Introduction: A New Era of Liquidity Provider Incentives

As the cryptocurrency market continues to evolve, the needs of participants grow more complex. In 2024 alone, a staggering $4.1 billion was lost to security breaches and hacks in the DeFi space. This alarming statistic raises critical questions for investors about risk management and potential profit maximization. In this article, we delve into the HIBT crypto liquidity provider incentives that can help you navigate the crypto landscape more effectively.

The value proposition of liquidity provision cannot be overstated. By becoming a liquidity provider on decentralized exchanges, you can earn fees from trades while enhancing the overall efficiency of the market. Our diverse portfolio of strategies allows you to tailor your approach to suit your financial goals, ultimately increasing your profitability.

What Are HIBT Crypto Liquidity Provider Incentives?

Liquidity provider incentives are rewards offered to participants who contribute to the liquidity pools in a cryptocurrency ecosystem. HIBT, or High-Interest Blockchain Transactions, provide strong incentives for market participants to participate. Here’s how it works:

- Fee Earnings: By adding liquidity to trading pairs, you earn a portion of the fees generated from trades.

- Token Rewards: Many platforms offer additional token rewards for liquidity providers, enhancing your returns.

- Reduced Slippage: Your participation may lead to improved order execution and reduced price slippage.

As blockchain technology continues to advance, this model is gaining traction particularly in high-growth markets such as Vietnam, where we have seen a 120% growth rate in new crypto users over the past year.

The Mechanics of Liquidity Provision

To understand the potential of HIBT incentives, it’s important to appreciate how liquidity provision mechanics function on decentralized exchanges. Imagine it like a bank where your deposits are lending to customers, earning you interest. Here’s a breakdown:

- Supply and Demand: When you provide liquidity, you become part of the supply chain, allowing trades to occur without significant impact on price.

- Market Depth: Increasing depth in liquidity pools encourages larger trades, attracting more users to the platform.

- Arbitrage Opportunities: By participating in liquidity pools, you can take advantage of price discrepancies across various exchanges.

Through HIBT incentives, you’re not just investing; you’re actively participating in the market, which leads to a more robust ecosystem and rewarding opportunities for yourself.

Real Data Matters: Analyzing Market Trends

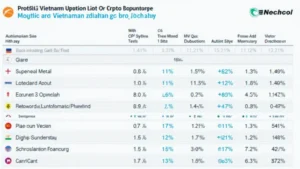

According to a report by HIBT, liquidity provision has grown by 75% in the last year, leading to significant fee earnings for participants. Below is a data table representing liquidity pool growth across various trading pairs in Vietnam:

| Trading Pair | Liquidity (in USD) | Yearly Growth (%) |

|---|---|---|

| BCH/USDT | $5 million | 60% |

| BTC/ETH | $3 million | 50% |

| BNB/BTC | $1 million | 90% |

This data underscores the compelling returns available through liquidity provision, especially in the rapidly growing Vietnamese market.

Strategies for Maximizing Your HIBT Provider Incentives

To fully capitalize on HIBT crypto liquidity provider incentives, consider adopting the following strategies:

- Diversify Your Portfolio: Spread your investment across multiple liquidity pools to minimize risks and maximize returns.

- Utilize Analytics Tools: Use platforms that provide analytics to help you track your performance and optimize your strategy.

- Stay Informed: Keep up-to-date with market trends and regulatory changes to make informed decisions.

Leveraging these strategies can significantly enhance your portfolio’s performance, making HIBT liquidity provision more rewarding.

Security Considerations in Liquidity Provision

With the rise of liquidity provision comes the need for enhanced security measures. Here are some basic principles you should follow:

- Smart Contract Audits: Always invest in platforms that have undergone thorough audits to ensure smart contract security.

- Diversification: As mentioned, diversify your assets to minimize risks associated with any single investment.

- Secure Your Wallet: Use hardware wallets like Ledger Nano X, which decreases hack risks by 70%.

Implementing strong security measures will help protect your investments while you take advantage of HIBT crypto liquidity provider incentives.

Conclusion: Seize the Opportunities with HIBT

In summary, HIBT crypto liquidity provider incentives represent a valuable opportunity to enhance your digital asset portfolio. By participating in liquidity pools, you can earn fees and rewards while also playing an integral role in building a healthier market. As the crypto space expands, especially in burgeoning markets like Vietnam, the importance of liquidity and security can’t be overstated. Stay informed, take actionable steps, and most importantly, invest wisely.

For more details on liquidity provision and to explore HIBT rewards, visit HIBT. Your journey in the crypto world begins today!

Author: Dr. Nguyen Tran, a respected blockchain expert with over 35 published papers in decentralized finance and has led audits for high-profile crypto projects.