HIBT Hot Wallet vs Cold Wallet: Investment Use Cases in Vietnam

As Bitcoin and cryptocurrencies gain traction in Vietnam, understanding how to securely store these digital assets becomes paramount. With over $4.1 billion lost to DeFi hacks in 2024 alone, investors are increasingly looking for secure ways to manage their cryptocurrencies. The choice between a hot wallet and a cold wallet has significant implications for investment security and accessibility.

The Rise of Cryptocurrency in Vietnam

Vietnam has seen a surge in cryptocurrency adoption in recent years. According to recent studies, over 7 million Vietnamese are actively using or investing in cryptocurrencies, making it one of the fastest-growing markets in Southeast Asia. As adoption rates climb, security standards have become more critical for protecting digital assets.

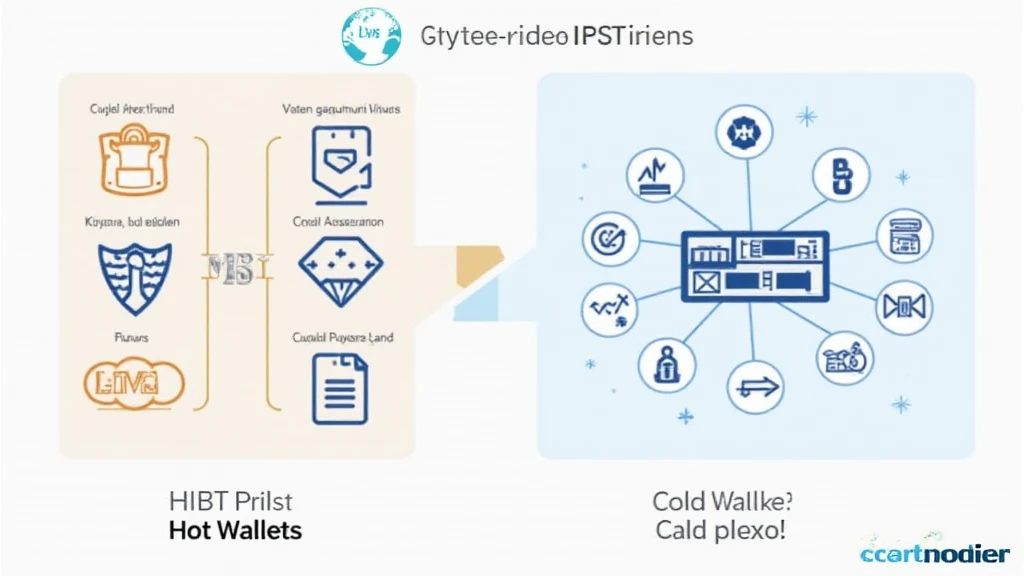

Understanding Hot Wallets

Let’s break it down. A hot wallet refers to a wallet that is connected to the internet, allowing for quick access and transactions. Here’s why it’s appealing:

- Immediate Access: Users can send and receive cryptocurrencies quickly without unnecessary delays.

- User-Friendly: Most hot wallets come with easy-to-navigate interfaces, making them suitable for beginners.

- Cost-Effective: Hot wallets are often free to use and require minimal technical knowledge.

However, there are risks associated with hot wallets. Since they are online, they are more susceptible to hacks. This leads many investors to question their safety, especially when considering long-term investments.

The Mechanics of Cold Wallets

On the flip side, cold wallets offer a different level of security. Typically, these wallets store cryptocurrencies offline, akin to keeping money in a safe deposit box. Here’s why they might be the best choice:

- Superior Security: Being offline dramatically reduces the likelihood of hacks.

- Long-Term Storage: Cold wallets are ideal for investors looking to store their assets securely for a long period.

- Variety of Options: From hardware wallets to paper wallets, investors have multiple cold storage solutions to choose from.

However, accessing funds from a cold wallet can be less convenient, which is a trade-off for security.

Investment Use Cases in Vietnam

When evaluating the investment use cases for hot vs. cold wallets, it’s vital to consider the specific needs of Vietnamese investors. Depending on your investment strategy, your wallet choice may vary:

1. Day Trading and Active Investment

If you’re a day trader looking to capitalize on rapid price swings, a hot wallet might be most beneficial:

- Hot wallets provide immediate liquidity, allowing you to execute trades quickly.

- You can efficiently manage multiple transactions without delays.

2. Long-Term Holding Strategies

In contrast, if you’re planning to hold digital assets for the long term, a cold wallet is likely preferable:

- Cold wallets ensure your assets remain safe from hackers.

- You can securely store large amounts of cryptocurrency without worrying about daily market volatility.

Market Trends and Security Standards

As blockchain technology evolves, so do the necessary security standards. The 2025 Blockchain Security Standards will play a crucial role in enhancing the ways assets can be stored, especially in regions like Vietnam. Crypto services need to comply with these standards while providing innovative solutions for better security.

Currently, Vietnamese users are encouraged to adopt robust security measures such as:

- Multi-signature wallets for increased security.

- Regular software updates to ensure maximum protection.

- Utilizing reputable platforms for crypto transactions.

Incorporating these practices can lead to a more secure investment environment for all Vietnamese crypto users.

Integration of Hot and Cold Wallets

Many savvy investors use a combination of hot and cold wallets to balance convenience and security. For example, an investor might keep a small amount in a hot wallet for everyday transactions, while storing the majority of their assets in a cold wallet for long-term holding. This hybrid approach minimizes risk while maximizing fluidity in trading.

Conclusion

In summary, choosing between HIBT hot wallets and cold wallets for investment is a critical decision for Vietnamese crypto investors. As the market continues to evolve, understanding the nuances can help investors make informed choices. Whether you’re actively trading or long-term holding, aligning your wallet choice with your investment strategy is essential.

For more insights on securing your digital assets, visit hibt.com.

Expert Author: Dr. Anna Le, a leading consultant in blockchain security standards, has published over 20 articles in the field and led audits for high-profile crypto projects across Southeast Asia.