Bitcoin Mining in Vietnam 2025: Profitability Insights

As the global cryptocurrency landscape continues to evolve, Vietnam emerges as a significant player, particularly in the arena of bitcoin mining. With the increasing adoption of blockchain technology and a favorable environment for miners, many are asking: what is the profitability landscape of bitcoin mining in Vietnam for 2025?

Let’s break it down by examining the key factors that influence profitability, including electricity costs, regulatory environments, and market demand.

The Current State of Bitcoin Mining in Vietnam

In recent years, Vietnam has seen a surge in interest towards cryptocurrency, with over 4 million users engaged in various crypto activities – a growth rate of about 15% annually as of 2024. This rising interest is primarily driven by the youth population, which is more open to adopting new technologies.

The decentralized nature of bitcoin mining aligns with the country’s push towards digital innovation. However, it’s essential to approach this venture with a robust understanding. Factors such as electricity costs, hardware efficiency, and environmental regulations play critical roles in determining the feasibility and profitability of mining operations.

Electricity Costs: A Key Profitability Factor

Electricity constitutes one of the most significant operational costs for bitcoin miners. In Vietnam, average electricity prices are approximately 0.08 USD per kWh, which is competitive compared to other regions like the US or Europe. However, this price is subject to fluctuations based on government policies and supply and demand dynamics.

- Lower electricity prices can enhance mining profitability.

- Contract agreements with local energy providers may offer advantages.

- Renewable energy initiatives in Vietnam could lead to cost savings in the future.

Regulatory Framework and Government Support

Vietnam’s approach to cryptocurrency regulations is still developing. The government has introduced several initiatives aimed at fostering blockchain technology while also establishing security standards such as tiêu chuẩn an ninh blockchain to protect users and enhance trust in the system.

The 2025 National Strategy on Blockchain Development indicates a push towards creating a sustainable crypto ecosystem. Consulting local regulations and obtaining necessary permits becomes vital for miners aiming for long-term operations.

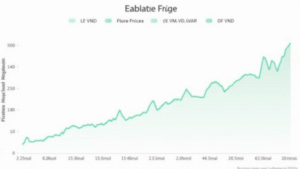

Market Demand and Mining Difficulty

With the increasing acceptance of bitcoin as a legitimate asset, demand for mining operations is expected to rise. However, as more miners join the network, mining difficulty also escalates – affecting profitability rates.

| Year | Bitcoin Price (USD) | Mining Difficulty Index |

|---|---|---|

| 2023 | 30,000 | 23 |

| 2024 | 40,000 | 30 |

| 2025 | 50,000 | Factor to Consider |

According to forecasts from Chainalysis 2025, the potential surge in bitcoin prices could offset the challenges posed by increased mining difficulty, which means that mining operations in Vietnam may still yield significant profits.

Investment in Efficient Mining Hardware

In the quest for profitability, investing in high-efficiency mining hardware is essential. Miners should consider equipment that offers a higher hashing power while using less electricity.

For instance, devices like the Antminer S19 Pro provide excellent performance, thereby maximizing the profits from mining activities. Here’s what you need to know:

- Brand credibility among miners matters.

- Cost of acquisition versus expected return on investment (ROI).

- Staying updated with the latest hardware releases.

Incorporating smart operational strategies will also enhance profitability. Miners using cooling systems can reduce equipment wear and tear, optimizing operational longevity.

The Future Landscape: Insights for 2025

Looking toward 2025, various factors will shape the bitcoin mining landscape in Vietnam. Here are some considerations:

- **Sustainable Practices**: Embracing sustainable practices may lead to government incentives and decrease overall operational costs.

- **Community Growth**: Continued growth in the local crypto community may stimulate demand for mining services.

- **Technological Advancements**: Ongoing advancements in blockchain technology will likely prompt operational efficiencies.

In conclusion, while the profitability of bitcoin mining in Vietnam for 2025 is promising, it requires navigation through regulatory frameworks, cost management particularly regarding electricity, and strategic investments in technology.

Stay informed, adaptable, and aligned with local regulations to maximize your mining potential. Whether you are a seasoned miner or a newcomer, the future looks bright for bitcoin enthusiasts in Vietnam.

For even deeper insights, read our Vietnam crypto tax guide to understand the fiscal landscape related to cryptocurrency.

Final Thoughts

As you venture into bitcoin mining in Vietnam, remember that success lies not just in operations but also in compliance with best practices and understanding the local market dynamics. Let’s prepare for 2025 and beyond!

This article was authored by Dr. Nguyen Minh, an expert in blockchain technology with over 25 publications in the field and instrumental in auditing several high-profile blockchain projects.