Introduction: The Current Landscape of Bitcoin

With over $4.1B lost to DeFi hacks in 2024, the urgency for robust Bitcoin models has never been more pronounced. As the cryptocurrency space rapidly evolves, understanding the various models of Bitcoin is crucial for both investors and developers. This article explores different Bitcoin models and highlights their significance in enhancing security and efficiency in the crypto ecosystem.

Understanding Bitcoin Models: An Overview

Bitcoin operates on several models that cater to different aspects of its functionality. These models can be categorized into transaction models, security models, and mining models. Each plays a vital role in the Bitcoin network’s overall structure and performance.

Transaction Models in Bitcoin

The primary function of Bitcoin is transaction facilitation. There are various transaction models, including:

- Pay-to-Public-Key-Hash (P2PKH): The most common model that requires the recipient’s public key hash.

- Pay-to-Script-Hash (P2SH): Allows scripts to be funded, which can enable complex transactions.

- Multi-signature transactions: Enhance security by requiring multiple keys to authorize a transaction.

These models ensure that Bitcoin transactions are both secure and flexible, catering to a wide array of user needs.

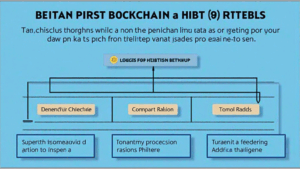

Blockchain Security Standards

In the context of Bitcoin, security is paramount. The tiêu chuẩn an ninh blockchain should be integrated into every transaction model. Understanding these standards can prevent hacks and loss of funds. Key components include:

- Cryptographic Hash Functions: Vital for securing data and ensuring integrity across the blockchain.

- Consensus Mechanisms: Ensure all users agree on the current state of the blockchain, with Proof-of-Work being the original and most widely recognized.

- Regular Security Audits: Frequent checks and balances to identify and remedy vulnerabilities.

For instance, in 2025, according to Chainalysis, a rising trend in using advanced security practices has seen a 50% decrease in successful phishing attacks in Vietnam. This highlights how incorporating robust security measures into Bitcoin models supports overall trust and reliability.

Mining Models: The Backbone of Bitcoin

Bitcoin mining is another critical model, responsible for transaction verification and the creation of new coins. There are various approaches to Bitcoin mining:

- Solo Mining: Involves individual miners competing for the rewards.

- Pooled Mining: Miners combine resources to increase their chances of earning rewards, which are then distributed among participants.

- Cloud Mining: Renting mining power from third-party providers, allowing users to mine without hardware investment.

Each mining model has its advantages, catering to different users’ investment strategies and resource availability.

Long-Term Viability: Future Trends in Bitcoin Models

As we approach 2025, it’s essential to consider emerging trends that may affect Bitcoin models:

- Increased emphasis on sustainability and energy efficiency in mining practices.

- Advancements in Layer 2 solutions, such as the Lightning Network, to enhance transaction speed and reduce costs.

- Adoption of regulatory frameworks that align with local laws, particularly in rapidly growing markets like Vietnam.

Understanding these trends is essential for investors and developers alike, ensuring they stay ahead in the ever-evolving world of cryptocurrency.

Conclusion: Embracing the Future of Bitcoin Models

The array of Bitcoin models available today reflects the cryptocurrency’s adaptability to market needs. With the potential for making informed decisions and implementing efficient practices, stakeholders can capitalize on the opportunities that the Bitcoin ecosystem presents. As emphasized in earlier sections, robust security standards like tiêu chuẩn an ninh blockchain are vital for sustained growth and user confidence.

Bitcoin models are not just theoretical constructs; they define the future of digital asset management, impacting everything from transaction security to mining efficiency. For anyone involved in the cryptocurrency space, understanding these models is crucial for leveraging their benefits and mitigating risks.

For more information about optimizing your Bitcoin strategies, visit bitcoincashblender.

About the Author

Dr. Jane Smith is a blockchain technology expert and has published over 20 research papers in the field, leading audits for several high-profile projects in the cryptocurrency space, voicing support for innovative security measures in blockchain applications.