Bull Market Exit Strategy for 2025: Mastering Your Crypto Moves

As we stand on the brink of a new bull market in the crypto world, many investors are eagerly pondering how to optimize their exit strategies for 2025. With vulnerabilities exposed in previous years, and considering the staggering amounts lost to crypto hacks — estimated at $4.1 billion in 2024 alone — having a robust exit strategy becomes crucial. This article presents a detailed roadmap to help both new and seasoned investors navigate the 2025 crypto landscape securely and effectively.

Understanding the Bull Market Cycle

The bull market represents a period where the prices of cryptocurrencies rise significantly. This cycle can last long enough to create wealth for many investors, but it can also create anxiety over the timing of exits. When we think about a bull market, it’s vital to consider how external factors can influence price movements. Geopolitical events, regulatory changes, and technological advancements play a pivotal role in shaping market dynamics.

Key Indicators of a Bull Market

- Increased Trading Volumes: A surge in trading activity often signals bullish sentiment.

- Positive Market Sentiment: Social media trends and expert opinions can sway public perception.

- Technological Advancements: Upgrades can lead to increased investor confidence.

- Institutional Involvement: Increased participation from institutional investors often indicates validation of market potential.

Planning Your Exit Strategy

Just as important as recognizing a bull market is understanding how to plan your exit. Here’s how you can make informed decisions:

Setting Price Targets

The first step is to set realistic price targets. A well-thought-out target allows you to take profits without succumbing to FOMO (Fear of Missing Out) ravaging your decision-making process. Aim for a price that reflects your desired return on investment, yet leave room for potential growth.

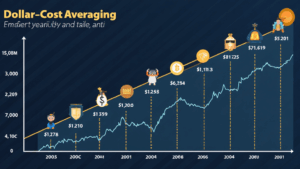

Gradual Liquidation Tactics

Implementing a gradual liquidation strategy can help mitigate risks associated with sudden market downturns. This approach involves selling off parts of your holdings at different price levels rather than exiting all at once. Doing so provides greater flexibility and reduces the chances of being caught with a large volume of assets just as prices dip.

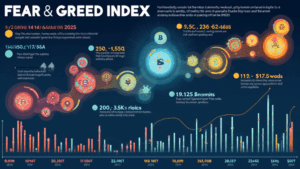

Analyzing Market Sentiment in 2025

Market sentiment can fluctuate rapidly, making it essential for investors to stay updated. In Vietnam, for instance, the user growth rate for cryptocurrency has been notable, with a reported increase of 37% in 2024. This growing interest reflects a bullish sentiment as more individuals seek financial independence through digital assets.

Monitoring Social Media and Community Trends

Platforms like Twitter, Reddit, and local forums can provide real-time insights into investor sentiment. Often, the collective psyche of the crypto community can be an early indicator of changing market conditions. Pay attention to trends and discussions and use these insights to inform your exit strategy.

Safeguarding Your Investments

Security should be a top priority for any crypto investor. Protecting your assets against hacks and fraud must be integrated into your exit strategy as well. While a bull market can lead to increased capital inflow, it can also attract malicious actors seeking to exploit weaknesses in security.

Security Measures to Consider

- Use Hardware Wallets: Devices like the Ledger Nano X can minimize risks associated with online hacks.

- Enable Two-Factor Authentication: Always secure your accounts with two-factor authentication to add an extra layer of protection.

- Stay Updated on Cybersecurity Threats: Research and stay informed about the latest threats within the crypto space.

When to Reassess Your Strategy

Post-exit evaluations are critical. After selling your assets, assess the effectiveness of your exit strategy and the financial gains achieved. Did you maximize your profits? Identify any areas for improvement so you can refine your approach for future bull markets.

Learning from Your Experience

Every investor will encounter unique challenges. Documenting your decisions, such as when to buy, sell, and hold, can provide valuable insights that guide future investments. Be mindful of creating a flexible strategy, allowing you to pivot as needed, based on market conditions.

Capitalizing on Future Opportunities

Post-exit, it is essential to explore potential reinvestment opportunities. While securing profits is fundamental, following up with reinvesting in promising projects can yield substantial returns. In 2025, some altcoins may offer significant growth potential, so consider diversifying your portfolio accordingly.

Recommended Altcoins for 2025

- Project A: Focuses on enhanced transaction privacy.

- Project B: Aims to improve cross-border transactions through innovative blockchain solutions.

Conclusion: Your Roadmap to Success

Ultimately, preparing an effective bull market exit strategy for 2025 encompasses a myriad of factors, each integral to safeguarding your investments. By understanding market cycles, setting clear goals, and adopting protective measures, you stand a better chance of navigating the often tumultuous waters of crypto investment. Remember, it’s not merely about making profits but ensuring that your financial future remains secure.

For more insights on navigating the crypto landscape, check out hibt.com and enhance your investment acumen.

Not financial advice. Consult local regulators.

Written by Dr. Anh Tran, a recognized expert in blockchain security with over 20 publications and leading audits for noted crypto projects.