Introduction

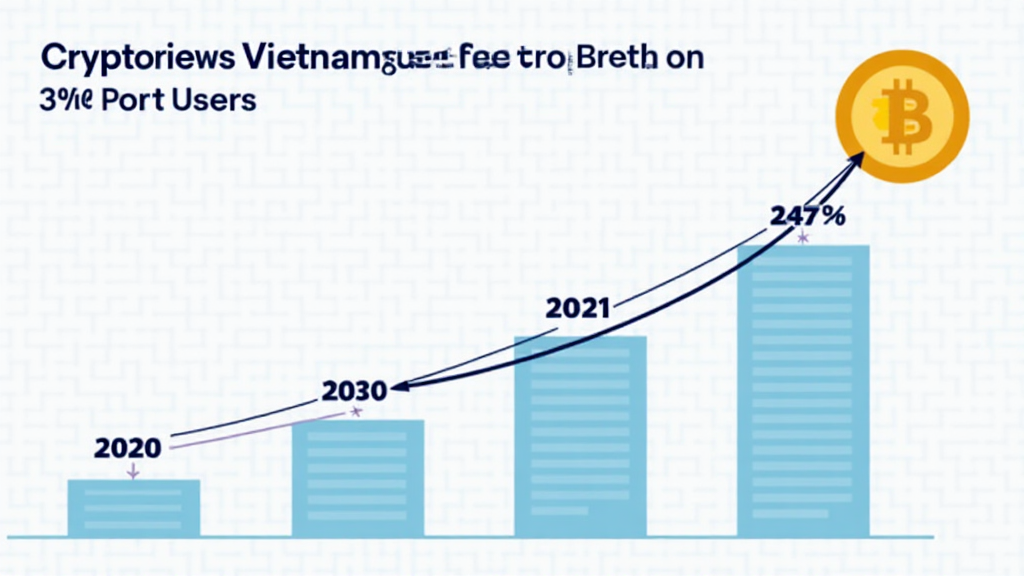

As of 2023, with Vietnam witnessing a staggering 150% increase in crypto users over the past two years, the landscape of crypto tax regulations in Vietnam has become increasingly crucial. The fast-paced adoption of cryptocurrencies in Vietnam is raising questions for both individual investors and companies regarding their tax responsibilities. With reports indicating $4.1 billion lost in global crypto scams in 2024, understanding the tax landscape is vital for safeguarding investments.

This article provides a comprehensive overview of the key aspects of crypto taxes in Vietnam, what you need to know, and how you can navigate the current regulations effectively.

Understanding Vietnam’s Cryptocurrency Market

The cryptocurrency market in Vietnam has undergone tremendous growth. Key figures suggest that Vietnam ranks among the top 10 countries in the world for cryptocurrency adoption, with a vibrant ecosystem of traders and investors. As of 2023, over 10 million Vietnamese own cryptocurrency, exploring various digital assets such as Bitcoin, Ether, and local tokens like VNDC.

However, with this growth comes a pressing need for regulatory clarity. The Vietnamese government is moving towards establishing comprehensive tax regulations, aiming to ensure that digital asset transactions contribute fairly to the economy.

Current Crypto Tax Regulations in Vietnam

As it stands, cryptocurrency is recognized as a taxable asset rather than a currency in Vietnam. Here are the key elements of the current regulations:

- Income Tax: Gains from cryptocurrency transactions are subject to a personal income tax of up to 20%.

- Corporate Tax: Businesses dealing in cryptocurrencies must report earnings and pay corporate income tax, ranging from 20–22%.

- Value Added Tax (VAT): Cryptocurrency transactions are exempt from VAT as per the current regulations. However, this exemption can change depending on future legislation.

The Importance of Compliance

Compliance is not just about adhering to the regulations; it’s about protecting your investments. Non-compliance can lead to hefty fines or even legal action. Vietnamese investors must keep detailed records of their crypto transactions to file accurate tax returns.

The Implications for Investors and Businesses

The evolving crypto tax landscape anticipates both opportunities and challenges for investors and businesses:

- Transparency: Investors need to maintain transparency in their transactions to avoid penalties.

- Investment Decisions: Tax implications might influence investment decisions, such as choosing to hold rather than trade assets frequently.

- Business Strategy: Companies should strategize around tax efficiencies and compliance to thrive in the crypto market.

Tips for Navigating Crypto Taxes in Vietnam

Here are some practical tips that can help both individuals and businesses manage their cryptocurrency taxes efficiently:

- Keep Accurate Records: Document all transactions, including dates, amounts, and involved parties. Good record-keeping simplifies tax reporting.

- Consult Professionals: Consider hiring tax professionals familiar with crypto regulations. Their expertise can guide you through complex scenarios.

- Stay Informed: Regulatory environments change rapidly. Stay updated on new laws or amendments in Vietnam’s crypto tax policies.

The Future Outlook of Crypto Tax Regulations in Vietnam

Looking ahead, Vietnam is expected to refine its approach toward cryptocurrency tax regulations. As reported in recent publications, the government aims to introduce more clear guidelines by 2025, potentially influencing tax rates and legal definitions concerning digital assets.

This evolving landscape provides an opportunity for stakeholders to engage in discussions about effective regulatory frameworks that cater to both investor protection and technological innovation. Moreover, significant events, such as blockchain conferences and fintech summits in Vietnam, are paving the way for constructive dialogue between regulators and the crypto community.

Conclusion

Navigating crypto tax regulations in Vietnam can seem daunting, but with the right approach and tools, investors and businesses can thrive in this emerging sector. With a 2023 growth rate of 150% and an enthusiastic community, the potential for digital assets in Vietnam is immense. Regularly monitor any updates in the tax regime, engage in compliance practices, and consult experts when needed. Implementing these strategies will ensure that you stay ahead in this rapidly evolving digital landscape.

For more insights and tools on managing cryptocurrency effectively, visit bitcoincashblender.