Introduction

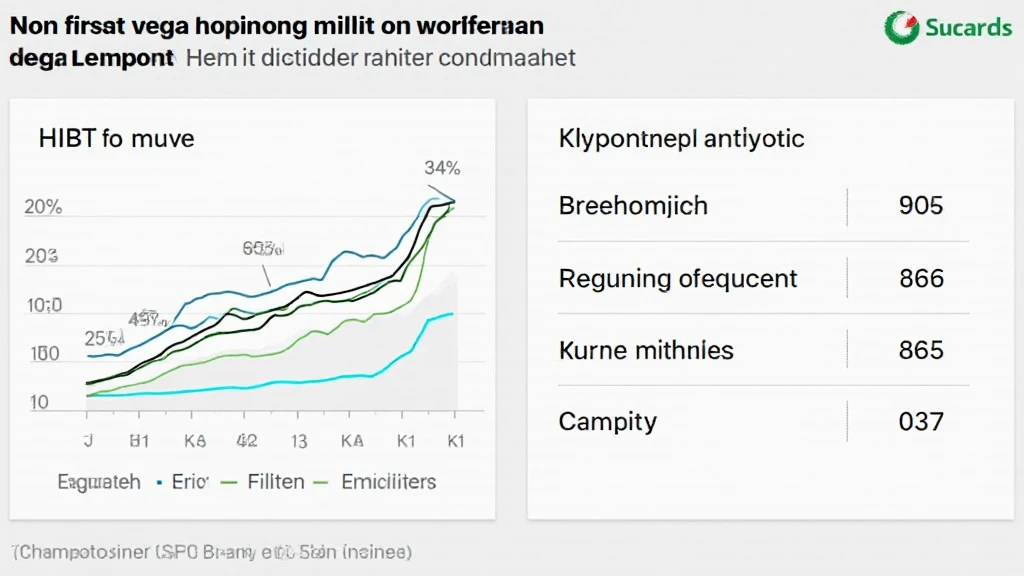

As Vietnam embraces the blockchain revolution, it is vital to stay informed about the upcoming trends and regulations shaping its cryptocurrency landscape. 2024 saw a remarkable growth in the number of Bitcoin users in Vietnam, increasing by over 200% compared to the previous year. This surge prompts questions regarding trading requirements, particularly with Bitcoin futures. Specifically, HIBT’s Bitcoin futures margin requirements for Vietnam is a topic that commands attention.

With over $4.1 billion lost to DeFi hacks in 2024, traders are increasingly cautious about their investments. This article dives deep into HIBT’s margin requirements, the implications for Vietnamese traders, and how to navigate these regulations effectively.

Understanding Bitcoin Futures

Bitcoin futures contracts allow investors to speculate on the future price of Bitcoin. By trading these, individuals can hedge their investments or capitalize on price fluctuations. Think of it as betting on the horse you believe will win a race long before it takes off.

The Role of Margin in Futures Trading

- Leverage: Margin provides traders with leverage, enabling them to operate with more capital than they actually possess.

- Risk Management: Holding a certain margin protects exchanges and other traders from potential losses.

- Regulatory Compliance: In Vietnam, adhering to margin requirements is crucial to ensuring compliance with local regulations.

HIBT’s Margin Requirements Explained

HIBT has set specific margin requirements tailored to the Vietnamese market, considering local trading behaviors and regulations. Understanding these requirements can greatly enhance your trading experience.

Initial Margin Requirements

The initial margin is the upfront amount required to open a futures position. For Bitcoin futures, HIBT has outlined that the initial margin must be at least 10% of the total contract value. This means if the total contract is valued at $10,000, a trader would need to deposit $1,000 as the initial margin.

Maintenance Margin

Once a position is opened, traders must maintain a minimum balance, known as the maintenance margin. If the account balance drops below this level, traders will receive a margin call to deposit more funds or risk liquidation of their position. HIBT maintains this margin at 5% of the total contract value.

The Growth of Bitcoin Trading in Vietnam

The cryptocurrency market in Vietnam is expanding rapidly. According to Statista, there were approximately 7 million cryptocurrency users in 2024, reflecting a market growth rate of over 150%. Moreover, the Vietnamese government has shown increasing interest in regulating cryptocurrency, providing a more secure environment for traders.

Local Regulations Impacting Margin Trading

Government regulations play a crucial role in shaping the operational framework for cryptocurrency trading. In Vietnam, the State Bank has been vocal about the need for compliance and security within the cryptographic sector.

Adapting to Margin Requirements

Adapting to HIBT’s margin requirements can feel daunting. However, understanding the following steps can simplify the process for Vietnamese traders.

- Educate Yourself: Familiarize yourself with future contracts, margin requirements, and trading strategies.

- Set a Budget: Determine a budget that aligns with your risk tolerance and margin requirements.

- Utilize Tools: Consider using tools like portfolio management software to monitor margins efficiently.

The Future of Bitcoin Futures in Vietnam

As trends evolve, more traders in Vietnam enter the Bitcoin futures market. HIBT aims to streamline margin requirements to encourage safer trading practices. Predictions indicate that by 2025, the Bitcoin market in Vietnam could exceed $10 billion, highlighting the potential growth and the importance of understanding margin requirements.

Conclusion

In summary, staying informed about HIBT’s Bitcoin futures margin requirements for Vietnam is crucial for any trader entering the futures market. Given the rapid growth of cryptocurrency in Vietnam, adhering to the defined margin requirements allows traders to navigate the market with confidence.

To sum it up, the emerging regulations are not just hurdles but also protectors for traders. As the landscape of crypto trading continues to evolve, being proactive in understanding these requirements ensures that you are well-equipped for the future.

For more actionable insights and updates, visit HIBT’s official website. As always, stay informed, stay compliant, and happy trading!

Best regards,

Dr. Anh Nguyen, a cryptocurrency analyst and researcher, has authored over 30 papers in blockchain technology and has led audits for multiple prestigious projects.