The HIBT Market Microstructure: A Deep Dive into Cryptocurrency Dynamics

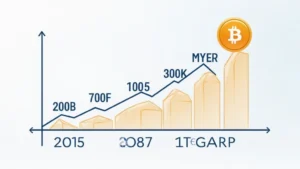

With the cryptocurrency market burgeoning, particularly in Southeast Asia, understanding the HIBT (High Impact Buy and Trade) market microstructure is essential. The significant growth seen in Vietnam’s crypto adoption—with a user rate increase of 110% in 2023— highlights an urgent need for traders and investors to grasp how market microstructure impacts their trading strategies and outcomes.

Understanding Market Microstructure

Market microstructure revolves around the processes that facilitate the exchange of assets in a market. It encompasses the mechanisms, rules, and systems that define how trades are executed and how prices are determined. For crypto assets, particularly on platforms like hibt.com, comprehension of these elements can vastly improve trading effectiveness.

What is HIBT Market Microstructure?

- Participatory Elements: This includes liquidity providers, market makers, and retail investors—the core structure of any trading environment.

- Order Types: Market orders, limit orders, and stop orders significantly influence trade execution and hence price movement.

- Transaction Costs: Slippage and commissions that occur during trading affect the profitability of transactions.

- Market Depth: The volume of buy and sell orders at various price levels shapes the market’s ability to absorb new trades without drastic price changes.

The Importance of Liquidity

Liquidity is a critical component of market microstructure, often termed the lifeblood of any financial market. Higher liquidity facilitates a smoother trading experience, allowing transactions to be executed quickly without causing significant price movements. In a rapidly evolving market like cryptocurrency, liquidity can diminish sharpy, leading to increased volatility.

- Low Liquidity Risks: When liquidity is low, traders may face larger spreads, making it more expensive to enter and exit trades.

- HIBT liquidity strategies: Utilizing liquidity pools to balance market pressure and enhance transaction experiences.

Price Discovery Mechanisms

Price discovery, the process of determining the price of an asset in a marketplace, is crucial in the HIBT framework. The dynamic participation of buyers and sellers leads to fluctuations, representing their perceptions of value based on various factors such as external news or internal trading volumes. Here’s how price discovery operates in HIBT market microstructure:

- Order Book Dynamics: The order book displays current buy and sell orders, and its shape directly informs traders of the prevailing market sentiment.

- Impact of News: Traders often react to news events, causing significant price spikes or drops. For instance, regulatory announcements regarding cryptocurrencies can shift investor sentiment drastically.

The Role of Algorithms in Trading

The emergence of algorithmic trading has transformed market microstructures. Algorithms execute trades at optimal moments based on predefined criteria, improving efficiency and potentially enhancing profitability. For Vietnam, where crypto trading is rapidly growing, algorithms can yield significant advantages for traders.

- Trading Bots: Automated bots can manage trades based on market signals to optimize entry and exit points.

- Market Sentiment Analysis: Algorithms can process massive datasets quickly to gauge market trends and sentiments, enhancing decision-making.

Challenges in HIBT Market Microstructure

While understanding market microstructure can enhance trading strategies, several challenges persist:

- Regulatory Uncertainty: Inconsistencies across regulations in different regions can lead to confusion and volatility.

- Market Manipulation: Techniques like pump-and-dump schemes can distort market perceptions and impact liquidity adversely.

- Technological Vulnerabilities: As with any digital framework, security remains paramount. The rise of cyber threats poses risks to trading efficiency and user trust.

Conclusion: Navigating the HIBT Market Microstructure

For traders and investors keen on optimizing their strategies in the cryptocurrency landscape, a comprehensive understanding of the HIBT market microstructure is critical. Understanding liquidity, price discovery, and challenges helps shape trading outcomes and contributes to aggregate market efficiency. As the industry evolves, embracing technology and robust trading strategies will be essential.

Ultimately, knowledge is power. The cryptocurrency market, particularly in a developing and rapidly adopting region like Vietnam, provides vast opportunities for those that navigate with insight and strategy. To learn more about effective trading practices and enhance your crypto trading experience, visit bitcoincashblender.