Introduction

In recent years, the cryptocurrency landscape has experienced exponential growth, with billions of dollars being invested in various digital assets. In 2024 alone, a staggering $4.1 billion was lost due to DeFi hacks, highlighting the urgent need for robust asset allocation strategies in the crypto space. Investors must develop sound plans to protect their wealth and optimize returns, especially in volatile markets.

Understanding HIBT asset allocation strategies can be a game-changer for cryptocurrency enthusiasts. These strategies not only enhance investment efficacy but also pave the way for long-term success and sustainability. This article delves into effective allocation methods, spotlighting practical examples and extracting insights for the Vietnamese market, which has seen a remarkable surge in cryptocurrency adoption.

Understanding HIBT Asset Allocation

Asset allocation is a strategic approach that involves distributing investments among various asset categories, such as cryptocurrencies, stocks, bonds, and other assets. The HIBT framework refers to the holistic integration of diversified strategies tailored for identifying promising assets and managing risk effectively.

According to recent surveys, Vietnam has recorded a cryptocurrency adoption rate of **20%** among its population, making it crucial for local investors to understand asset allocation. HIBT strategies offer a structured methodology for individuals looking to navigate this exciting yet unpredictable landscape.

Comparative Analysis of Asset Classes

- Cryptocurrencies: High volatility paired with high reward potential.

- Stocks: Classic long-term investment vehicles with various sectors.

- Bonds: Fixed-income securities that provide more stability.

- Real Estate: Tangible assets that often appreciate over time.

- Commodities: Assets such as gold yield hedge advantages during inflation.

The idea is to balance the risks and rewards by selecting the right mix of these classes. For instance, while cryptocurrencies can deliver substantial returns, they also expose investors to higher risks due to market fluctuations.

Factors Influencing Asset Allocation

Several variables play a pivotal role in determining how assets should be allocated. Investors must consider:

– Risk tolerance: How much risk is an investor willing to take?

– Investment goals: Are they looking for quick gains or long-term wealth building?

– Market trends: Keeping an eye on current and emerging trends in the crypto space is essential.

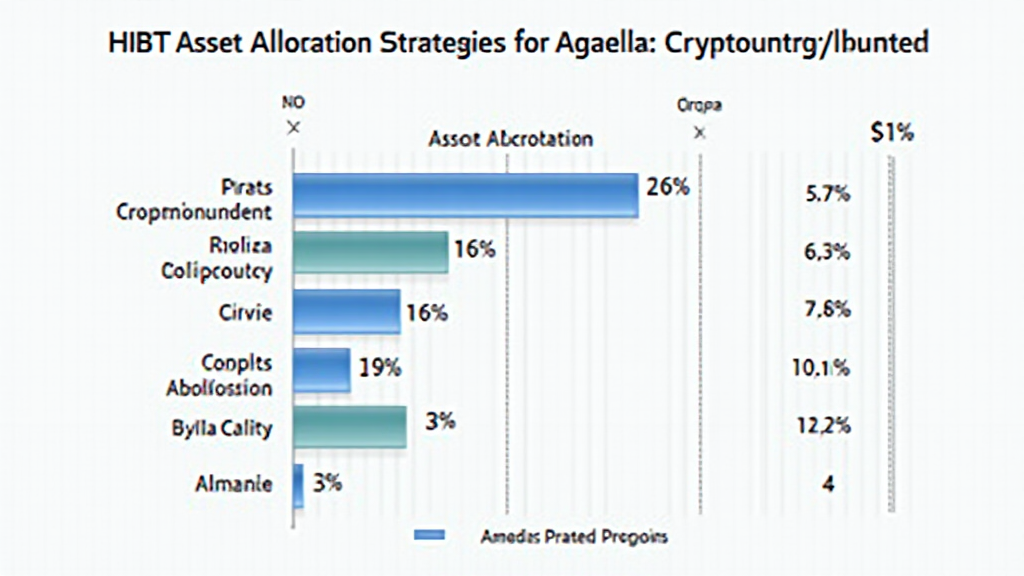

Popular HIBT Asset Allocation Strategies

Many investors have adopted HIBT strategies for asset allocation, focusing on leveraging technology and market data effectively. Here are some prominent approaches:

1. **The 60/40 Rule:** This classic investment strategy suggests allocating **60%** to equities (stocks) and **40%** to fixed-income assets (bonds) – adapted for crypto investors this could mean **60%** in cryptocurrencies and **40%** in more stable assets.

2. **Tactical Asset Allocation:** This strategy allows for flexibility in the allocation based on market conditions. Investors can rebalance their portfolios frequently based on performance metrics and market analysis.

3. **Risk Parity:** Aiming for equal risk among various asset classes rather than equal dollar amounts. For cryptocurrency, this would involve calculating the expected volatility of each asset and adjusting allocations accordingly.

4. **Core-Satellite Strategy:** This approach suggests a core investment in major stable coins (such as Bitcoin and Ethereum) while allocating the satellite portion to smaller altcoins that have high potential for growth.

Example of a Vietnamese Cryptocurrency Portfolio

In the Vietnamese context, let’s break down a sample portfolio for a crypto investor:

– **Core Investments (70%):** 40% in Bitcoin, 30% in Ethereum.

– **Satellite Investments (30%):** 15% in local Vietnamese projects (like VNDC), 10% in DeFi projects, and 5% in NFTs.

This allocation not only retains a balanced risk profile while targeting growth in the burgeoning Vietnamese crypto market.

Monitoring and Adjusting Your Portfolio

Asset allocation is not a one-time activity; it requires regular monitoring and adjustments based on changes in market conditions and personal circumstances. Market trends, regulatory changes, and emerging technologies can impact asset performance, warranting a reevaluation of your allocation strategy.

For continual optimization:

– Set reminder periods to review the portfolio

– Analyze performance through reliable sources

– Use tools and software, such as CoinMarketCap and CoinGecko, to keep track of asset metrics.

Conclusion

In the rapidly evolving landscape of cryptocurrencies, understanding HIBT asset allocation strategies is vital for investors aiming to thrive in this market. By blending risk management with strategic investment choices, investors can cultivate a robust portfolio that not only secures their assets but also fosters long-term growth.

As we look ahead to 2025, adapting to technological advancements and evolving market conditions will remain crucial. With approximately **20%** of the Vietnamese population engaging in cryptocurrency, there is immense potential for strategic development and financial education. For more insights on navigating the crypto landscape, visit hibt.com.

Author: Dr. Nguyen Thi Anh, a recognized expert in blockchain technology with over 15 publications in the field and significant involvement in auditing major crypto projects. Her insights continue to guide investors in Vietnam toward successful asset allocation strategies.