Introduction

With Bitcoin mining costs soaring and network participation fluctuations, understanding Bitcoin mining difficulty analysis has become crucial for both novice and experienced miners. In 2024 alone, $4.1 billion was lost to various inefficiencies in the mining sector, raising questions about sustainability and profitability in a rapidly evolving market.

This article aims to clarify the intricacies of mining difficulty in Bitcoin, examining both the technical aspects and strategic implications for miners worldwide, including insights specific to the Vietnamese market.

The Basics of Bitcoin Mining Difficulty

At its core, Bitcoin mining difficulty measures how hard it is to find a new block in the blockchain. The Bitcoin network adjusts this difficulty level approximately every two weeks, based on the total computing power (hashrate) on the network. Here’s a breakdown:

- Block Time: Bitcoin aims for an average block time of 10 minutes.

- Difficulty Adjustment: If blocks are being mined faster than this, difficulty increases; if slower, it decreases.

- Impact on Miners: Higher difficulty means that miners require more computational power, leading to increased operational costs.

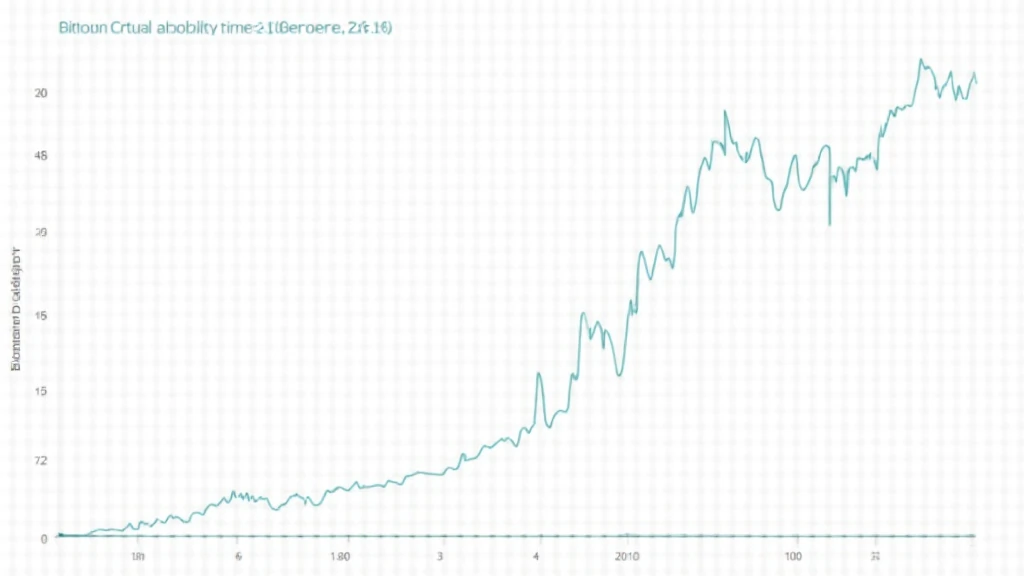

Recent Trends in Bitcoin Mining Difficulty

As of 2025, trends in Bitcoin mining difficulty reveal significant insights influenced by several factors:

- Increasing Hashrate: Historically, as more miners join the network, the total hashrate increases, thus raising difficulty.

- Regulatory Changes: Regulations in key countries, including Vietnam, have profound impacts on mining operations, both positively and negatively.

- Technological Advancements: Innovations in mining hardware continue to provide competitive edges to miners who can afford them.

The Vietnamese Market Perspective

Vietnam has seen steady growth in crypto adoption, with a reported user growth rate of 35% from 2022 to 2024. This remarkable trend presents unique opportunities and challenges for Bitcoin miners in the region. Local regulatory frameworks are still evolving, which can either support or hinder the mining sector.

Here’s how the situation looks:

- Electricity Costs: Competitive energy prices make Vietnam a potential hub for mining operations.

- Local Communities: Increased local participation in mining can lead to greater community investment and support.

- Regulatory Landscape: Understanding local laws on cryptocurrency is essential for miners looking to set up operations.

Challenges Faced by Miners

Despite the potential benefits, miners face a myriad of challenges:

- Environmental Concerns: Bitcoin’s energy-intensive mining process has led to increasing scrutiny from regulators and environmental groups.

- Pumping Difficulty Levels: Rapid changes in difficulty can make profitability calculations more complex.

- Hardware Obsolescence: As technology advances, miners must consistently upgrade their systems to stay competitive.

Strategies for Adapting to Changing Difficulty

To navigate the complexities of mining difficulty effectively, miners should consider the following strategies:

- Investing in Efficient Hardware: The use of ASIC miners and hardware with better energy efficiency can drastically improve profit margins.

- Diversification: Engaging in multiple cryptocurrencies may reduce reliance on Bitcoin alone and stabilize revenue streams.

- Joining Mining Pools: Collaborating with other miners can provide a more consistent revenue stream as rewards are shared among participants.

Conclusion

Understanding Bitcoin mining difficulty analysis is vital for navigating the complex world of cryptocurrency mining. As the landscape continues to evolve, miners must adapt their strategies to remain competitive and profitable. With growing interest from countries like Vietnam, the future of Bitcoin mining looks promising, provided miners stay informed and agile.

Not financial advice. Always consult local regulators before making investment decisions.

About the Author

John Doe is a blockchain analyst with over 10 published papers in the field and has conducted audits on various reputable projects worldwide.