Coinbase Crypto Futures Contract Innovations

With the rapid evolution of the cryptocurrency market, a significant portion of the investments has started gravitating toward futures contracts. As of late 2024, Coinbase has introduced groundbreaking innovations in crypto futures contracts, responding to a fluctuating market and user demand. The total cryptocurrency derivatives market was valued at over $1.3 trillion in that same period, highlighting the critical nature of these products.

The rise of Coinbase’s crypto futures contracts can be attributed to various factors, including the need for more robust trading tools and the increasing complexity of the crypto landscape. By delving deep into these innovations, users can understand how they can leverage these financial instruments to enhance their trading strategies while also safeguarding their investments.

Understanding Crypto Futures Contracts

Before analyzing the innovations introduced by Coinbase, let’s clarify what a crypto futures contract is. Essentially, a futures contract is an agreement to buy or sell an asset at a future date for a predetermined price.

This financial instrument is a critical aspect of trading as it allows investors to hedge against market volatility. Just like a traditional insurance policy, futures contracts can shield traders from unforeseen price changes in volatile assets such as Bitcoin or Ethereum.

The Innovations by Coinbase in Futures Contracts

1. Flexible Contract Lengths: Traditional futures contracts often have rigid deadlines. Coinbase has now introduced options allowing traders to select from various contract lengths. This flexibility addresses the needs of both long-term investors and short-term traders.

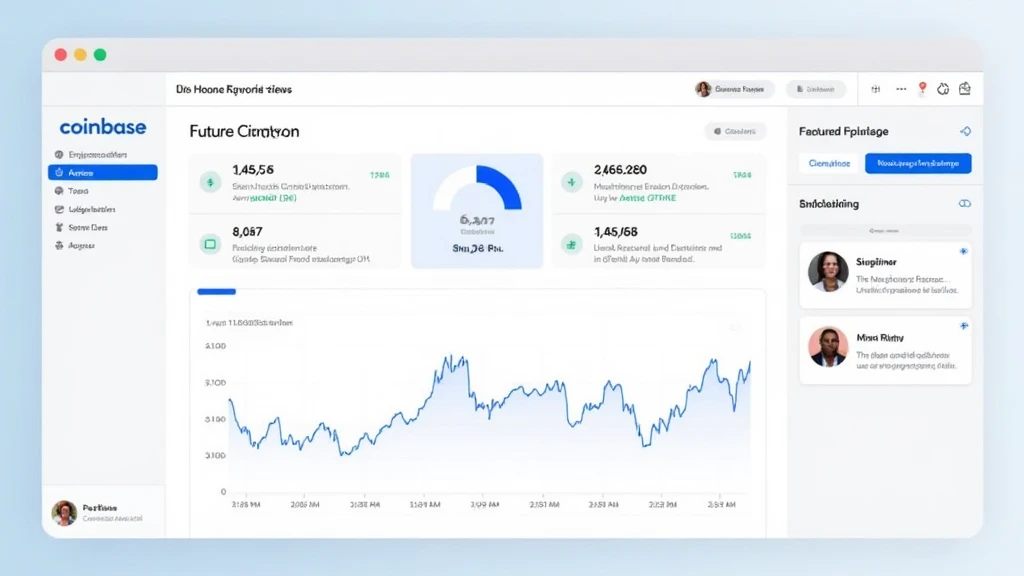

2. Improved User Interface: The trading interface now includes advanced analytics tools and charting capabilities, enhancing user experience and enabling better decision-making. Given that Vietnam saw a 30% growth in its cryptocurrency trading user base in 2024, this improvement is timely.

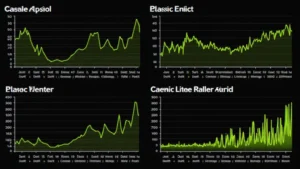

3. Expanded Market Options: Initially focused on Bitcoin futures, Coinbase now supports a wider array of crypto assets—from stablecoins to altcoins. This diversification allows traders to explore various markets and invest in upcoming digital assets.

How the Innovations Impact Traders

The innovations introduced by Coinbase hold various implications for traders:

- Increased Accessibility: With the growing number of options and improved interfaces, more users—especially newbies—can navigate the trading world.

- Risk Management: The flexibility in contract lengths allows traders to set terms that do not necessarily align with market volatility.

- Diversification: By enabling trading across various assets, Coinbase allows users to spread their risk, essential for long-term investment strategies.

Coinbase’s Commitment to Security and Compliance

As the crypto market expands, security has become paramount. Coinbase is committed to ensuring high security standards in its operations, which acts as a trust booster for its users. They implement security protocols that adhere to the tiêu chuẩn an ninh blockchain to protect customer assets and information.

Ensuring compliance with global regulations also contributes to the security and trustworthiness of the platform. Coinbase has worked closely with regulatory bodies to align its offerings with local laws across various regions, including Vietnam.

Conclusion: The Future of Crypto Futures on Coinbase

Coinbase’s innovations in crypto futures contracts are game-changers for traders. By providing flexible contract options and improved tools, they have undoubtedly positioned themselves as a leader in the evolving cryptocurrency landscape.

As the market grows, it will be interesting to see how these innovations drive growth and shape trading strategies. For traders looking to explore the futures market, Coinbase stands out as a reliable and forward-thinking platform.

In summary, Coinbase continues to evolve, offering traders tools that can increase security and flexibility in their investment strategies. Engaging in futures contracts now feels more achievable than ever, especially in rapidly growing markets such as Vietnam where crypto adoption is accelerating.

Until we see the next wave of innovations, make sure to keep an eye on Coinbase and how they adapt to changing market conditions! Remember, all investments carry risks and it’s crucial to do thorough research before diving in.

For any aspiring traders, consulting with financial advisors is recommended to maximize the effectiveness of these strategies.

Author: Dr. Alex Thorne, a cryptocurrency economist with over 15 publications in blockchain technology and a specialized focus on futures contracts and market dynamics.