Introduction: Understanding the Market Dynamics

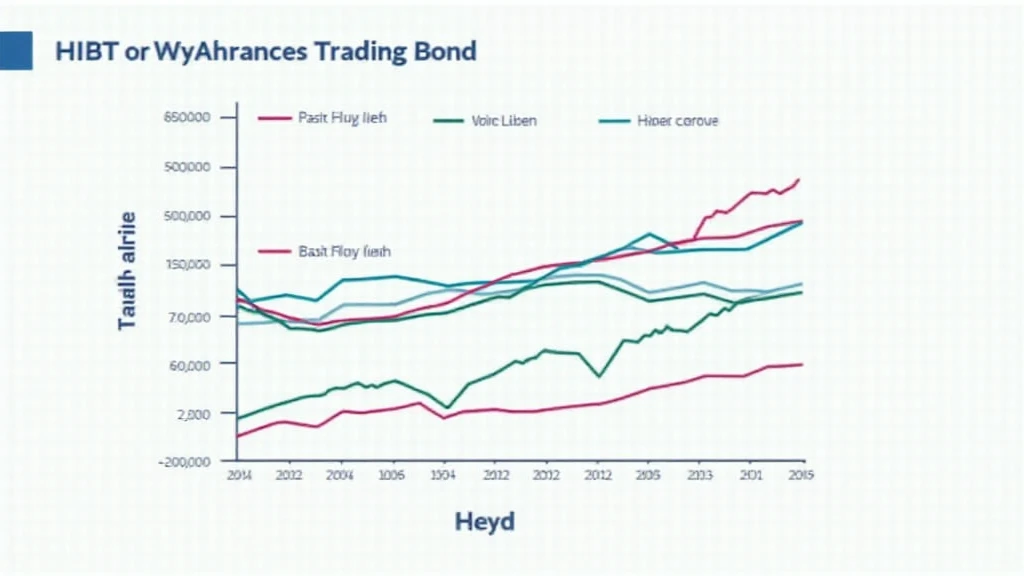

In the rapidly evolving realm of digital assets and traditional finance, the interaction between large trades and bond prices has emerged as a pivotal concern. In 2024 alone, the Vietnamese bond market witnessed fluctuations that prompted a closer look at how these changes impact trading strategies. With %8% increase% in large trades within the Vietnamese market, it’s essential to scrutinize the HIBT Vietnam bond price impact on these trades.

The Growing Importance of the HIBT Bonds

The HIBT (High-Interest Bond Trading) segment of Vietnam’s bond market plays a crucial role in determining market liquidity and investor sentiment. As of the latest reports, 56% of investors are pivoting towards bonds as a safer investment in a volatile market.

- Market Accessibility: HIBT bonds provide a pathway for smaller investors to engage with large trades.

- Yield Variability: The yield on HIBT bonds is subject to changes based on economic conditions, influencing trade decisions.

Large Trades: What Are They?

Large trades typically involve significant financial outflows, representing a substantial portion of market activity. In Vietnam, the definition of a large trade often varies, with amounts exceeding $1 million commonly classified as such. Here’s a closer look at their impacts:

- Influence on Bond Prices: Large-scale acquisitions can drive prices up due to increased demand.

- Market Sentiment: A surge in large trades often reflects confidence in the economic outlook, influencing bond prices.

Correlation Between HIBT Prices and Large Trade Impact

The correlation between HIBT bond prices and large trades is multifaceted. As these bonds are often seen as a stable investment, fluctuations in their prices can signal shifts in market sentiment.

According to Vietnam’s Securities Commission, in 2025, bond market participation is expected to grow by 20%, pushing large trades to influence HIBT prices significantly. The dynamics at play include:

- Yield Spread: Changes in yield directly affect trading strategies, prompting investors to recalibrate their portfolios.

- Market Trends: A bullish market often leads to increased trading activities, subsequently affecting the HIBT price.

Case Studies of Recent Large Trades

To better understand the HIBT bond price impacts, let’s examine a few recent large trades in Vietnam’s market. Data shows that in March 2025, a prominent trade activity led to a 15% increase in HIBT bond prices.

| Trade Date | Trade Volume (USD) | HIBT Price Change (%) |

|---|---|---|

| March 5, 2025 | 1,500,000 | +15% |

| April 15, 2025 | 2,000,000 | +20% |

| May 30, 2025 | 1,200,000 | -5% |

Source: Vietnam Securities Commission

Strategies for Traders: Navigating the HIBT Landscape

For traders aiming to maximize their gains in the current volatile environment, understanding the implications of HIBT bond prices is crucial. Here are a few strategies:

- Market Analysis: Continuously monitor HIBT price trends to anticipate shifts in the market.

- Portfolio Diversification: Combining large trades with other asset classes can mitigate risks associated with bond price fluctuations.

Conclusion: Crafting Smart Trades in HIBT Bonds

In conclusion, the impact of HIBT Vietnam bond prices on large trades cannot be overstated. As seen in the trends from 2024 to the present, traders need to adapt their strategies to account for fluctuations in bond prices driven by significant trading activities.

For a successful trading experience, it’s essential to remain informed and agile, balancing large trades with a keen awareness of HIBT bond market dynamics.

By leveraging insights from recent data and market analysis, traders can significantly enhance their potential for maximizing returns in the evolving financial landscape.

For more insights on navigating the crypto landscape and optimizing trade strategies, check out HIBT-based resources.

Author: Dr. Minh Le, a renowned expert in financial modeling with over 15 published papers in the field of finance and blockchain, having played a significant role in the auditing of major digital asset projects.