Fintech and Crypto Integration in Vietnam

In recent years, Vietnam has emerged as a significant player in the fintech and cryptocurrency landscape. With approximately 30% of the population being active internet users, and a rapidly growing positive sentiment toward digital currencies, the Vietnamese market shows immense potential for fintech and crypto integration. In fact, according to Statista, over 50% of Vietnamese are interested in using cryptocurrencies as part of their financial transactions by 2025.

As we dive into the intricacies of fintech and crypto integration in Vietnam, let’s address the questions: What are the current trends driving this integration? How can businesses leverage these opportunities? And what are the challenges on this road to blockchain adoption?

Current Trends in Fintech and Crypto Integration

The fintech sector in Vietnam is undergoing a tremendous transformation, driven by several factors:

- Rising Smartphone Penetration: With nearly 150 million mobile connections, the accessibility of smartphones has facilitated digital finance services in rural and urban settings alike.

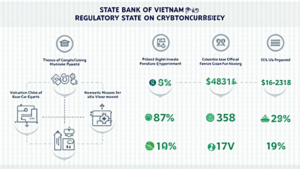

- Government Support: The Vietnamese government has expressed proactive interest in blockchain technology, aiming to create a favorable regulatory environment for cryptocurrency adoption.

- Investor Enthusiasm: According to Chainalysis, the $1.1 billion investment in the Vietnamese crypto market showcases significant investor confidence.

Case Studies of Successful Crypto Integration

Numerous companies in Vietnam have already begun to exploit the benefits of fintech and crypto integration. Here are a couple of successful case studies:

Case Study: MoMo Wallet

MoMo, a leading mobile e-wallet in Vietnam, has recently integrated cryptocurrency buying and selling within their platform. This innovative approach has attracted new users and improved customer loyalty significantly. In just one year, MoMo saw a 200% increase in users engaging with its cryptocurrency services.

Case Study: Tiki’s E-commerce Entry

Tiki, one of Vietnam’s largest e-commerce platforms, has implemented crypto payment options for various merchandise. This forward-thinking strategy not only enhances the shopping experience but also positions Tiki at the forefront of a new payment revolution.

Challenges in the Adoption of Crypto Technology

While the prospects for fintech and crypto integration seem bright, several obstacles remain:

- Regulatory Uncertainty: Though the government shows potential in advancing blockchain initiatives, there’s still ambiguity surrounding regulations for cryptocurrency usage.

- Cybersecurity Concerns: Increased instances of hacking and fraud incidents raise questions about the security of crypto transactions. A 2024 report indicated that losses from DeFi hacks exceeded $4.1 billion.

- Public Awareness: Many Vietnamese are still unaware of the benefits and risks associated with cryptocurrencies. Financial literacy programs are critical to expand understanding.

The Future of Fintech and Crypto in Vietnam

As we look toward the future, the integration of fintech and cryptocurrencies in Vietnam promises multiple opportunities:

- Increased Accessibility: With growing internet penetration and smartphone usage, fintech services will likely reach underserved populations in rural areas.

- Cross-Border Transactions: The introduction of cryptocurrencies can facilitate faster and cheaper international money transfers, benefiting Vietnamese workers abroad.

- Improved Services: Companies focusing on blockchain-based solutions can provide enhanced security and transparency in transactions.

Practical Steps for Businesses Seeking to Adapt

For businesses aiming to integrate fintech and crypto solutions, here’s how to start:

- Establish partnerships with tech companies to develop crypto-friendly payment solutions.

- Conduct market research to understand customer needs and preferences regarding digital currencies.

- Invest in cybersecurity to protect customers and build trust.

Conclusion

Vietnam’s fintech and crypto integration is not just an emerging trend; it is a palpable shift redefining the financial landscape. With a population eager for digital solutions and a government supportive of progressive policies, the future looks promising. Businesses must navigate the challenges meticulously, ensuring they harness the potential of this integration effectively.

For ongoing insights and developments in the world of cryptocurrency, don’t forget to explore Bitcoincashblender for reliable services that prioritize security and efficiency.

Author: Dr. Nguyen Tran, a seasoned blockchain expert with over 15 published papers in the field and a leader in multiple high-profile project audits.