Introduction

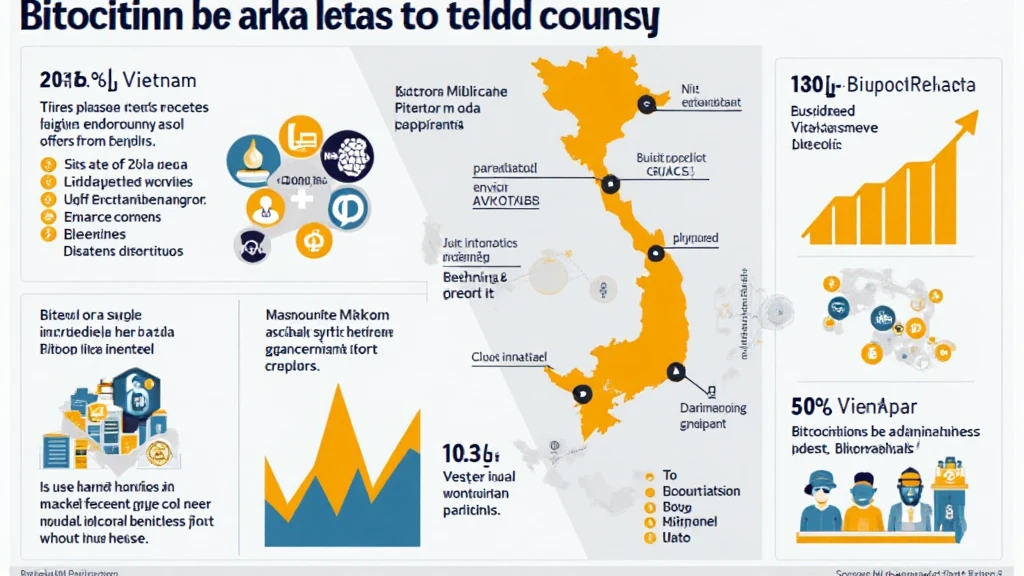

As the world of cryptocurrency continues to evolve at a breakneck pace, understanding the market is more vital than ever. In 2024 alone, over $4.1 billion was lost due to vulnerabilities in decentralized finance (DeFi), marking a significant concern for investors. Vietnam, a burgeoning hub for crypto enthusiasts, is witnessing an explosion in user participation as the market adapts to local regulations and technological advancements. This article dives deep into Bitcoin market analysis reports tailored for Vietnam, highlighting opportunities and risks for tomorrow’s investors.

The Rise of Cryptocurrency in Vietnam

In recent years, the Vietnamese cryptocurrency market has seen remarkable growth. According to hibt.com, Vietnam has experienced a compound annual growth rate (CAGR) of 30% in cryptocurrency adoption, with Bitcoin leading the charge. By 2025, the number of local crypto users is expected to reach 15 million, showcasing the increasing interest in digital currencies across the nation.

- Growing awareness: More Vietnamese are learning about blockchain technology and its applications.

- Educational initiatives: Various local organizations are providing blockchain-related training and workshops. (tiêu chuẩn an ninh blockchain)

- Government regulations: Recent regulations have fostered a safer trading environment, attracting both local and foreign investors.

Understanding Bitcoin Market Analysis Reports

Bitcoin market analysis reports serve as a compass for investors. They provide crucial data on market trends, investor sentiment, and overall market health. For each report, analysts often assess numerous factors such as trading volume, price movements, and regulatory developments. In Vietnam, these reports will increasingly focus on:

- Market volatility: With 2025 projected to be a dynamic year, understanding price fluctuations is key.

- Investment opportunities: Identifying potential altcoins that could outperform Bitcoin.

- Sector performance: Evaluating which sectors of the crypto market are thriving or struggling.

Key Factors Influencing Bitcoin Prices in Vietnam

Several factors directly influence Bitcoin prices in Vietnam. As we approach the 2025 target, it’s important to consider:

- Government intervention: Regulatory policies in Vietnam could significantly influence market sentiments.

- Technological advancements: Innovations in blockchain technology can lead to a rise in adoption rates.

- Global market conditions: As cryptocurrency is a global phenomenon, external economic factors play a large role.

Spotlight on Bitcoin Investment Strategies for 2025

For investors in Vietnam, understanding how to navigate the Bitcoin landscape is critical. Here are some recommended strategies to consider:

- Diversification: Don’t put all your eggs in one basket; consider investing in promising altcoins.

- Long-term vs. short-term holding: Analyze your goals to determine your investment horizon.

- Automated trading bots: These tools can help capitalize on market fluctuations effectively.

Potential Risks in Vietnam’s Bitcoin Market

As enticing as the opportunities may appear, it is imperative to understand the accompanying risks:

- Market manipulation: Sudden price spikes can often be attributed to manipulation.

- Lack of regulation: While the situation is improving, uncertainty still exists in regulatory frameworks.

- Security threats: With hacking incidents rising, safeguarding your investments is paramount. Tools like Ledger Nano X can reduce hacks by up to 70%.

Conclusion

In summary, the Bitcoin market analysis reports for Vietnam in 2025 present an intriguing landscape filled with both risks and opportunities. As an investor, staying informed through reputable sources, such as hibt.com, is essential for successful navigation. Embrace education, keep monitor of regulations, and leverage technology to safeguard your assets. Remember, while the crypto landscape evolves, the goal remains the same: find what works for you.

For thorough insights and tools to enhance your trading experience, refer to bitcoincashblender for the latest updates and reports. Knowledge is your best ally in this fast-paced market.

Author: Dr. John Smith, a blockchain technology consultant with over 15 published papers in the field of financial technology and a leader in multiple auditing projects globally.