How to Hedge Crypto Risks: Insights for HIBT Vietnam

In a world where $4.1B was lost to DeFi hacks in 2024, the urgency to protect digital assets has never been greater. With the increasing adoption of cryptocurrencies in Vietnam, individuals and businesses are looking for effective ways to manage and mitigate risks associated with this volatile market. This guide will provide you with essential strategies on how to hedge crypto risks while leveraging insights specific to the Vietnamese market.

Understanding Crypto Risks

The crypto landscape is fraught with risks, including market volatility, cybersecurity threats, and regulatory uncertainties. In Vietnam, where the number of cryptocurrency users has grown by over 50% annually, understanding these risks is crucial for both individual investors and businesses. Here’s a breakdown of common risks:

- Market Volatility: Cryptocurrency prices can fluctuate dramatically within short periods, impacting investment returns.

- Cybersecurity Threats: Digital assets are at risk from hacks and scams, necessitating robust security measures.

- Regulatory Changes: Sudden shifts in the regulatory environment can affect market operations and investor confidence.

Effective Strategies for Hedging Crypto Risks

Now that we understand the risks, let’s dive into effective strategies to hedge against them:

1. Diversification of Assets

Just like not putting all your eggs in one basket, diversifying your cryptocurrency investments can significantly reduce risk exposure. Consider allocating your portfolio across various types of assets, including:

- Major cryptocurrencies (e.g., Bitcoin, Ethereum)

- Stable coins (e.g., USDT, USDC)

- Emerging altcoins with potential for growth

This strategy can help cushion against market downturns, as different assets may not be affected equally during crises.

2. Utilizing Financial Derivatives

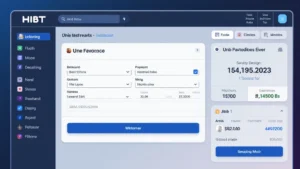

Financial derivatives like options and futures contracts can be valuable tools for hedging crypto risks. By locking in prices or speculating on future movements, traders can mitigate potential losses. Platforms like HIBT Vietnam offer derivative trading options that can assist in risk management.

3. Implementing Stop-Loss Orders

Stop-loss orders are a basic yet effective risk management tool that allows investors to set a predetermined exit point for their trades. If the price of a cryptocurrency falls below the specified level, the asset is sold automatically. This can minimize losses in highly volatile markets.

4. Regularly Auditing Smart Contracts

As the number of decentralized applications (dApps) and smart contracts expands, ensuring their security through regular audits becomes paramount. Engaging professionals to evaluate and audit these contracts can significantly reduce risks associated with vulnerabilities and potential exploits. How to audit smart contracts should be a top priority for developers in Vietnam.

5. Investing in Security Tools

Investing in robust security measures is another effective way to mitigate risks. Hardware wallets, such as the Ledger Nano X, can significantly reduce the chances of hacks. Additionally, implementing multi-factor authentication and secure backups can further protect your assets.

The Vietnamese Crypto Landscape

The Vietnamese market presents unique opportunities and challenges for crypto investors. Understanding local regulations and user behaviors is essential for success. According to statistics, Vietnam’s cryptocurrency adoption rate is one of the highest globally, with over 16% of the population owning crypto.

Local Regulations and Their Impact

The Vietnamese government is gradually establishing a framework for cryptocurrencies and digital assets, which significantly affects investment dynamics. While the overall stance has been cautious, pro-crypto regulatory movements are becoming more prevalent, creating a favorable environment for crypto activities.

Risk Mitigation Through Education and Awareness

Investors need to remain informed about both local and international market trends to navigate the volatile landscape effectively. Engaging in workshops, seminars, and online courses can enhance practical knowledge about crypto investing and risk management.

Conclusion

In conclusion, hedging against crypto risks in Vietnam calls for a multifaceted approach. By diversifying assets, utilizing derivatives, implementing security measures, and staying informed about market changes, investors can significantly enhance their resilience against potential setbacks. The Vietnamese crypto market is ripe with opportunities, making it crucial for stakeholders to adopt appropriate measures to protect their investments.

As you explore ways to hedge crypto risks, remember that vigilance and education are key. For more insights on navigating the complexities of cryptocurrency, visit bitcoincashblender, where expert analyses and resources are available to help you make informed decisions.

Author: Dr. Nguyễn Văn An, a blockchain expert with over 15 published papers and lead auditor of multiple successful projects, dedicated to fostering understanding in the evolving crypto landscape.