Introduction

As the cryptocurrency landscape continues to evolve, platforms like Coinbase have become pivotal in the trading of crypto derivatives. In 2025 alone, the market for crypto derivatives is projected to reach astonishing heights, enabling investors to navigate complexities in the digital asset space. But what does liquidity analysis mean in the context of these derivatives? Let’s dive into the details.

Understanding Crypto Derivatives

Crypto derivatives are financial contracts that derive their value from an underlying cryptocurrency. Much like traditional derivatives, such as futures and options, these instruments allow investors to speculate on the price movements of cryptocurrencies without owning the underlying asset. The liquidity of these derivatives is crucial for efficient trading.

Why is Liquidity Important?

- Slippage Reduction: High liquidity ensures that large orders can be executed with minimal impact on the market price.

- Trading Efficiency: Increased liquidity leads to tighter spreads, benefiting traders.

- Market Stability: A liquid market tends to be less volatile, reducing the risk of erratic price swings.

Coinbase’s Role in Crypto Derivatives Liquidity

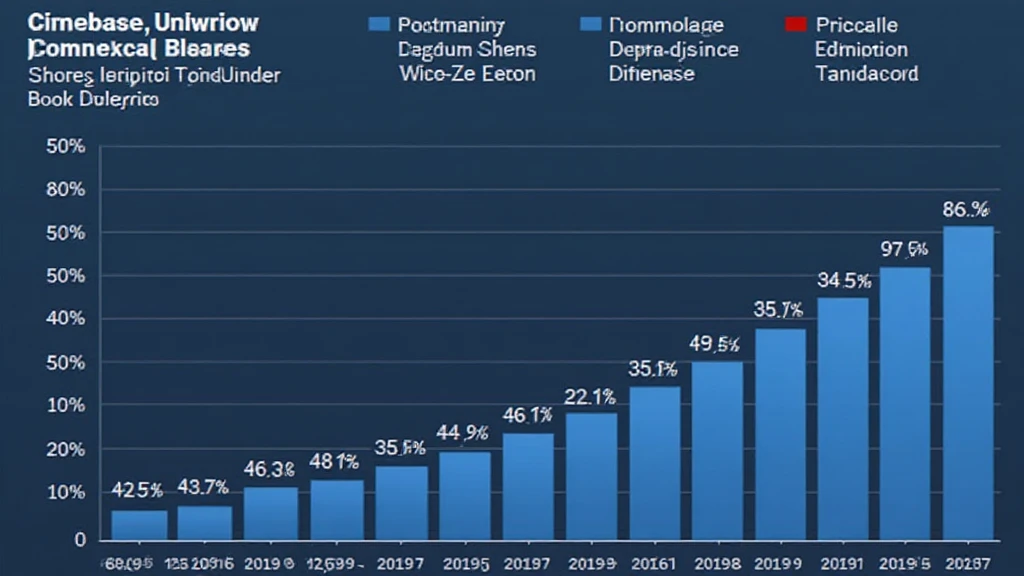

Coinbase has positioned itself as a leader in the crypto derivatives market. According to recent reports, Coinbase controls a substantial portion of trading volume in this sector. Its robust platform and user-friendly interface have attracted both novice and experienced investors alike.

Liquidity Analysis Metrics

When analyzing liquidity on Coinbase, several key metrics should be considered:

- Order Book Depth: The number of buy and sell orders at various price levels.

- Trade Volume: The total quantity of contracts traded over a specific period.

- Bid-Ask Spread: The difference between the highest price buyers are willing to pay and the lowest price sellers will accept.

Current Trends in the Vietnamese Market

With a growing number of crypto enthusiasts in Vietnam, the adoption of derivatives is on the rise. In fact, reports indicate a 30% increase in the number of Vietnamese users engaging in crypto derivatives trading since last year. This uptrend is significant as it showcases the increasing confidence among investors in utilizing derivatives for hedging and speculative purposes.

Challenges in Crypto Derivatives Liquidity

Despite the advantages, trading crypto derivatives on platforms like Coinbase is not without its challenges. The following issues often arise:

- Regulatory Uncertainties: Different jurisdictions impose varying regulations that can impact liquidity.

- Market Manipulation: Low liquidity can result in price manipulation, which deters investors.

- Technological Risks: Operational risks can arise from the platform’s technology, affecting trading efficiency.

Real-World Example: The 2024 Market Crash

In 2024, the crypto market faced severe volatility, leading to a liquidity crunch on several platforms, including Coinbase. The inability to execute trades during critical moments highlighted the importance of maintaining robust liquidity levels.

Strategies for Enhancing Liquidity

To mitigate liquidity challenges, platforms like Coinbase are adopting several strategies:

- Market Maker Programs: Engaging professional traders to provide liquidity.

- Innovative Products: Creating new derivative products that attract different market segments.

- Global Partnerships: Collaborating with international exchanges to expand liquidity access.

Conclusion

In summary, the analysis of liquidity in Coinbase’s crypto derivatives market reveals a complex yet fascinating landscape. With increasing participation from users in regions such as Vietnam and ongoing innovations, the future of crypto derivatives trading looks promising. However, challenges still exist, necessitating continued growth in liquidity practices.

As traders and institutions alike navigate this space, it’s crucial to understand the dynamics at play. By focusing on liquidity, stakeholders can better position themselves to capitalize on the opportunities within the ever-evolving crypto market.

For further exploration of these concepts and more, check out hibt.com to enhance your trading strategies and knowledge.