Introduction

Bitcoin has been captivating investors and enthusiasts since its inception. With $4.1B lost to DeFi hacks in 2024, security in the blockchain space has never been more crucial. One of the most anticipated events in the Bitcoin ecosystem is the Bitcoin Halving, which occurs approximately every four years. This event has profound implications on Bitcoin’s supply, price, and overall market dynamics. In this article, we will delve into the historical data related to Bitcoin Halving events, examining their effects on market behavior and prices.

Understanding Bitcoin Halving

Bitcoin Halving refers to the process whereby the rewards for mining new blocks are cut in half. This mechanism aims to create scarcity by limiting the total supply of Bitcoin to 21 million. The first halving event took place on November 28, 2012, followed by events on July 9, 2016, and May 11, 2020. The next halving is projected for 2024.

What Happens During Halving?

During each halving event, the reward miners receive for validating transactions decreases from 12.5 to 6.25 BTC in 2020. This reduction essentially slows the issuance rate of new bitcoins, mirroring the economic principles of supply and demand. As the supply decreases while demand continues to grow, the price of Bitcoin typically escalates.

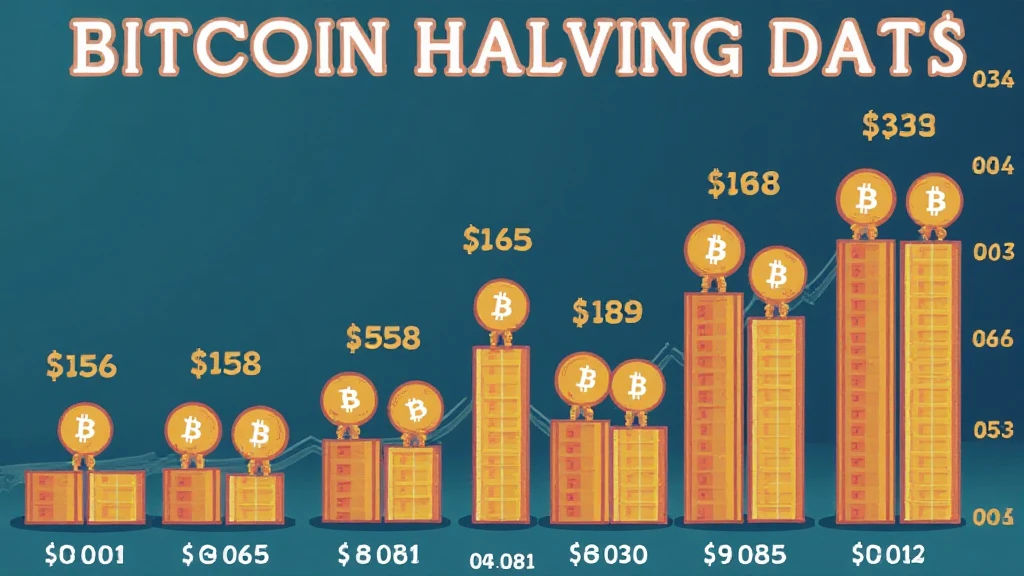

Bitcoin Halving Historical Data

First Halving: November 2012

The first halving brought Bitcoin’s reward down from 50 BTC to 25 BTC. This event marked a significant turning point in Bitcoin’s price trajectory:

- Price Before Halving: Approximately $12.31

- Price One Year After: Approximately $1,000

Second Halving: July 2016

The second halving reduced the block reward to 12.5 BTC. This period saw increased adoption and awareness of cryptocurrencies:

- Price Before Halving: Approximately $657

- Price One Year After: Approximately $2,500

Third Halving: May 2020

The most recent halving further halved the reward to 6.25 BTC. This halving occurred amidst the COVID-19 pandemic and resulted in:

- Price Before Halving: Approximately $8,500

- Price One Year After: Approximately $60,000

The Impact of Halving on Bitcoin’s Price

The price reactions observed during previous halving events have drawn significant attention from investors. High volatility and speculative trading often follow these events. Historical data shows that prices tended to experience substantial increases within a year following the halving. This pattern suggests that halving has a strong influence on market sentiment.

Global Bitcoin Adoption and Its Correlation with Halving

As we analyze Bitcoin Halving events, it is essential to consider global Bitcoin adoption. According to various reports, the number of cryptocurrency users in Vietnam has grown significantly, reflecting increased interest in Bitcoin:

Vietnam Market Data

- User Growth Rate: Approximately 30% year-on-year

- Estimated Users by 2025: Over 10 million

Anticipating the 2024 Halving

The upcoming halving event is anticipated to occur in 2024. As Bitcoin approaches this milestone, it’s crucial for investors to stay informed about potential price movements. Historical trends indicate that preparations for another significant price rally might be underway. Here’s the catch: while historical performance provides insight, it does not guarantee future results.

Conclusion

In conclusion, the historical data surrounding Bitcoin Halving events provides a fascinating lens through which to understand market dynamics. With each halving, Bitcoin has proven to be resilient, often resulting in price appreciations that attract both old and new investors. For anyone looking to invest in Bitcoin, understanding these events is essential. The anticipated 2024 halving presents another opportunity for insight and potential profitability in the cryptocurrency market. It’s important to stay informed and make well-thought-out decisions as we navigate the complexities of Bitcoin trading.

This article serves as a comprehensive overview of the historical data related to Bitcoin Halving events and their impact on the cryptocurrency market. For more information on blockchain security practices, consider checking out hibt.com. Not financial advice. Consult local regulators.