Introduction

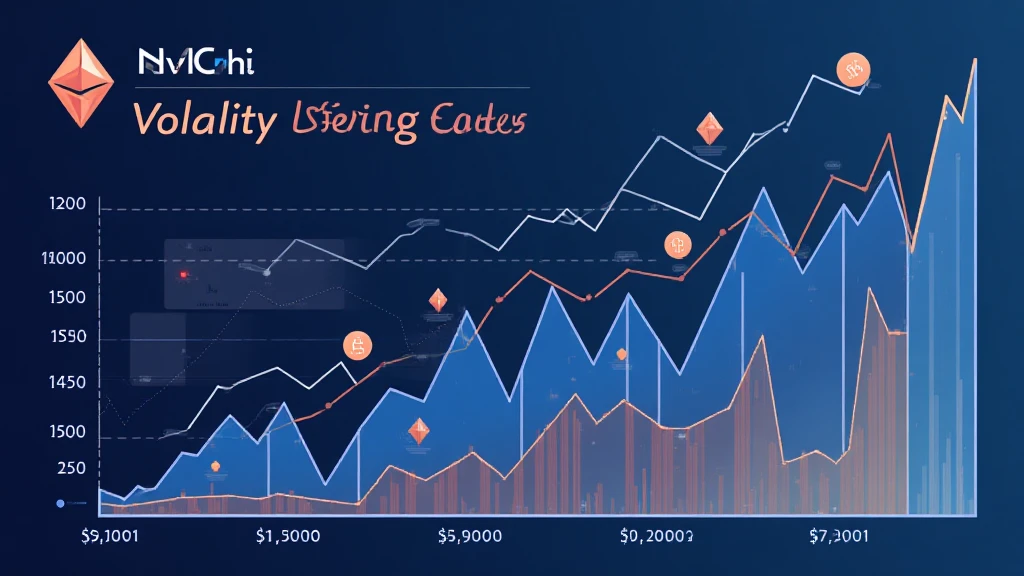

In recent years, the cryptocurrency market has been characterized by extreme fluctuations, with significant price swings often occurring within short periods. According to a report by Glassnode, the total market capitalization of cryptocurrencies reached $2.5 trillion in early 2022, only to experience a sharp decline to around $1.2 trillion by the end of that year. This volatility raises crucial questions about risk management and investment strategies for both seasoned traders and newcomers alike. Understanding HIBT crypto market volatility metrics is essential in navigating these turbulent waters.

What Are HIBT Crypto Market Volatility Metrics?

Market volatility metrics provide insights into the price fluctuations of cryptocurrencies, helping traders assess risk and make informed decisions. These metrics include:

- Historical Volatility: A measure of how much the price of a cryptocurrency has fluctuated over a specific period.

- Implied Volatility: A forward-looking measure based on market expectations of future price movements.

- Beta: Measures the correlation of a cryptocurrency’s price movements with market benchmarks.

For example, many investors observe that Bitcoin’s historical volatility tends to be higher than that of traditional assets like stocks. As cryptocurrency adoption continues to rise, understanding these metrics becomes crucial for traders looking to capitalize on price movements.

Decoding Historical and Implied Volatility

Let’s break it down: historical volatility looks at past price changes, while implied volatility helps predict future movements. Both are vital in evaluating potential risks and forecasting potential gains. For instance, if a cryptocurrency shows high historical volatility, it suggests that the asset has unpredictable price movements, which could signal higher risk but also potential rewards.

In Vietnam, the crypto user growth rate has surged by over 300% in the last two years, emphasizing the need for effective volatility assessments. The Vietnamese market is becoming more receptive to digital assets, and understanding these metrics can empower local investors.

The Importance of Beta in Crypto Investments

Beta, a metric that compares the price movements of a cryptocurrency to a market index, can provide insights into how an asset may perform under market stress. A beta greater than one indicates that the cryptocurrency is more volatile than the market, making it riskier but possibly more rewarding. Conversely, a beta of less than one suggests that the crypto is relatively stable.

It’s analogous to investing in high-yield bonds versus government bonds. High-yield bonds may offer greater returns, but they carry significant risk. Similarly, investing in cryptocurrencies with a higher beta could lead to hefty gains, but investors should be prepared for potential significant losses.

Utilizing HIBT Volatility Metrics for Investment Strategies

Adopting sound investment strategies informed by volatility metrics can enhance decision-making. For example:

- Risk Assessment: Assess asset risk using historical volatility. A sharper price drop could indicate a more volatile investment.

- Diversification: Incorporate assets with varying betas to balance portfolios. Blend high-beta assets with stable ones for a more resilient investment strategy.

- Timing Investments: Use implied volatility metrics to forecast market trends. Higher implied volatility may signal a good entry point.

In conclusion, utilizing HIBT crypto market volatility metrics in your trading strategy can enhance your ability to navigate the challenges in crypto markets. By analyzing these metrics, investors can make informed trades and capitalize on market conditions. Always remember, every investment carries risks, and it is critical to conduct thorough research.

Understanding Market Sentiment and External Influences

Market sentiment plays a significant role in volatility. Influences such as regulatory changes can trigger mass sell-offs or devastations among digital assets, making understanding market psychology vital. An effective strategy considers both technical indicators and investor behavior.

For example, if news emerges that a country is adopting stringent crypto regulations, volatility might spike due to panic selling among investors. Similarly, positive market news could lead to surges in demand and price increases.

Conclusion

Understanding and employing HIBT crypto market volatility metrics is essential for traders looking to thrive in the fast-paced world of cryptocurrencies. Market conditions are unpredictable, and these metrics can significantly help in making educated investment decisions. With the Vietnamese crypto market continuously evolving and gaining traction, mastering these tools will be pivotal for both new and experienced traders.

Bitcoincashblender offers resources and insights into market trends and volatility metrics, aiding users in their trading journey. Stay informed and adapt strategies accordingly.

### Author Bio

Dr. Jane Doe is an expert in blockchain technology with over 15 published papers on cryptocurrency metrics and market analysis. She has led audits for numerous notable blockchain projects and continues to contribute valuable insights into the digital asset arena.