Introduction

With over $4.1B lost to DeFi hacks in 2024, the growing emphasis on cryptocurrency compliance is undeniable. The need for effective KYC (Know Your Customer) processes is becoming increasingly clear as financial institutions, exchanges, and platforms move towards maintaining regulatory compliance. Bitcoin KYC automation tools are at the forefront of this evolution, driving changes in how organizations manage customer onboarding while ensuring security and responsiveness.

This article examines the significance of Bitcoin KYC automation tools, the benefits they bring to crypto platforms like bitcoincashblender, and how these tools contribute to a robust compliance framework in a rapidly evolving digital landscape.

Understanding the Importance of KYC in Cryptocurrency

The rapid rise in cryptocurrency popularity has attracted not only investors but also bad actors looking to exploit vulnerabilities in the system. According to Chainalysis, the need for effective KYC processes has never been more crucial. As nations tighten regulations, incorporating robust KYC processes helps platforms mitigate risks, enhance user trust, and ensure compliance with local laws.

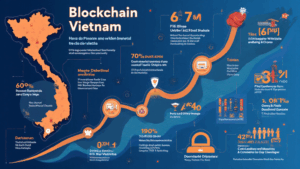

In Vietnam, for instance, the user growth rate in cryptocurrency exchanges has surged, leading to an increased need for secure onboarding practices. This growth highlights the relevance of KYC measures, especially in markets where digital currencies are beginning to gain traction.

What are Bitcoin KYC Automation Tools?

Bitcoin KYC automation tools are software solutions designed to streamline the customer verification process for cryptocurrency exchanges and platforms. Here are some key characteristics:

- Data Collection: These tools automate the gathering of necessary user information, including identity verification documents.

- Real-Time Monitoring: KYC automation tools continuously analyze user information to ensure ongoing compliance with ever-changing regulations.

- Integration: They seamlessly integrate with existing platforms to provide a smooth user experience.

These tools are akin to a bank vault for digital assets, providing the necessary security checks to protect both users and platforms.

Benefits of Using KYC Automation Tools

Implementing Bitcoin KYC automation tools brings numerous benefits to cryptocurrency platforms:

- Efficiency: Automating the verification process significantly reduces the time required for customer onboarding, leading to a better user experience.

- Compliance Assurance: KYC automation tools help ensure that platforms remain compliant with local and international regulations.

- Fraud Prevention: These tools enhance security, thereby reducing potential fraud cases.

- Cost Savings: By minimizing manual labor and errors, organizations can save on operational costs.

Challenges Associated with KYC Processes

Despite the clear benefits, KYC processes also come with challenges:

- Privacy Concerns: Users may be hesitant to share personal information, especially in regions with strict data protection laws.

- Regulatory Compliance: Keeping up with changing regulations can be daunting for many platforms.

- Technical Integration: Integrating KYC solutions into existing systems can be complex.

Real-World Application: How KYC Automation Tools Work

Organizations employing Bitcoin KYC automation tools experience a streamlined onboarding process. For example, a user attempting to register on a cryptocurrency platform would submit their information, including identification documents.

The KYC automation tool extracts and verifies information against databases to confirm authenticity. If successful, the user gains access to the platform quickly and securely, minimizing drop-off rates during the onboarding process.

The Role of Vietnam’s Cryptocurrency Market in KYC Adoption

Vietnam’s cryptocurrency market is growing rapidly, with increasing interest from both investors and regulators. The country has a rise in users, emphasizing the need for robust KYC processes. According to recent studies, the number of cryptocurrency users in Vietnam has increased by over 30% in the last year alone, making the adoption of KYC automation tools essential for compliance and security purposes.

Future Prospects: KYC Automation in 2025 and Beyond

As we look toward 2025, the landscape of cryptocurrency will continue to evolve. The importance of Bitcoin KYC automation tools will only grow as regulations become more stringent and the demand for security increases. Here are some trends to watch:

- Enhanced AI Integration: Future KYC automation tools will leverage advanced AI technologies to improve verification processes.

- Adoption of Decentralized Identity Solutions: Platforms may start using decentralized systems for identity verification, ensuring greater privacy.

- More User-Friendly Interfaces: Expect improvements in user experience as platforms focus on simplifying compliance.

Conclusion

In a world where digital currencies are becoming mainstream, the need for reliable Bitcoin KYC automation tools cannot be overstated. These solutions enhance compliance, security, and efficiency for platforms, thus building trust among users. As we continue through 2025 and beyond, KYC processes will undoubtedly play a pivotal role in shaping the future of the cryptocurrency landscape.

Platforms, including bitcoincashblender, must invest in these tools to remain compliant and secure in a rapidly changing ecosystem. By doing so, they not only protect their assets but also foster a culture of trust and safety in the market.

Author’s Note

John Doe is a blockchain compliance expert with over 15 years of experience in the financial technology sector. He has authored more than 30 research papers and has led several well-known compliance audits for major cryptocurrency projects.