Bitcoin Halving Historical Performance: Insights and Trends

As the cryptocurrency sector gains traction, Bitcoin (BTC) remains at the forefront of discussions amongst investors and tech enthusiasts alike. Recently, a pivotal moment caught the eyes of many: the Bitcoin halving events. Have you ever wondered how these halvings impact the market dynamics and investor behavior? In this article, we will delve into the historical performance of Bitcoin halvings, analyzing their long-term effects on pricing and market strategies.

What is Bitcoin Halving?

At the heart of Bitcoin’s unique economic model is halving, a process that occurs approximately every four years. During a halving event, the reward given to miners for processing transactions and adding them to the blockchain is cut in half. This mechanism is designed to control Bitcoin’s supply inflation rate, mimicking the scarcity of precious metals like gold.

- First halving – November 2012: Reward dropped from 50 BTC to 25 BTC

- Second halving – July 2016: Reward reduced to 12.5 BTC

- Third halving – May 2020: Current reward is 6.25 BTC

The next anticipated halving is expected in 2024, when the reward will decrease to 3.125 BTC.

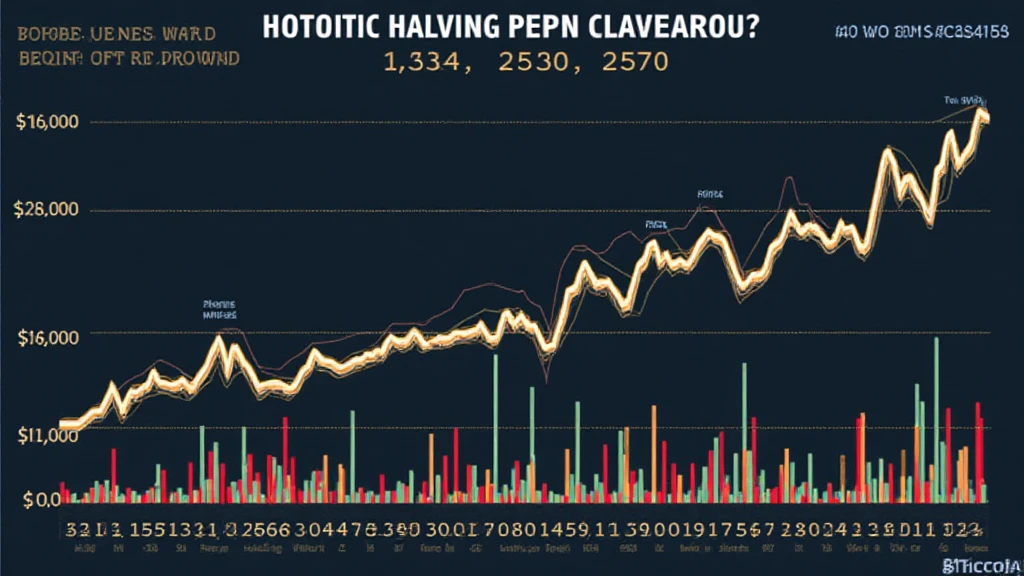

The Impact of Bitcoin Halving on Market Dynamics

Halving events often lead to substantial price fluctuations. For instance, following the first halving in 2012, Bitcoin’s price skyrocketed from around $12 to over $1,150 within a year. Similarly, after the 2016 halving, the price surged to nearly $20,000. But how does this happen?

The main factors contributing to these price movements include:

- **Reduced Supply**: With fewer Bitcoins entering circulation, scarcity increases, possibly driving prices up.

- **Increased Media Attention**: As reward reductions are significant news, media coverage can spur interest and speculation.

- **Investor Sentiment**: Past performances have often led to bullish sentiment among investors, impacting buying behavior.

Bitcoin Halving and Historical Price Performance

Let’s analyze the price performance following each halving event historically:

| Halving Date | Price Before Halving | Price One Year Later |

|---|---|---|

| November 28, 2012 | $12 | $1,150 |

| July 9, 2016 | $657 | $20,000 |

| May 11, 2020 | $8,578 | $64,863 |

According to market analysis, one year post-halving, Bitcoin has typically seen an increase of over **1,000%** in price.

Impact on Investment Strategies

Understanding the potential impact of halvings allows investors to formulate effective strategies. Here are some insights:

- **Long-term Holding**: Many investors adopt a ‘HODL’ strategy, buying Bitcoin before halvings and holding through the potential price increase.

- **Timing the Market**: Traders may capitalize on short-term volatility, buying after initial sell-offs post-halving.

- **Diversifying Investments**: Beyond Bitcoin, investors often explore altcoins that may follow bullish trends post-halving.

For instance, the growth in interest around altcoins has been notable in markets like Vietnam, where growth rates have been significant, suggesting that local demographic trends and investing behaviors are also vital.

Current Trends and Future Predictions

As we approach the next halving in 2024, analysts are predicting potential price movements based on historical trends. Various models suggest the possibility of Bitcoin reaching new all-time highs again, especially if previous trends hold true.

Moreover, emerging markets like Vietnam, with a growing number of users engaging in cryptocurrency, could significantly impact Bitcoin’s next phase. The growing interest poses questions on whether local regulations will affect market participation.

According to recent data, Vietnam’s cryptocurrency user growth rate has exceeded **30%** in the last two years, indicating a burgeoning community that could influence the market.

Conclusion

In retrospect, Bitcoin halvings have historically been catalysts for significant price movements and shifts in market sentiments. For investors, understanding these patterns is crucial for developing robust strategies. Whether you’re planning for the upcoming 2024 halving or evaluating the past performances of Bitcoin, informed decision-making is key.

Keep an eye on the indicators, prepare your strategies, and stay tuned for the next wave of changes in the cryptocurrency landscape. The journey of Bitcoin continues to be one of intrigue, opportunity, and growth.

For further insights on improving your cryptocurrency strategies, check out hibt.com.

This content aims to provide valuable insights and is not financial advice. Always consult local regulatory bodies for opinions tailored to your financial situation.

Author: Nguyen Tuan, a blockchain specialist with over 10 published papers, focusing on cryptocurrency market strategies and compliance.