HIBT Crypto Derivatives Market: The Future of Digital Trading

With over $4.1 billion lost to DeFi hacks in 2024, security concerns in the crypto space are rising. The need for robust and innovative solutions has never been more paramount. A promising solution lies within the HIBT crypto derivatives market, a sector poised to reshape how digital assets are traded and secured.

The HIBT crypto derivatives market offers a plethora of opportunities for traders as well as investors. Understanding how to navigate this complex market can be a game-changer for both experienced traders and newcomers alike.

What are Crypto Derivatives?

To grasp the potential of the HIBT crypto derivatives market, one must first understand what crypto derivatives are. Simply put, crypto derivatives are financial instruments whose value is derived from an underlying cryptocurrency asset. They allow traders to speculate on the price movements of cryptocurrencies without needing to own the assets themselves.

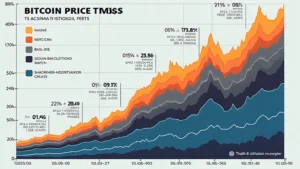

In recent times, we’ve seen rapid growth in the adoption of derivatives across various sectors. The market is expected to boom, with projections indicating significant growth in both trading volume and value by 2025. For instance, according to a recent report by CoinMarketCap, the derivatives market share is expected to reach over 70% of the total crypto trading volume by 2025.

Why HIBT Stands Out in the Market

HIBT differentiates itself through its unique features and user-centric approach. Here are some key highlights:

- User-Friendly Interface: Designed with novices in mind, HIBT’s platform simplifies the complex world of derivatives for every user.

- Robust Security Measures: With the integration of cutting-edge security protocols, including multi-signature wallets and DDoS protection, HIBT ensures user funds are safe.

- Educational Resources: HIBT provides a wealth of resources to help users better understand the market, making it easier for new traders to start their journey.

Understanding the Mechanics of HIBT Crypto Derivatives

Engaging with the HIBT crypto derivatives market involves understanding various significant components:

Futures and Options

Futures contracts allow traders to buy or sell a cryptocurrency at a predetermined price at a specified future date. On the other hand, options provide the right, but not the obligation, to buy or sell at a certain price prior to the expiration of the contract. Both these instruments can be advantageous for hedging or speculation.

Liquidity and Market Depth

The liquidity and depth of the market play vital roles in ensuring efficient trading in the HIBT platform. High liquidity minimizes slippage, allowing users to enter and exit positions as they desire. According to recent data, the liquidity in the HIBT market has seen exponential growth, showcasing its rising popularity among traders.

Local Insights: The Growth of Cryptocurrency in Vietnam

The Vietnamese market has shown significant interest in cryptocurrency, with a reported user growth rate of over 25% in the past year. HIBT’s entry into Vietnam could not have come at a better time. With a young population eager to explore new investment avenues, the HIBT crypto derivatives market is set to make a sizable impact. Moreover, the integration of key Vietnamese terms into the platform, like tiêu chuẩn an ninh blockchain, enhances its local accessibility.

How to Get Started with HIBT

For those interested in diving into the HIBT crypto derivatives market, here’s how to get started:

- Open an Account: Sign up on the HIBT platform and complete your identity verification.

- Deposit Funds: Choose from a range of cryptocurrencies to fund your account.

- Educate Yourself: Utilize HIBT’s educational resources to familiarize yourself with trading strategies.

- Start Trading: Begin with small trades and gradually increase your exposure as you gain confidence.

Safety Precautions

Trading in crypto derivatives involves risks. Always remember to use risk management tools and stay updated about market trends. Setting stop-loss orders can help mitigate potential losses.

The Future Outlook for HIBT

As we head towards 2025, the HIBT crypto derivatives market is expected to evolve, adapting to the changing dynamics of the cryptocurrency ecosystem. With continuous technological advancements and increasing regulatory clarity, HIBT is well-positioned to capitalize on these trends, all while offering a secure and reliable trading environment.

Conclusion: A New Era of Trading

The HIBT crypto derivatives market signifies a transformative phase in the world of digital assets. By embracing this innovative financial solution, both seasoned traders and newcomers can navigate the growing complexities of cryptocurrency trading. As the interest grows in Vietnam, defined by rising user engagement, HIBT is ready to lead the charge into the future of secure and innovative trading.

Always conduct your due diligence and consider the inherent risks involved in trading. Not financial advice; consult local regulators for your specific conditions.

For more information on the HIBT crypto derivatives market, visit HIBT’s official site. Stay informed and trade smartly!

Written by Dr. Alex Chen, a blockchain expert with over 15 published papers in the field and experience in auditing notable projects. Conducting research in emerging digital finance technologies, his insights are valuable for understanding the evolving landscape.