Understanding HIBT Emotional Trading: Avoid Investment Mistakes in Vietnam

As the cryptocurrency market continues to evolve, especially in engaging regions like Vietnam, investors face growing challenges and mistakes along the way. With emotions playing a critical role in decision-making, understanding the nuances of HIBT (Hindsight, Intuition, Bias, and Timing) in emotional trading is essential in avoiding pitfalls that can compromise investments. In 2024, it was reported that Vietnamese investors lost more than $500 million due to impulsive trading decisions influenced by emotional responses. In this article, we will delve into the common emotional trading mistakes that investors in Vietnam make and provide practical strategies to help mitigate them.

What is HIBT Emotional Trading?

Before we explore the emotional trading pitfalls, it’s crucial to understand the concept of HIBT. This acronym encompasses the critical factors that influence traders’ decisions:

- Hindsight: Reflecting on past mistakes too heavily.

- Intuition: Relying on gut feelings rather than data-driven analysis.

- Bias: Allowing personal beliefs to distort investment choices.

- Timing: Poor timing based on emotional swings rather than market trends.

Traders in Vietnam, often commendable for their swift adaptation to technologies, find themselves entangled in these emotional aspects when navigating the crypto markets.

Impact of Emotional Trading Mistakes on Investments

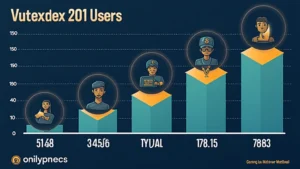

Emotional trading can lead to significant financial harm, particularly in booming markets like Vietnam where crypto adoption is surging, boasting a user growth rate of 33% year-on-year. Below, we highlight some common mistakes and their repercussions:

- Overtrading: Frequent buying and selling due to anxiety can erode potential gains.

- Ignoring Stop-Loss Orders: Failing to set stop-loss orders can magnify losses.

- FOMO (Fear of Missing Out): Rushing into investments because of hype can result in costly mistakes.

- Emotional Selling: Panic selling during downturns can lead to enduring financial loss.

How to Combat Emotional Trading in Vietnam

Addressing emotional trading requires a structured approach. Here are several methods that assist in overcoming the traps of HIBT:

1. Develop a Trading Plan

Creating a comprehensive trading plan can enhance trading discipline. This plan should include:

- Defined investment goals.

- Risk management strategies.

- Pre-set rules for entering and exiting trades.

2. Regularly Review Trades

After closing a trade, reviewing past decisions can provide valuable insights. Ask yourself questions like:

- What influenced my decision?

- How did emotions sway my trade outcome?

- What can I learn for future trades?

3. Use Data Analysis Tools

Incorporating tools that rely on analysis and metrics, rather than emotions, can create a solid foundation for investment decisions. For example:

- Technical analysis tools can reveal market trends.

- Blockchain analytics platforms can help evaluate risks.

Real-Life Examples of Emotional Trading in Vietnam

Understanding real-world implications of emotional trading will help illustrate how critical it is to avoid these practices:

- In 2024, a Vietnamese investor bought into a hype-driven coin without proper research, resulting in a 75% loss after the market crashed.

- A group of traders panicked during a market dip in 2023, leading to mass selling and locking in losses that could have been mitigated.

The Role of Education and Community Support

Educating oneself on market dynamics can lead to more informed decision-making. Here’s how you can leverage community resources:

- Participate in local crypto meetups or forums to exchange insights.

- Follow reputable sources for market news and trends.

- Engage with trading educators for guidance.

Conclusion: Building a Resilient Investment Strategy

In summary, combating emotional trading in Vietnam’s fast-paced crypto market requires a combination of strategic planning, education, and discipline. Analyzing trading mistakes through the HIBT lens is vital in ensuring that investors make informed decisions rather than be swayed by fear and greed. As we prepare for the potential ahead in 2025, avoiding emotional trading mistakes will not only safeguard investments but also enhance the overall trading experience.

For more insights and resources on how to optimize your investment strategy, visit HIBT’s website. Remember, each decision is a step towards a more informed and successful trading journey.

Author: Nguyen Tran – A renowned blockchain analyst and economist with over 20 publications on cryptocurrency strategies and past advisory roles for leading Vietnamese blockchain initiatives.