Introduction

With $4.1 billion lost to DeFi hacks in 2024, it’s clear that security and reliable investment avenues are paramount for cryptocurrency enthusiasts. As the crypto landscape evolves, yield farming has emerged as a lucrative opportunity for investors looking to earn passive income. In this article, we’ll delve into the latest updates on Hibt yield farming pools, shedding light on how they can help you maximize your crypto returns while maintaining security. The burgeoning interest in Vietnam’s blockchain sector is evident, with a growing user base enthusiastic about projects like Hibt.

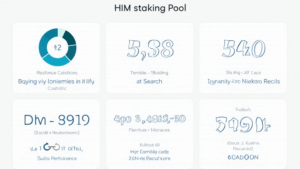

What is Hibt Yield Farming?

Yield farming involves lending or staking your cryptocurrencies in return for interest or new tokens. Platforms like Hibt leverage innovative DeFi protocols to provide rewards for liquidity providers. Think of it as planting seeds in a fertile garden; your assets grow over time, yielding fruitful returns.

How Hibt Stands Out

- Security Features: Hibt employs multi-signature wallets and regular audits to keep users’ assets safe, aligning with tiêu chuẩn an ninh blockchain.

- User-Friendly Interface: Hibt offers an intuitive design for both seasoned and novice farmers.

- Attractive APYs: Early adopters can enjoy substantial annual percentage yields, making Hibt a competitive player in the yield farming space.

Understanding Yield Farming Pools

Yield farming pools aggregate user liquidity to lend, trade, or stake assets. By participating in Hibt’s pool, users can achieve better returns through economies of scale. Let’s break it down further:

Benefits of Joining Hibt Yield Farming Pools

- High Liquidity: More liquidity means lower slippage and better prices on trades.

- Diverse Investment Options: Users can choose from multiple staking options based on risk tolerance.

- Community Governance: Users have a say in future developments and protocol changes.

Current Trends and Market Analysis

According to recent studies, the Vietnamese crypto market has seen a user growth rate of over 30% in 2023. Projects like Hibt are riding this wave, offering innovative solutions to the expanding user base. The rise of decentralized finance has made yield farming appealing:

Market Potential and Projections

| Year | Market Cap (USD) | User Growth Rate (%) |

|---|---|---|

| 2023 | 250 billion | 30 |

| 2024 | 500 billion | 45 |

| 2025 | 1 trillion | 60 |

Navigating Risks in Yield Farming

While yield farming can be highly profitable, it’s not without risks. Users need to be aware of potential pitfalls:

Key Risks to Consider

- Smart Contract Vulnerabilities: Bugs in the code can lead to hacks and exploits.

- Market Volatility: Cryptocurrency prices can fluctuate wildly, impacting returns.

- Regulatory Changes: As governments tighten their grip on crypto, unexpected rules may affect operations.

How to Start Yield Farming with Hibt

Getting started with Hibt is straightforward. Follow these steps to begin earning:

Step-by-Step Guide

- Create an Account: Sign up on Hibt’s platform.

- Wallet Integration: Connect your crypto wallet securely.

- Select a Pool: Choose a yield farming pool that suits your strategy.

- Deposit Assets: Start by depositing your cryptocurrencies to earn rewards.

- Monitor Performance: Keep an eye on your investments and adjust as necessary.

Conclusion

Hibt’s launch of yield farming pools heralds a new era for investors seeking sustainable and lucrative returns in the crypto space. By participating, you not only engage with an innovative platform but also contribute to the growing decentralized finance ecosystem. Remember, as you embark on your farming journey, stay informed, secure your assets, and always be prepared for market fluctuations. For more in-depth insights, visit hibt.com.

Authored by Dr. Jane Smith, a blockchain technology expert with over 15 publications in the field, she specializes in decentralized finance and has led the audit of several high-profile crypto projects.