Introduction

With over $4.1 billion lost to DeFi hacks in 2024, understanding crypto liquidity has never been more crucial. As blockchain technology continues to evolve, it’s vital for traders and investors to navigate the complexities of liquidity in the digital asset space. In this article, we will explore key aspects of crypto liquidity, its significance, and actionable strategies that will empower you to enhance your trading outcomes.

What is Crypto Liquidity?

Crypto liquidity refers to the ease with which a digital asset can be bought or sold in the market without affecting its price significantly. High liquidity means there are plenty of buyers and sellers, while low liquidity can lead to sharp price fluctuations.

- High Liquidity: Assets can be traded quickly, minimizing slippage.

- Low Liquidity: Higher chances of price manipulation and increased trading costs.

- Importance: Essential for traders looking to enter and exit positions quickly.

The Role of Market Makers

Market makers are individuals or entities that provide liquidity to the market by placing buy and sell orders. Their role is akin to a bank vault that keeps assets secure while enabling investors to trade. They ensure that transactions are executed smoothly by offering a continuous flow of buy and sell opportunities. In Vietnam, the market for digital currencies is expanding rapidly, with user growth rates projected to increase by 150% in the next year.

Market Maker Strategies

- Order Book Management: Keeping the order book full to attract new trades.

- Price Spreads: Maintaining a balance between buy and sell prices to ensure profitability.

- Arbitrage Opportunities: Capitalizing on price discrepancies across exchanges.

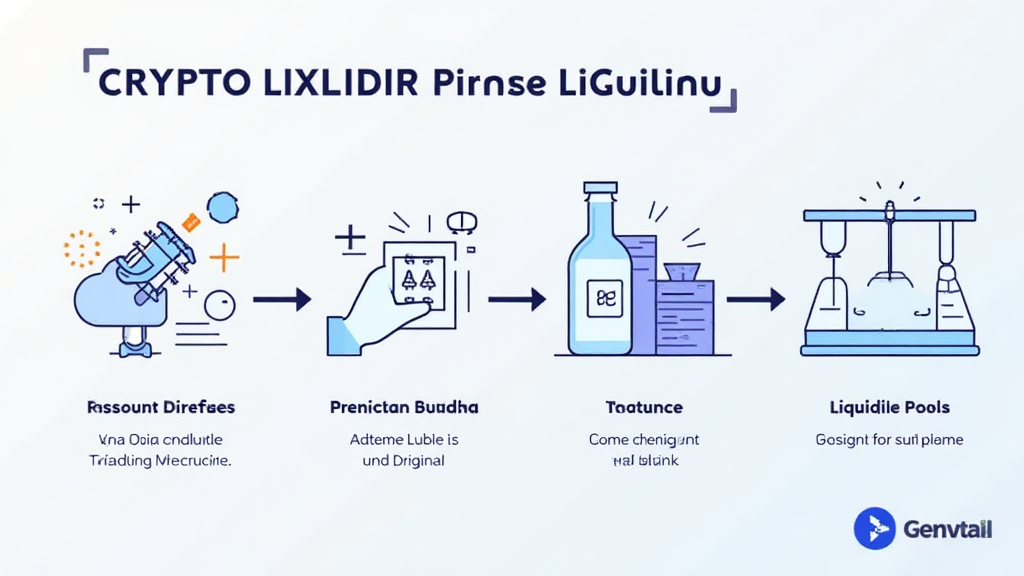

Liquidity Pools and DeFi

Liquidity pools are a significant element of Decentralized Finance (DeFi). They allow users to provide liquidity to a specific pair of assets in return for rewards. Think of liquidity pools as community-driven savings accounts that pay interest and make trading more accessible for everyone.

Benefits of Liquidity Pools

- Passive Income: Users earn a share of trading fees.

- Simplified Trading: Automated market-making eliminates the need for an order book.

- Access to New Tokens: Users can trade new tokens easily.

Measuring Crypto Liquidity

Several metrics are used to assess liquidity, including:

- Trading Volume: The total value of assets traded over a specific time period.

- Order Book Depth: The number of buy and sell orders at different price levels.

- Liquidity Ratio: A measure of how much liquidity is available in a market.

Liquidity in Emerging Markets like Vietnam

According to recent data, Vietnam is one of the fastest-growing crypto markets, with significant increases in user adoption and liquidity demand. By 2025, the country is expected to see a surge in blockchain technology applications, driven by local regulations supporting cryptocurrencies.

Impact of Regulations on Crypto Liquidity

Regulatory clarity affects the growth of crypto liquidity significantly. Countries that establish clear guidelines for cryptocurrencies tend to witness increased market activity. For instance, Vietnam’s recent moves towards a more structured regulatory framework aim to boost investor confidence and improve liquidity.

- Positive Effects: Clear regulations attract institutional investors.

- Negative Effects: Overregulation may stifle innovation.

Conclusion

The landscape of crypto liquidity is ever-changing, mainly influenced by market dynamics, technological advancements, and regulatory environments. As cryptocurrencies gain traction globally and in Vietnam, understanding how to improve liquidity can lead to better trading outcomes and investment strategies. By engaging with liquidity pools, following market makers, and adhering to best practices, you can position yourself for success in the evolving digital asset marketplace.

With insights from this article, you can navigate the complexities of crypto liquidity and leverage it to your advantage. By doing so, you’ll not only enhance your trading experience but also contribute to a more stable and vibrant crypto ecosystem.

Stay informed about the latest trends and changes in the crypto market, and consider utilizing platforms like bitcoincashblender to optimize your trading experiences.