Bitcoin Layer: Navigating the Future of Blockchain Security

In 2024, approximately $4.1 billion was lost due to DeFi hacks, raising urgent questions about the security of blockchain networks. Among the many security solutions emerging in the cryptocurrency landscape, the concept of the Bitcoin Layer stands out. This article aims to empower users with essential knowledge about Bitcoin Layer standards specifically pioneering approaches in securing cryptocurrency transactions and users’ assets.

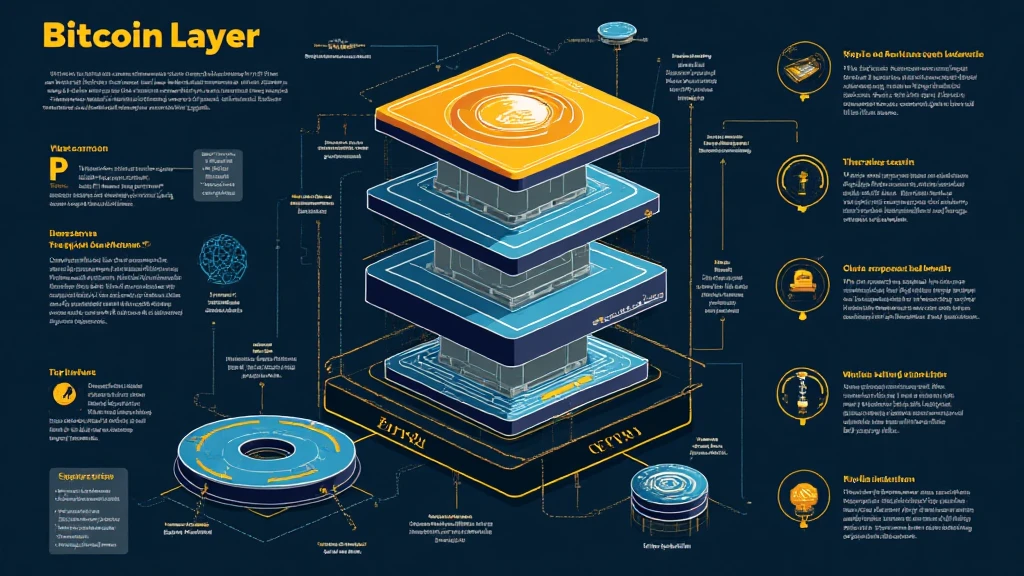

Understanding the Bitcoin Layer

The Bitcoin Layer refers to the various protocols and layers on top of the base Bitcoin blockchain that enhance its functionality and security. This includes concepts such as layer-two solutions, which offer improved transaction speeds and costs while maintaining the security and decentralization of the original blockchain. As the cryptocurrency ecosystem evolves, understanding the significance of Bitcoin Layer is crucial for both novice and experienced users.

The Importance of Security Standards

- Protecting against hacks and fraud

- Ensuring transaction integrity

- Building user confidence in digital assets

Việt Nam has seen a staggering growth rate in cryptocurrency adoption, with reports indicating that 20% of the population engaged with digital assets in 2023. This startling statistic emphasizes the need for robust security frameworks within the Bitcoin Layer.

Comparing Bitcoin Layer with Other Layers in Blockchain

To grasp the unique aspects of Bitcoin Layer, it is essential to compare it with other layers in blockchain technologies, such as Ethereum’s Layer 2 solutions.

- Layer 1: The base layer, for example, the Bitcoin blockchain itself.

- Layer 2: Protocols like the Lightning Network that aim to enhance transaction efficiency.

- Layer 3: Application layer where smart contracts and decentralized applications operate.

Each layer introduces its own set of vulnerabilities that must be addressed to maintain the overall integrity of blockchain security. Imagine it as a bank—where the Bitcoin Layer acts as the vaults protecting your wealth.

Identifying Vulnerabilities in Consensus Mechanisms

Consensus mechanisms are fundamental to how blockchain networks verify transactions. However, they are not foolproof. The most prominent mechanisms include Proof of Work (PoW) and Proof of Stake (PoS). Here’s the catch: each has vulnerabilities.

- Proof of Work: Vulnerable to 51% attacks, where a single entity gains control

- Proof of Stake: Can lead to centralization among a few wealth holders

These weaknesses in security mechanisms underline the necessity for continuous improvement in Bitcoin Layer frameworks.

Real-World Applications of Bitcoin Layer Technologies

The Bitcoin Layer is not just theoretical. It has tangible applications across sectors:

- Micropayments: Lightning Network enables instant, low-cost transactions—ideal for small purchases.

- Decentralized Finance: Various platforms utilize Bitcoin Layer to facilitate loans, trading, and yield farming.

- Remittances: Bitcoin Layers simplify cross-border transactions, significantly lowering the costs.

According to Chainalysis 2025, the growth of Bitcoin Layer applications is expected to correlate strongly with the increasing usage of cryptocurrency in everyday transactions.

Security Measures and Best Practices for Users

A crucial aspect of utilizing Bitcoin Layer solutions involves understanding risks and implementing security measures. Here’s a quick rundown:

- Use hardware wallets like the Ledger Nano X to reduce hacks by 70%.

- Regularly update software to mitigate vulnerabilities.

- Engage with trusted platforms and services that align with the Bitcoin Layer protocols.

Tiêu chuẩn an ninh blockchain should always be kept in the forefront of any financial technology discussions. Safeguarding your assets requires not only awareness but proactive steps toward security.

Conclusion: Embracing the Future with Bitcoin Layer Security

In conclusion, understanding and implementing the Bitcoin Layer security standards is paramount for anyone involved in cryptocurrencies today. As the digital asset landscape continues to evolve, adhering to these principles will help safeguard your investments against emerging threats.

In a world where cyber threats loom larger each day, the Bitcoin Layer provides a crucial framework for securing the future of digital assets. Remember, staying informed and taking decisive action is essential for all investors.

For a deeper dive into cryptocurrency regulations and best practices, consider visiting HIBT.

John Smith is a blockchain security expert with over 10 published papers and has led audits for several notable projects within the cryptocurrency sphere.