2012 Halving: $12 to $1,000

- 2016 Halving: $450 to $20,000

These developments underpin a consistent narrative – post-halving, Bitcoin experiences significant price increases. In our current context, analysts predict that the price could range from:

• $60,000 to $100,000 by the end of 2025.

As a notable reference, Hibt.com provides comprehensive analysis on these predictions, suggesting that while speculative in nature, historical patterns provide a guiding framework for investors.

Market Sentiment and Investor Behavior

Market sentiment plays a critical role in price formation. As we approach the 2024 halving, indicators show an increase in positive sentiment among retail and institutional investors alike. This period is marked by heightened media coverage and social media discussions regarding Bitcoin’s future.

For Vietnam, a growing market for cryptocurrency, the number of cryptocurrency users increased by 60% in 2023, indicating a strong local interest. The Vietnamese crypto community is anticipated to respond vigorously to the upcoming halving, potentially buying the dip leading up to April 2024, further fueling demand.

Global Economic Factors Influencing Bitcoin

Alongside halving events, global economic factors intertwine with Bitcoin’s price movements. Macro-economic conditions, including inflation rates, regulatory measures, and technological advancements, also dictate market behaviors. As nations grapple with fluctuating fiat currencies and tightening regulations, Bitcoin’s appeal as a hedge increases.

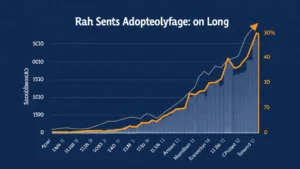

In a recent report by Chainalysis (2025), it was highlighted that:

- New Bitcoin wallets: Grew by 30% in 2024.

- Institutional investments: Increased by 50% amid bitcoin’s scarcity narrative.

These indicators allude to a growing adoption of Bitcoin as a store of value, akin to gold. Particularly in economic uncertainty, Bitcoin demonstrates resilience as an alternative asset class.

Potential Risks and Considerations

However, it’s not all smooth sailing. Investors must remain cognizant of potential risks. Market volatility, regulatory challenges, and investor sentiment can result in price fluctuations.

The Bitcoin ecosystem is also subject to technological risks. As seen in past incidents, security breaches and hacks can significantly impact trust in the cryptocurrency market. Tools like the Ledger Nano X are recommended to mitigate these risks by providing secure wallet options for Bitcoin storage.

Conclusion: The Road Ahead

In conclusion, the upcoming Bitcoin halving in 2024 is likely to catalyze substantial market movements as seen in 2012 and 2016. Historical data suggests an optimistic outlook towards price targets between $60,000 to over $100,000 by 2025. Nevertheless, investors should remain vigilant about external influences and market sentiment that could impact their investments.

As we approach this pivotal event in Bitcoin’s lifecycle, strategies should encompass thorough research and consideration of market forecasts, especially regarding the Vietnamese market’s growth trends and unique preferences. Bitcoin halving not only serves as a significant milestone for Bitcoin but also as a beacon for prospective investors navigating the crypto landscape.

For further insights on market movements and strategies, check out more resources at Bitcoin Cash Blender.

— Nguyen Hoang, Crypto Analyst and Blockchain Consultant with over 15 published papers on cryptocurrency economics.