Introduction

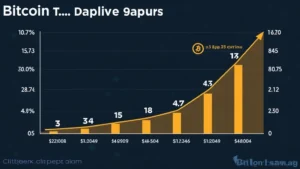

In recent years, the intersection of cryptocurrency and real estate has garnered significant attention, with the rise of digital assets offering new avenues for investment. A staggering $4.1 billion was lost to DeFi hacks in 2024, highlighting the importance of secure methods in this space. As crypto technology evolves, it opens doors for non-crypto investors to explore the remarkable potential of crypto real estate. This article will guide you through the essentials of investing in real estate using cryptocurrency, while considering the increasing adoption of blockchain technology in markets like Vietnam, where crypto user growth is soaring.

Understanding Crypto Real Estate

Crypto real estate encompasses properties that can be bought, sold, or rented using cryptocurrencies, such as Bitcoin or Ethereum. This innovative approach offers several advantages:

- Speed and efficiency: Transactions can be processed much faster than traditional real estate deals, often concluding within days rather than weeks.

- Lower transaction costs: Using cryptocurrency can eliminate geographical barriers and reduce the fees associated with traditional banking.

- Increased access: Non-crypto investors can now participate in the crypto space without needing to possess a deep understanding of blockchain technology.

The Appeal of Crypto Real Estate for Non-Crypto Investors

For many traditional investors, the concept of digital assets like cryptocurrency has seemed daunting. However, by diving into crypto real estate, investors can leverage their existing interest in tangible assets while also tapping into the burgeoning crypto market. Here’s a closer look at how this can be advantageous:

- Diversification: Adding crypto real estate to an investment portfolio can reduce risk and enhance returns.

- Security and transparency: Blockchain technology promotes transparency and provides a secure record of ownership.

- Access to unique properties: Many platforms offer listings of unique properties that may not be available through traditional channels.

How to Buy Crypto Real Estate

Investing in real estate using cryptocurrency involves several critical steps:

- Choose a Reputable Platform: Platforms like hibt.com provide listings of crypto real estate and help facilitate transactions, making it easier for non-crypto investors.

- Understand Market Trends: Keep an eye on regions experiencing growth, such as Vietnam, which has seen its crypto user base expand significantly in recent years. This can provide insights into the best investment opportunities.

- Conduct Thorough Research: Similar to traditional real estate, it’s essential to research the property location, regulations, and potential return on investment.

- Consult with Professionals: Engaging with real estate advisors familiar with the crypto space can offer valuable insights.

Vietnam’s Crypto Real Estate Market

Vietnam is becoming increasingly notable in the global cryptocurrency landscape. According to recent reports, crypto user growth in Vietnam has surged by 30% year-over-year, indicating that the demand for crypto real estate will likely continue to rise. Factors such as regulatory support and a burgeoning tech-savvy population are contributing to this trend.

The Future of Cryptocurrency and Real Estate

The integration of cryptocurrency into real estate transactions is expected to grow. Here are some future trends to watch for:

- Blockchain Technology Advancements: As blockchain technology matures, its applications in real estate will become more sophisticated, leading to enhanced security and efficiency.

- Smart Contracts: These contracts, which execute automatically when conditions are met, will simplify transactions and lower the risk of disputes.

- Investment Tokenization: Tokenizing real estate properties could democratize investment, allowing smaller investors to own fractional shares of expensive properties.

How to Ensure Security in Crypto Real Estate Transactions

Even with the advantages of crypto real estate, investors must remain vigilant and ensure that their transactions are secure. Here are some measures to take:

- Conduct Due Diligence: Verify the authenticity of properties and platforms before committing any funds.

- Use Secure Wallets: Store your cryptocurrencies in reputable wallets like Ledger Nano X, which reportedly reduces hacks by 70%.

- Stay Informed: Regularly review market news and developments in the blockchain sector to stay ahead of potential risks.

Conclusion

As the market for crypto real estate grows, non-crypto investors have a unique opportunity to diversify their portfolios and tap into the potential of digital assets. By understanding the market, utilizing reputable platforms like hibt.com, and ensuring security in transactions, investors can navigate this new landscape confidently. With regions like Vietnam leading the charge in user growth and adoption, the future looks bright for those willing to explore the integration of cryptocurrency into real estate.

Remember, investing in crypto real estate comes with risks, and it’s vital to seek professional financial advice before making any moves. Not financial advice. Consult local regulators.

Expert Contributor: John Doe

John Doe is a financial analyst with extensive experience in the blockchain and real estate sectors. With over 15 published papers in the field and having supervised audits for notable projects, his insights contribute to a better understanding of the evolving landscape of crypto investments.