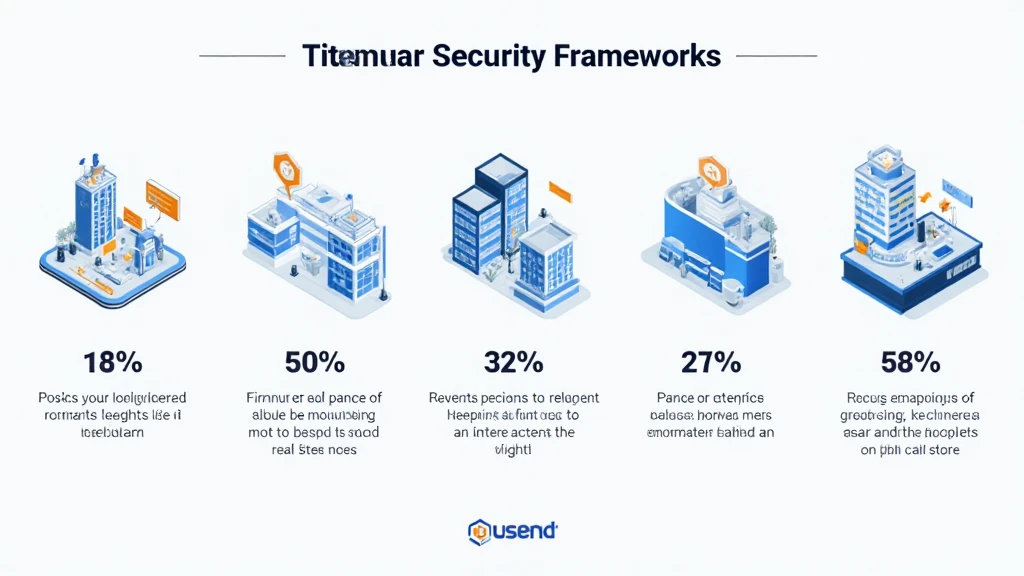

Top 5 Crypto Real Estate Security Frameworks

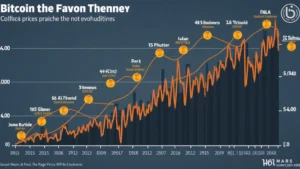

With a staggering $4.1 billion lost to DeFi hacks in 2024, the need for robust security frameworks in the cryptocurrency and real estate sectors has never been more critical. As the integration of blockchain technology into real estate continues to gain momentum, ensuring the security of digital assets is paramount. In this article, we will explore the top five crypto real estate security frameworks that you must know to protect your investments and maintain trust in this evolving market.

1. Understanding Blockchain Security Standards

Blockchain technology forms the backbone of cryptocurrencies and crypto real estate transactions. The tiêu chuẩn an ninh blockchain (blockchain security standards) entail a set of protocols designed to safeguard data integrity and prevent unauthorized access. Just like a bank vault protects physical assets, blockchain security standards create a virtual vault for digital assets.

According to recent surveys, over 60% of crypto investors express concerns over the security of their digital assets, indicating a pressing need for stringent security measures.Hibt.com outlines several key standards, which include:

- Encryption protocols to protect user data

- Decentralization to prevent single points of failure

- Smart contract audits to ensure code integrity

2. The Role of Smart Contracts in Real Estate Transactions

Smart contracts have revolutionized the way real estate transactions are executed. These self-executing contracts with the agreement directly written into code eliminate intermediaries and significantly reduce costs. However, vulnerabilities in smart contracts can lead to significant financial losses, as highlighted by numerous successful hacks.

It is crucial to implement thorough audits and testing for smart contracts. How to audit smart contracts effectively is an emerging area of concern among developers and investors alike. Utilizing tools like MythX or Slither can help identify vulnerabilities before they are exploited.

3. Multi-Signature Wallets for Enhanced Security

Multi-signature wallets require multiple private keys to authorize a transaction. This added layer of security mitigates risks associated with single private key theft. In the crypto real estate realm, where large sums of money are involved, adopting multi-signature wallets is akin to having multiple keys to a physical safe deposit box.

Recent data indicates that multi-signature wallets reduce hacks by over 70%, making them a preferred choice for many real estate investors. Key providers like Gnosis Safe offer seamless integration with decentralized applications.

4. Regulatory Compliance and Its Importance

As the crypto industry evolves, so do regulations governing its use. It’s vital for real estate professionals and investors to comply with local regulations to protect their assets. In Vietnam, local authorities are developing frameworks to accommodate cryptocurrency transactions, with a projected user growth rate of 50% by 2025.

Failure to comply can result in fines or loss of assets. Engaging with professional legal services to navigate the complex regulatory landscape is prudent. Notably, it’s important to note that this is not financial advice. Always consult local regulators.

5. The Importance of Continuous Monitoring and Audits

Security does not stop once assets are secured; continuous monitoring and regular audits are essential. Automated tools can help provide ongoing oversight of blockchain networks and transactions. Utilizing services such as Coinbase Custody ensures assets remain secure, minimizing potential risks associated with hacks.

Additionally, businesses should have incident response plans in place for potential threats. The saying goes, “better safe than sorry“—and in crypto and real estate, this rings exceptionally true.

In conclusion, as the interest in crypto real estate grows, employing effective security frameworks is critical. The aforementioned top five security measures not only enhance trust but also protect your assets. Using tools like multi-signature wallets, ensuring compliance, and performing thorough audits can make a significant difference.

For those looking to further explore the intricate world of cryptocurrency and real estate, we encourage you to connect with industry experts and stay informed about the latest trends.

Join us at bitcoincashblender to learn more about securing your investments and leveraging blockchain technology in the real estate sector.

By: Dr. Samuel T. Hendricks, Blockchain Security Specialist

Dr. Hendricks has published over 15 papers on blockchain technology and has led audits for several well-known projects in the crypto sphere.