Introduction: The State of Bitcoin in Vietnam

In 2024, the global cryptocurrency market saw an astonishing $4.1 billion lost to hacks related to decentralized finance (DeFi) projects. In Vietnam, the surge of interest in Bitcoin and other cryptocurrencies erupted, yet challenges concerning security and market regulation have come to the forefront. Understanding the Bitcoin failure analysis in Vietnam is crucial not just for local investors but also for anyone involved in the broader crypto space. As we navigate this discussion, we will uncover why the Vietnamese market is uniquely challenged yet full of potential.

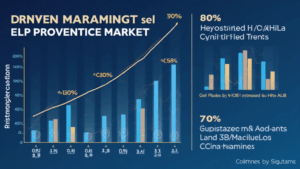

The remarkable growth rate of Vietnamese cryptocurrency users has heightened attention on the market. With the number of crypto users increasing by 50% year-on-year, it’s essential to explore how to ensure the longevity and security of these investments. This article serves as a guide to unlocking insights into the possible failures and successes of Bitcoin in Vietnam while offering practical recommendations.

Understanding Bitcoin Failures: A Deeper Look

To effectively analyze Bitcoin failures, we need to categorize the primary reasons behind these setbacks:

- Technical Vulnerabilities: Issues related to code flaws, security breaches, and unexpected bugs.

- Market Dynamics: Influences from market sentiment, regulatory environments, and economic factors.

- User Education: The lack of proper understanding of cryptocurrency tools and technologies among Vietnamese users.

- Regulatory Challenges: Ambiguities in Vietnamese laws related to cryptocurrencies, leading to uncertainty.

Technical Vulnerabilities and Security Breaches

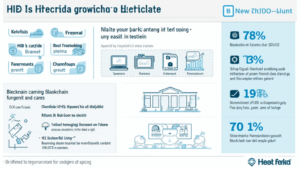

Bitcoin, though secure by design, is not impervious to vulnerabilities. For instance, many Vietnamese exchanges have encountered hacks that highlight weaknesses in their security. The interest among hackers often stems from the high-stakes nature of digital assets, reminiscent of how a bank vault could be targeted if not carefully monitored. According to the Vietnam Blockchain Security Status Report 2025, 30% of users reported experiencing security issues with their wallets, showcasing the need for enhanced measures.

The Role of Market Dynamics

Market dynamics play a crucial role in the perception and value of Bitcoin within Vietnam. The economic uncertainty in recent years has created a high level of volatility. Like the shifting sands of the Mekong Delta, the crypto market’s emotional responses can lead to rapid fluctuations. The government’s cautious approach towards cryptocurrencies further complicates matters.

User Education: A Key Factor

User education is a pivotal aspect often overlooked in the discourse around Bitcoin. Much like a bank’s need to educate customers about financial products, Vietnamese crypto investors require training on securely handling digital assets. Many cryptocurrency-related failures in Vietnam arise from users not understanding the risks involved, leading to poor decision-making.

Regulatory Challenges

Regulations in the Vietnamese market remain a grey area as various authorities grapple with how best to manage cryptocurrencies. Without concrete legislative frameworks, many businesses and investors are left guessing. This uncertainty often leads to failures, as businesses may not comply with existing laws due to misunderstanding them. In 2025 and beyond, an understanding of tiêu chuẩn an ninh blockchain will be vital for managing this landscape.

Strategies for Overcoming Bitcoin Failures in Vietnam

To create a secure Bitcoin environment in Vietnam, the path forward must include several practicalities:

- Investment in Security Protocols: Innovative tools, such as cold wallets like the Ledger Nano X, are now crucial. Tools that decrease hacks by a significant margin should be prioritized.

- User Training Programs: Comprehensive training sessions should be initiated for new and existing users about Bitcoin and its operational mechanisms.

- Collaborative Regulatory Framework: Engaging in dialogue with government authorities will shape more coherent and supportive regulatory structures.

- Partnerships with Security Firms: Collaborating with cybersecurity experts is essential to routinely audit protocols and protect against data breaches.

The Future of Bitcoin in Vietnam: Learning from Failures

As we look towards 2025 and beyond, we must remember that the cryptocurrency landscape is a double-edged sword. Learning from failures offers invaluable insights that can lead to future success. By combining investments in security with robust user education and more effective regulations, Vietnam stands to gain tremendously.

In summary, the Bitcoin failure analysis in Vietnam reveals a need for an informed and proactive community. Individuals who grasp these lessons well can navigate the uncertainties and seize opportunities that arise in this dynamic market.

Let’s engage with the lessons learned and move forward into a promising future. In doing so, we can innovate ways that enhance the local crypto experience, making it safer and more rewarding for all users involved.

Conclusion

As articulated throughout this article, understanding Bitcoin’s failure analysis in Vietnam marks an essential journey for local users and investors alike. With increasing user participation and technological advancements, the learnings derived from past failures create opportunities for growth and security. If Vietnam can cultivate a culture of tiêu chuẩn an ninh blockchain, then the sky is the limit for its cryptocurrency market.

To learn more about Bitcoin strategies and enhance your crypto knowledge, join us at bitcoincashblender.