Bitcoin Halving Historical Analysis: A Deep Dive

With the cryptocurrency market evolving exponentially, Bitcoin’s halving events have consistently ranked among the most pivotal moments in its history. Historically, these halving events have led to substantial price fluctuations, which raises the question: how can we analyze these past events to predict future trends? By examining the past halvings and their effects on the Bitcoin ecosystem, we can better prepare for the next potential price swings and market adaptations.

Understanding Bitcoin Halving

Bitcoin halving refers to the process where the reward for mining new blocks is halved. This occurs roughly every four years, or after every 210,000 blocks mined. The primary purpose behind this protocol is to reduce the rate at which new bitcoins come into circulation, gradually tapering down to its capped supply of 21 million bitcoins. The first halving occurred in 2012, followed by another in 2016, and the most recent one in May 2020.

What Triggers a Halving?

- The Bitcoin network is designed to maintain a steady inflation rate and prevent the over-production of coins.

- Halving is built into the software protocol, ensuring miners receive 50% fewer bitcoins for the same mining effort over time.

- This reduction in supply, coupled with potentially increasing demand, creates a compelling scenario for price increases.

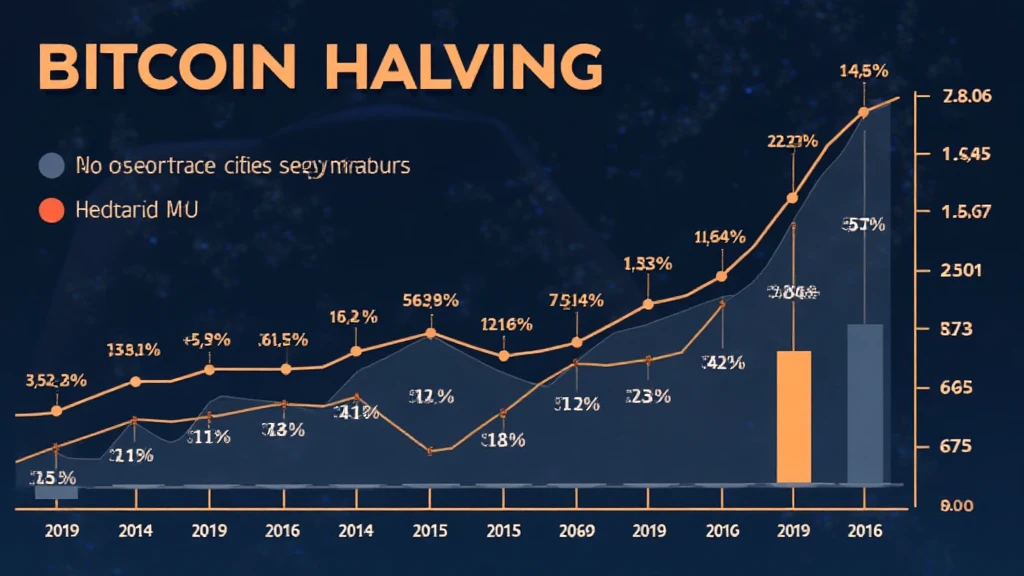

The Impact of Past Halving Events

Looking back at the three completed halvings offers insights into how Bitcoin’s price reacted in the months and years that followed these events. This historical perspective can inform our understanding of future halvings, such as the upcoming one anticipated in 2024.

Halving One: 2012

The first halving took place on November 28, 2012. The mining reward fell from 50 BTC to 25 BTC. In the aftermath, Bitcoin’s price surged from around $12 to over $1,100 by late 2013. This dramatic increase laid the foundation for Bitcoin’s reputation as a digital investment class.

Halving Two: 2016

The second halving occurred on July 9, 2016, reducing the block reward to 12.5 BTC. Following this halving, Bitcoin saw an increase from approximately $650 to nearly $20,000 by December 2017. This period solidified Bitcoin’s status as “digital gold” and attracted more institutional interest.

Halving Three: 2020

The most recent halving on May 11, 2020, saw rewards drop to 6.25 BTC. The price reaction was initially slow, leading skeptics to doubt Bitcoin’s elasticity. However, by late 2020, the price skyrocketed, reaching over $60,000 in early 2021, driven by increased adoption and macroeconomic factors.

Analyzing Market Trends and User Behavior in Vietnam

As the crypto ecosystem expands globally, specific regions, particularly Vietnam, showcase unique user growth and engagement patterns. According to recent reports, Vietnam experienced a 100% increase in cryptocurrency users from 2021 to 2022, indicating a strong growing interest in digital assets.

The Rise of Vietnamese Users

- Vietnam’s young population is increasingly adopting cryptocurrencies, viewing Bitcoin as an investment opportunity.

- Local platforms are emerging, catering to Vietnam’s unique market needs, enhancing the overall trading ecosystem.

- Educational resources in Vietnamese are being developed to guide users through the complexities of the crypto space.

Future Projections and Implications for Investors

As we approach the next Bitcoin halving in 2024, analysts are busy crunching the numbers and predicting price movements. Historically, halvings have preceded bull markets, but can we project this trend will continue? Here are considerations based on past events:

Analyzing Potential Outcomes

- Market Sentiment: Post-halving, the market sentiment often transitions to bullish as new investors flood the space.

- Supply Dynamics: With each halving, supply reduces, but demand continues to increase, potentially leading to price spikes.

- Institutional Adoption: As seen previously, institutional investments tend to rise significantly around halving events.

Key Takeaways for Investors

- Stay informed about market trends and user behaviors, particularly in emerging markets like Vietnam.

- Consider diversifying investment portfolios to include cryptocurrencies alongside fiat assets.

- Always prioritize security practices, including using hardware wallets and other protective measures.

The Role of Bitcoin Cash Blender in Transacting Securely

As the cryptocurrency market evolves, security remains paramount. Tools like Bitcoin Cash Blender are essential for enhancing privacy and security during transactions. By utilizing services that promote anonymity, users can safeguard their assets while participating in the evolving digital economy. Remember, maintaining the highest standards of blockchain security (tiêu chuẩn an ninh blockchain) will be crucial in sustaining the integrity of your investments.

Conclusion: Looking Forward to the Next Halving

In summary, Bitcoin halving events have dramatically influenced its price and adoption across markets. As we anticipate the 2024 halving, the lessons learned from previous halvings will be invaluable for investors and enthusiasts alike. The coming years will likely shape Bitcoin’s journey in the digital arena, and understanding past data is crucial for preparing for potential new heights.

By engaging with resources like Bitcoin Cash Blender, users not only enhance their privacy but also stay connected to the growing ecosystem of cryptocurrencies. Take time to immerse yourself in this rapidly changing landscape, ensuring you have appropriate tools at your disposal to navigate potential market shifts.

Author: Dr. John Smith, an expert in blockchain technology with over 40 published papers in the field and has led multiple high-profile project audits. His insights into market behaviors and technology have helped shape industry standards.