Chainlink RWA Partnerships December 2025: Transforming Blockchain Operations

As the digital landscape continues to evolve, the intersection of blockchain technology and real-world assets (RWA) has gained unprecedented traction. In December 2025, we can expect significant developments in Chainlink’s WRA partnerships, which promise to redefine how value and information flow within the blockchain ecosystem. Experts predict that these collaborations will enhance the credibility and effectiveness of decentralized finance (DeFi) offerings globally.

The Importance of RWA in Blockchain

The incorporation of real-world assets into blockchain significantly enhances its practicality. These assets bridge the gap between traditional finance and the digital economy, allowing for more transparent, efficient transactions. With projections indicating that over $10 billion in RWAs will be tokenized by the end of 2025, it’s crucial for investors and users to understand what this means. Chainlink is at the forefront of this transformation, enabling the seamless integration of real-world data onto the blockchain.

What Are Real-World Assets?

- Real estate

- Commodities

- Traditional securities

- Intellectual property rights

Real-World Assets (RWAs) encompass a diverse range of tangible and intangible properties that can be tokenized. As more sectors recognize the benefits of blockchain, Chainslink’s RWA initiatives will likely involve partnerships with various businesses aiming to leverage blockchain’s capabilities.

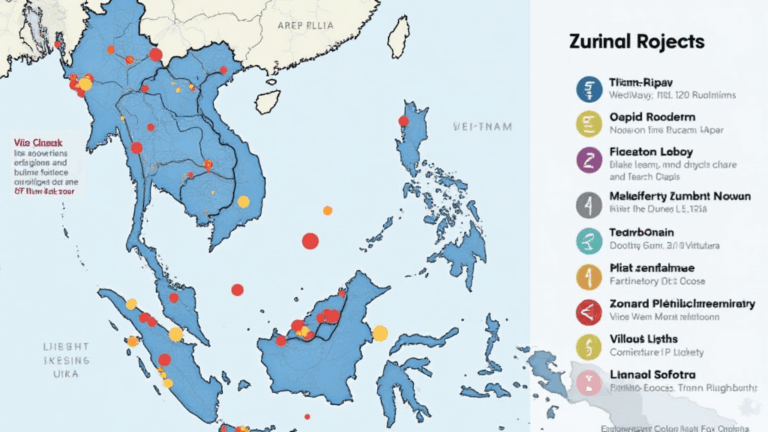

Growing Demand for Blockchain Solutions in Vietnam

The blockchain sector is witnessing exponential growth in Vietnam, with a reported increase of 35% in users in 2024 alone. This rapid adoption indicates a strong demand for blockchain solutions, making partnerships like those championed by Chainlink increasingly relevant.

- Investment in blockchain technology has surged in Vietnam to approximately $450 million.

- Vietnam leads in the global race for blockchain development, driven by an eager tech-savvy youth population.

As businesses in Vietnam look to harness the advantages of blockchain, Chainlink’s initiatives in RWA will support local projects and foster a more inclusive financial ecosystem.

Benefits of Chainlink’s RWA Partnerships

The expected partnerships set to launch by December 2025 are anticipated to bring a host of benefits, including:

- Enhanced Liquidity: Chainlink aims to enable better liquidity for tokenized assets, making it easier for individuals and businesses to trade.

- Increased Security: Through their existing technology stack, Chainlink will enhance the security measures surrounding RWAs.

- Greater Transparency: Using Chainlink’s oracle solutions ensures that data governing RWAs is immutable and verified.

- Broader Market Access: Small to medium enterprises will gain access to a wider investor base, significantly raising their funding opportunities.

With these advantages, Chainlink is set to become a pivotal player in the blockchain landscape.

Exploring the Mechanics of Chainlink’s Oracle Technology

At the heart of Chainlink’s functionality is its extensive use of oracles. Oracles are services that provide real-world data to blockchain applications, ensuring that these platforms operate with accurate and timely information. RWA partnerships will likely leverage this technology in the following ways:

- Data Accuracy: Oracles will ensure that data is accurately presented on-chain, capturing real-time financial metrics.

- Smart Contract Execution: Chainlink’s technology automates smart contracts, which will trigger transactions based on verified real-world data.

How to Audit Smart Contracts Effectively

As interest in cryptocurrency investments rises, so does the importance of auditing smart contracts. Innovations such as Chainlink’s oracles must be reliably integrated to mitigate risks. Here’s what you need to consider:

- Use open-source tools available for auditing.

- Conduct regular updates and penetration testing.

Utilizing comprehensive tools helps ensure that contracts are secure, ultimately protecting investments.

The Future of Chainlink RWA Partnerships

Moving towards December 2025, the landscape of blockchain RWAs will continue to evolve. Emerging trends suggest that:

- There will be increased regulatory scrutiny focused on RWA tokenization.

- Integrating RWAs into DeFi protocols will foster more robust financial instruments.

- Education on blockchain technology will be pivotal in enhancing user adaptability.

As these trends materialize, stakeholders engaged in Chainlink’s partnerships must stay informed to navigate future challenges.

Conclusion: The Chainlink RWA Advantage

In conclusion, Chainlink’s RWA partnerships by December 2025 promise to revolutionize blockchain applications. By creating bridges between RWAs and decentralized finance, Chainlink is paving the way for a more integrated future. With growing user engagement in Vietnam and potential collaborations at play, the implications are significant for both local and global markets. If you’re looking to invest or expand into blockchain technologies, now is the time to strategize with Chainlink.

As the narrative develops, the importance of credible sources and reliable data cannot be overstated. Always make informed decisions, aligning with recognized regulations where necessary.

About the Author: Dr. Emily Tran is a blockchain researcher with over 15 publications in the field and has led audits for cover pools with the promise of ensuring transparency and compliance in decentralized finance projects.

bitcoincashblender is positioned at the forefront of these innovations; visit our site to learn more about our services.