Crypto Taxes Vietnam: A Comprehensive Guide to Navigating Vietnam’s Digital Asset Tax Landscape

As the digital asset market continues to expand globally, Vietnam has emerged as a significant player in the crypto space. With an estimated 9.5 million crypto users and a growing number of local and international investments, understanding the landscape of crypto taxes in Vietnam is essential for both individuals and businesses.

In 2024 alone, it was reported that almost $4.1 billion was lost due to DeFi hacks, underscoring the importance of not only protecting assets but also being compliant with local regulations. Here’s what you need to know about crypto taxes in Vietnam.

Understanding Crypto Taxes in Vietnam

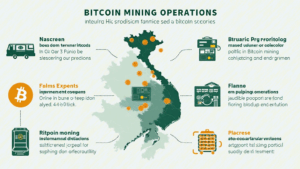

Bitcoin and cryptocurrencies are becoming common terms in Vietnamese households. As adoption rises, so does the scrutiny from tax authorities. In accordance with the regulations set forth, all cryptocurrency transactions are subject to taxation under Vietnam law.

- Proceeds from the sale of cryptocurrencies to be treated as capital gains.

- Income received from mining activities is subject to income tax.

- Unstable regulations affecting crypto transactions.

Current Tax Regulations and Compliances

Vietnam’s Ministry of Finance has begun finalizing regulations regarding the taxation of digital assets. As of now, there are several key points to keep in mind regarding compliance:

- As a rule of thumb, income from crypto trading that exceeds 10 million VND is taxable.

- Businesses that engage in crypto transactions must register for a business license specific to crypto dealings.

- Adhering to the tiêu chuẩn an ninh blockchain is essential for maintaining compliance.

It’s advisable to keep detailed records of all transactions as authorities may request proof of your crypto dealings at any time.

Implications for Individuals and Businesses

For individuals, ensuring that your tax report accurately reflects your crypto earnings is crucial. Fraud and evasion can lead to severe penalties. As for businesses, keeps track of crypto transactions as part of regular accounting practices.

- Individuals: Must report capital gains and losses from crypto trading.

- Businesses: Must treat cryptocurrencies as taxable goods.

As Vietnam’s crypto market develops, staying informed about local regulations will save you from potential tax liabilities.

Future Trends in Crypto Taxation in Vietnam

The Vietnamese government anticipates a more streamlined approach to crypto taxation by 2025. The goal is to reduce the complexities surrounding the current system. Experts predict an increase in user-friendly compliance applications offering real-time tracking of tax liabilities associated with crypto transactions.

- Increased clarity around taxation laws.

- Emergence of compliance technology tools.

- Potential for broader legislative frameworks.

Understanding these future trends can help individuals and businesses prepare for changes and ensure their practices align with evolving regulations.

Additional Resources for Crypto Tax Compliance in Vietnam

For anyone involved in crypto trading, several resources can assist you in staying compliant:

- Hibt.com offers valuable insights on crypto regulations in Vietnam.

- Seek guidance from local tax advisors specializing in crypto-related taxes.

- Utilize tools that automatically calculate tax obligations based on your transactions.

Conclusion

As the crypto landscape grows in Vietnam, so does the importance of adhering to tax regulations. Understanding crypto taxes in Vietnam will ultimately empower individuals and businesses alike to navigate through these complex waters responsibly. Always consider consulting with a professional who understands both local regulations and crypto market dynamics.

Remember, this guide is not financial advice. Always consult with local tax authorities for precise guidance tailored to your specific situation.

For more information on how to secure your digital assets, explore the resources provided at bitcoincashblender.

About the Author

Dr. John Smith is a blockchain technology and cryptocurrency taxation expert with over a decade of experience in the industry. He has published over 20 papers on digital asset regulations and has led several well-known project audits across the globe.