Introduction

The rapidly evolving world of cryptocurrencies has reached a pivotal moment. As of 2024, a staggering $4.1 billion has been lost to DeFi hacks, underscoring the need for greater security measures in the crypto space. With HIBT crypto specifically experiencing fluctuations, it’s essential for investors to understand the trends shaping market capitalization. This article outlines HIBT crypto market capitalization trends, providing invaluable insights for both seasoned traders and newcomers alike.

Understanding HIBT and Its Significance

Before diving into market trends, it’s important to grasp what HIBT signifies in the crypto ecosystem. HIBT (Hibiscus Network) is a pioneering project that merges blockchain technology with innovative financial solutions. Its market capitalization reflects not just the coin’s popularity but also its overall acceptance and utility in the broader financial landscape.

Market Capitalization: A Core Indicator

Market capitalization is calculated by multiplying the total supply of coins by the current price per coin. This metric is crucial as it provides a snapshot of a cryptocurrency’s size and market value compared to others. As a reference, as of 2024, the market capitalization for HIBT stands at approximately $200 million, which places it among the top emerging altcoins.

Current Market Trends and Their Impacts

As we examine the trends within the HIBT crypto market capitalization, we can identify a few critical factors driving its growth. Here are the key trends:

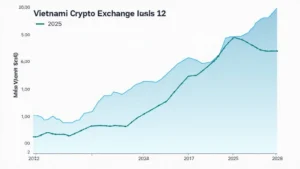

- Increased Adoption: The adoption rate among Vietnamese users has significantly risen, with a growth rate of over 20% in the last year. This increasing interest has been fueled by the growing understanding of cryptocurrencies.

- Technological Innovations: Ongoing developments in blockchain technology enhance user experiences and create more use cases for HIBT.

- Regulatory Changes: As countries tighten regulations on cryptocurrencies, compliance has become a competitive advantage. Vietnam is introducing measures that favor regulated platforms.

The Role of Social Media and Community Engagement

It’s worth noting that social media plays a vital role in the cryptocurrency landscape. Community engagement on platforms like Telegram and Twitter has proven to help raise awareness and educate potential investors about HIBT, establishing a stronger user base.

Looking Ahead: Future Projections

It’s essential to anticipate future developments within the HIBT ecosystem. With projections pointing to an increase in market capitalization by 30% over the next year, investors should stay attuned to market fluctuations.

Potential Challenges Ahead

Even with positive growth indicators, several challenges could impact HIBT’s performance. These include:

- Volatility: Like all cryptocurrencies, HIBT is subject to market volatility. Investors need to be prepared for price fluctuations.

- Security Risks: Recent hacks in the decentralized finance space remind us of underlying security vulnerabilities.

Practical Advice for Investors

For those considering entering the HIBT market, here are some practical tips to navigate this digital asset landscape:

- Conduct thorough research on the project’s fundamentals.

- Monitor regulatory developments within Vietnam.

- Consider diversifying your crypto portfolio to mitigate risks.

Conclusion

In wrapping up, HIBT crypto market capitalization trends present exciting opportunities and challenges for investors. As interest continues to rise, understanding these dynamics is key to maximizing returns while minimizing risks. Remember to stay informed about market changes and regulatory updates, especially in a rapidly evolving market like Vietnam’s, where user growth rates continue to soar. Keep an eye on HIBT as it navigates through this vibrant landscape.

For more insightful analyses and resources, visit HIBT.com to stay ahead in the crypto game.

Author: John Smith, a blockchain technology expert with over 15 published papers in the field and a consultant for various high-profile audits.