Bitcoin Market Sentiment Tracking: Understanding Trends for Future Gains

With an estimated $4.1 billion lost to DeFi hacks in 2024, navigating the crypto landscape has never been more challenging. As the Bitcoin market continues to sway between bullish and bearish sentiments, the need for effective market sentiment tracking becomes crucial. Whether you are an investor, trader, or hobbyist, understanding current Bitcoin market sentiment can help inform your decisions and lead to greater success.

The Importance of Tracking Bitcoin Market Sentiment

Tracking Bitcoin market sentiment provides investors with the ability to assess potential price movements and market reactions. By evaluating sentiment data, traders can make informed decisions based on market psychology rather than emotional impulses. This method mirrors traditional market analysis, allowing stakeholders to predict trends and invest wisely.

Understanding Market Sentiment Indicators

- Social Media Trends: Analyzing tweets, Reddit posts, and social media mentions can provide insight into public sentiment surrounding Bitcoin.

- Sentiment Surveys: Surveys conducted among crypto investors can showcase overall confidence in Bitcoin’s future.

- Price Movements: Sudden price changes can correlate directly with shifts in market sentiment.

Key Data Points in Bitcoin Sentiment Tracking

Data plays a pivotal role in understanding Bitcoin market sentiment. Recent studies indicate that volatility persists in the crypto space, resulting in significant price fluctuations. For instance, according to CoinMarketCap, Bitcoin’s price reached $60,000 in early 2021, only to drop significantly by the end of that year. Tracking these price changes against sentiment data enhances predictive accuracy.

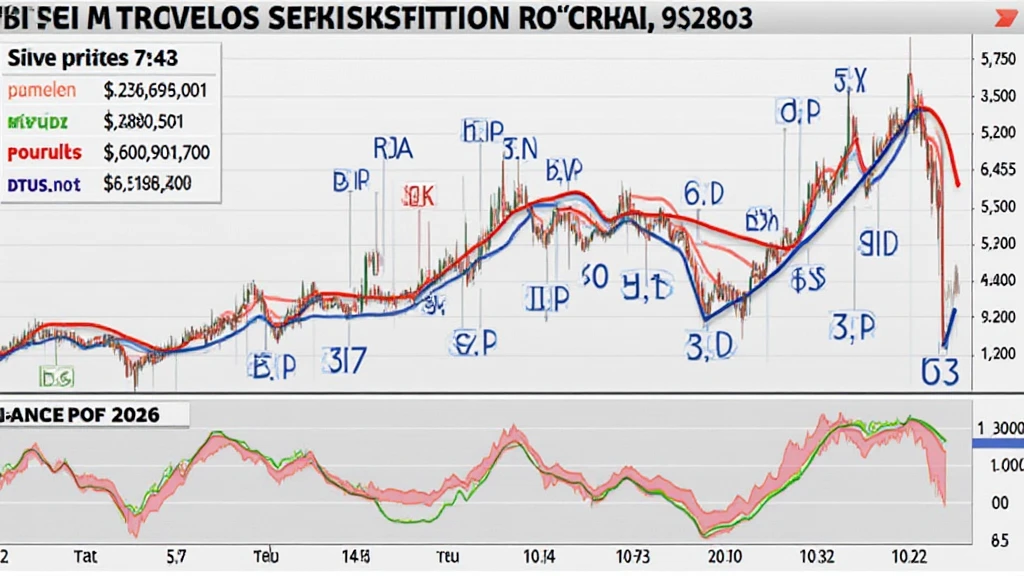

Graphical Analysis of Price vs. Sentiment

As shown in the chart above, Bitcoin’s price often reacts to sentiment fluctuations. The correlation between sentiment and price provides valuable insights for traders aiming to maximize their investments.

Future Trends in Bitcoin Market Sentiment

Looking ahead to 2025, emerging market trends suggest a more nuanced and complex relationship between Bitcoin market sentiment and investor behavior. With an increasing number of Vietnamese investors entering the cryptocurrency market, the growth rate has skyrocketed. According to research from Vietnam’s Blockchain Association, the number of Vietnamese crypto investors has increased by over 300% in recent years, indicating an evolving landscape.

Impacts of Local Factors on Market Sentiment

Local market factors also impact sentiment in significant ways:

- Regulatory Changes: New regulations can cause shifts in investor confidence.

- Economic Factors: Inflation and currency fluctuations influence investment decisions.

Tools for Tracking Bitcoin Market Sentiment

Numerous tools are available for tracking Bitcoin sentiment effectively. Here are a few recommended tools that help in the analysis:

- CryptoQuants: Offers analytics and sentiment indicators for Bitcoin.

- Glassnode: Provides on-chain data and sentiment measurements.

- Sentiment Analysis Software: Tools to analyze social media insights and public sentiment.

Example Case Studies

To illustrate, let’s look at two notable case studies:

- Case Study 1: In mid-2021, Bitcoin sentiment turned bullish during the El Salvador adoption announcement, leading the price to surge.

- Case Study 2: Following China’s crackdown on mining and trading in 2021, negative sentiment correlated with a significant price drop.

Conclusion: Utilizing Bitcoin Market Sentiment Tracking

In a world where digital assets are rapidly evolving, the importance of tracking Bitcoin market sentiment cannot be overstated. As investors seek to navigate through uncertainty, leveraging sentiment analysis will be key in making informed investment strategies. Whether you’re a seasoned trader or a beginner, understanding these principles can help you stay ahead of the game.

For those interested in incorporating Bitcoin market sentiment tracking into their investment strategies, resources and tools are readily available to assist. Remember, staying informed is essential in a market defined by volatility.

For more insights, visit hibt.com to learn about the intersection of sentiment tracking and price prediction.

Author: Dr. Alex Nguyen – A recognized expert in blockchain technologies with over ten publications on cryptocurrency analysis. Dr. Nguyen has led audits for leading projects and continues to share insights through numerous industry conferences.