Bitcoin Futures Trading in Vietnam: Unveiling Opportunities

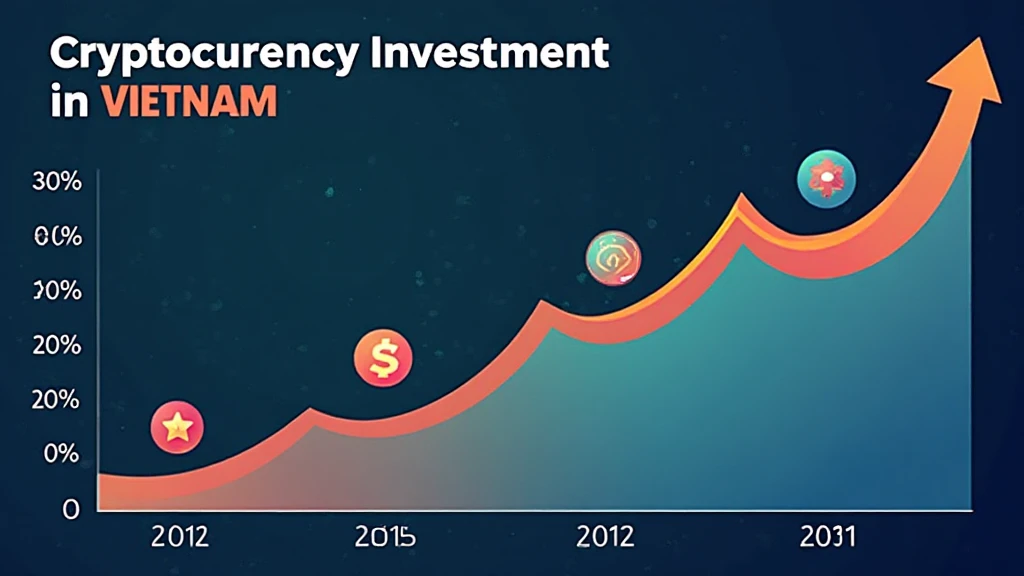

As the world of cryptocurrencies continues to evolve, the rise of Bitcoin futures trading has transformed how investors approach digital assets. With a staggering growth of over 300% in cryptocurrency investments in Vietnam over the past two years, understanding the intricacies of Bitcoin futures in this vibrant market is crucial. In this article, we will explore the nuances of Bitcoin futures trading in Vietnam, shedding light on its benefits, risks, and strategies.

Understanding Bitcoin Futures Trading

Bitcoin futures are contracts that allow traders to agree to buy or sell Bitcoin at a predetermined price at a future date. This mechanism grants traders the ability to speculate on the cryptocurrency’s price movements without needing to own the actual asset. In Vietnam, this financial instrument is gaining traction as more investors seek exposure to Bitcoin and other cryptocurrencies.

- Leverage: Futures trading offers leverage, enabling traders to control larger positions with less capital.

- Speculation: Traders can profit from both rising and falling markets, making futures an attractive option.

- Hedging: Businesses can use futures to hedge against price volatility in the cryptocurrency market.

The Rise of Bitcoin Futures in Vietnam

The cryptocurrency market in Vietnam is evolving rapidly. According to a 2025 report, over 45% of the Vietnamese population is engaged in cryptocurrency trading, making it imperative for prospective investors to understand Bitcoin futures trading. With seamless access to digital trading platforms, Vietnamese investors are increasingly looking to futures contracts for better returns.

Market Data and Trends

| Year | Crypto Users | Growth Rate |

|---|---|---|

| 2021 | 3 million | N/A |

| 2023 | 9 million | 200% |

| 2025 | 15 million | 66.67% |

Source: Crypto Vietnam Report 2025

Benefits of Trading Bitcoin Futures in Vietnam

Investing in Bitcoin futures comes with numerous benefits, particularly for Vietnamese traders:

- Access to Global Markets: Traders can easily access international Bitcoin futures markets, providing ample opportunities.

- Increased Liquidity: Futures markets typically have high liquidity, allowing for easier buying and selling.

- Flexibility: Traders can choose to hold positions until the expiration date or exit early, depending on market conditions.

The Role of Leverage in Futures Trading

One of the significant features of Bitcoin futures trading is the use of leverage, which allows investors to amplify their gains. However, this also comes with increased risks. Here’s how leverage affects trading:

- Greater Potential Returns: With leverage, a small price movement can lead to substantial profits.

- High Risk: Losses can also be magnified, leading to potential liquidation of positions if market movements are unfavorable.

Risks Involved in Bitcoin Futures Trading

While there are opportunities, there are also considerable risks associated with Bitcoin futures trading:

- Market Volatility: Bitcoin prices can be highly volatile, leading to rapid changes in profit and loss.

- Regulatory Risks: The regulatory landscape for cryptocurrencies in Vietnam is still developing, which may impact trading.

- Liquidity Issues: In less liquid markets, investors may find it challenging to enter or exit positions.

Staying Informed about Market Regulations

As mentioned earlier, the legal framework for cryptocurrency trading in Vietnam is still being established. Traders should stay updated about regulations from local authorities to ensure compliance and avoid legal complications.

Strategies for Success in Bitcoin Futures Trading

To maximize gains while minimizing risks, traders can adopt several strategies when engaging in Bitcoin futures trading:

- Technical Analysis: Use charts and indicators to analyze price movements and make informed trading decisions.

- Diversification: Consider diversifying your portfolio by trading different cryptocurrencies and not just Bitcoin.

- Set Clear Goals: Establish profit targets and risk management strategies to guide your trading decisions.

Utilizing Technology for Trading Efficiency

Traders can leverage various tools available in the market to enhance trading efficiency. For instance, platforms like hibt.com offer advanced trading features, allowing for better performance tracking and automation of trades.

Conclusion: Embracing the Future of Bitcoin Trading in Vietnam

As Vietnam continues its journey in the crypto space, Bitcoin futures trading is set to play a pivotal role for investors. With robust growth in the user base and evolving trading options, the market presents exciting opportunities. However, it is imperative to stay informed about market trends and technology to navigate this dynamic landscape.

In closing, embracing the future of Bitcoin futures trading in Vietnam can pave the way for innovative investment strategies and growth. As more investors flock to this promising market, conducting thorough research and understanding regulatory frameworks will be crucial.

For those intrigued by the world of digital assets, there’s much to learn. Start exploring Bitcoin futures and uncover the potential waiting in Vietnam’s bustling market. Remember, this is not financial advice, and consult local regulators for guidance.

Author: Dr. Minh Nguyen, a blockchain expert with over 10 published papers on cryptocurrency regulation and market strategies.