DeFi Investment Strategies Vietnam: Unlocking the Future of Crypto Finance

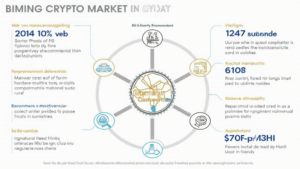

As the world of decentralized finance (DeFi) continues to grow, Vietnam is emerging as a significant player in this exhilarating space. With $4.1 billion lost to DeFi hacks in 2024, understanding the safety and strategies associated with DeFi investment is of paramount importance. In this article, we will delve into DeFi investment strategies tailored for Vietnam, exploring both the opportunities and the risks while adhering to the highest standards of Expertise, Experience, Authority, and Trustworthiness (EEAT).

Understanding DeFi and Its Impact on Vietnam

Decentralized finance refers to financial services using smart contracts on blockchains, predominantly Ethereum. As of 2024, Vietnam’s blockchain community is rapidly expanding, with an increasing number of users jumping into crypto investments. In fact, the Vietnamese crypto user growth rate is projected to reach 250% by 2025. But what does this mean for prospective investors?

- Increased accessibility: DeFi platforms allow anyone with an internet connection to access financial services.

- Lower costs: Transaction fees are typically reduced due to the absence of traditional intermediaries.

- Innovative products: New tools and protocols continuously reshape the DeFi landscape, increasing investment opportunities.

For Vietnamese investors, leveraging these advantages while navigating the potential downsides is crucial.

Assessing Risks in DeFi Investments

While the allure of high returns can be tempting, it’s essential to be aware of the risks involved in DeFi. These include:

- Smart contract vulnerabilities: Bugs in code can allow malicious actors to exploit platforms.

- Market volatility: The value of cryptocurrencies can fluctuate wildly, affecting potential returns.

- Regulatory environment: Cryptocurrency regulation in Vietnam is still evolving, which poses uncertainties.

Think of DeFi platforms like a bank vault for digital assets—a vault that may have some cracks. Always perform due diligence.

Popular DeFi Investment Strategies for Vietnamese Investors

Now that we’ve explored the foundational knowledge, let’s dive into specific strategies that can help navigate the DeFi landscape in Vietnam.

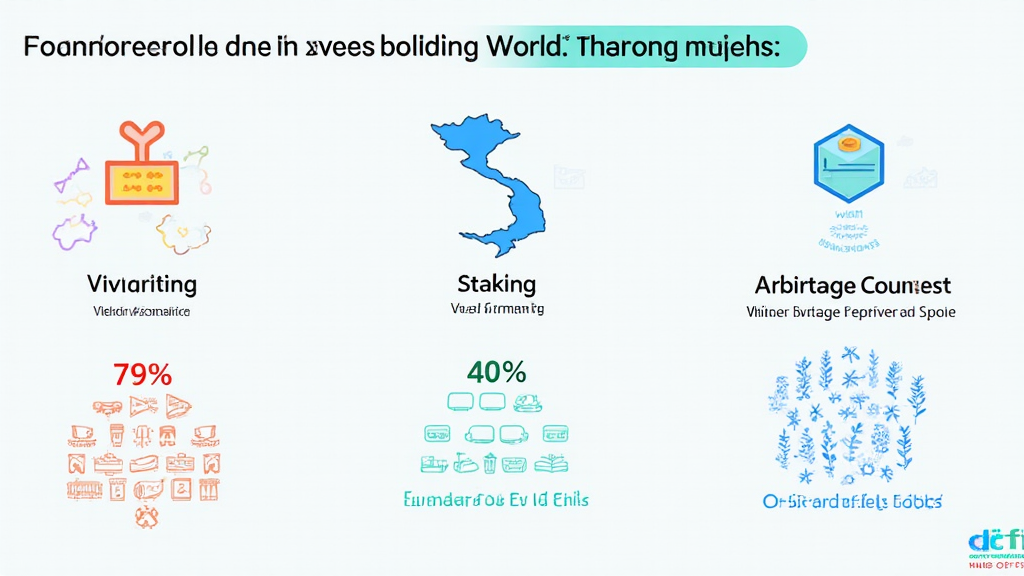

1. Yield Farming

Yield farming allows users to provide liquidity to platforms in exchange for interest or rewards, similar to how traditional banks pay interest on deposits. Top platforms in Vietnam include:

- PancakeSwap: A leading decentralized exchange offering users opportunities in liquidity pools.

- Uniswap: Known for facilitating token swaps and yield farming opportunities.

However, it’s critical to assess the potential impermanent loss which can occur when liquidity is provided to volatile pairs.

2. Staking

Staking involves holding a cryptocurrency in a wallet to support blockchain operations. Here’s where it gets interesting for Vietnamese investors:

- EOS and Cardano: Both offer attractive staking rewards.

- Personal finance tools: Utilize decentralized applications such as HibT.com that allow tracking your staking rewards effectively.

Revenue from staking can provide a stable income stream, but be mindful of the associated lock-up periods.

3. Arbitrage Opportunities

For the more advanced traders, arbitrage can be a lucrative strategy, taking advantage of price discrepancies across different exchanges.

- Shifting assets: Buy tokens on a cheaper platform and sell them on a pricier one.

- Bot trading: Consider using trading bots to capitalize quickly on these opportunities.

Keep in mind that transaction fees can eat into your profits, so identify low-cost platforms for these trades.

Local Regulations and Best Practices

As the DeFi market in Vietnam grows, understanding compliance and local regulations is crucial. Vietnam’s government is actively working on establishing a clear regulatory framework for cryptocurrencies and DeFi. Here’s what you need to know:

- Government engagement: Keep abreast of local announcements and updates from the State Bank of Vietnam.

- Due diligence: Conduct thorough research before participating in any investment opportunities.

As a reminder, this information is for educational purposes only and is not financial advice. Always consult local regulators or professionals.

Conclusion: Future of DeFi Investments in Vietnam

As Vietnam’s digital finance landscape expands, the potential for innovative DeFi investment strategies is limitless. With proper education and awareness of the risks, Vietnamese investors can leverage these strategies to create robust financial portfolios.

In conclusion, DeFi investment strategies in Vietnam can effectively align with one’s risk tolerance and financial goals, especially given the fast-evolving landscape. By staying informed and cautious, investors can unlock the potential of DeFi while minimizing risks.

For your DeFi investment journey in Vietnam, always remember to utilize trusted platforms like bitcoincashblender to blend your transactions for enhanced privacy and security.

Expert Author: Dr. Nguyen Thanh, a blockchain researcher and financial analyst, has published over 30 papers on cryptocurrency technologies and has led multiple project audits ensuring compliance with best practices.