Navigating MB Bank Crypto Transaction Limits: A Complete Guide for 2025

With rapid growth in digital currencies, understanding the MB Bank crypto transaction limits has become essential for users aiming to venture into the cryptocurrency landscape. The rise of decentralized finance (DeFi) has reshaped financial transactions, offering opportunities along with inherent risks. In the past year, losses from DeFi hacks reached a staggering $4.1 billion. This alarming statistic has urged investors to prioritize their security and understanding of transaction limits.

As digital assets gain traction in Vietnam, the need for regulations that cater to the unique nature of cryptocurrencies is becoming more pronounced. This article aims to illuminate the nuances surrounding MB Bank crypto transaction limits while also exploring the local market growth, security protocols, and compliance standards.

Understanding MB Bank’s Crypto Transaction Limits

MB Bank, a leading financial institution in Vietnam, has established specific transaction limits for cryptocurrency trading. These parameters are crucial for ensuring customer security and regulatory compliance. Let’s break down how these limits work:

- Daily Transaction Limit: As of 2025, MB Bank allows daily crypto transactions up to 100 million VND (approximately $4,300).

- Monthly Transaction Limit: Users can transact up to 1 billion VND per month, which encourages broader engagement with crypto markets.

- Foreign Transactions: Any international crypto transactions are subject to additional scrutiny and may have lower limits based on regulatory guidelines.

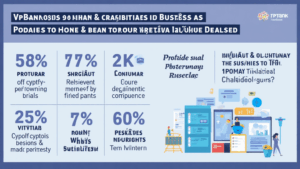

Market Context: Vietnam’s Crypto Growth

Vietnam’s cryptocurrency market is witnessing exponential growth, with a reported user increase rate of 41% from 2023 to 2025, making it one of the fastest-growing markets globally. Blockchain technology’s adoption among Vietnamese financial institutions is partly driven by the demand for innovative banking solutions.

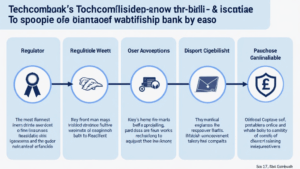

Security and Compliance with Crypto Transactions

Prioritizing security is imperative for both individuals and institutions. As highlighted by the surging losses in DeFi hacks, understanding and complying with security standards is vital. In Vietnam, the tiêu chuẩn an ninh blockchain (blockchain security standards) outline the necessary protocols for safeguarding transactions.

- Two-Factor Authentication (2FA): MB Bank employs 2FA to ensure that only authorized users can perform transactions.

- Regular Audits: Routine audits conducted by independent third parties help maintain compliance with security best practices.

- User Education: Ongoing education about risks associated with cryptocurrency trading is promoted by MB Bank.

The Importance of Compliance

Compliance with local regulations is not just a legal obligation but a cornerstone of trust. According to Chainalysis, a leading blockchain data platform, compliant transactions have reduced fraud cases by 30% over the last year. Developers and transaction platforms must remain vigilant.

Best Practices for Managing Transaction Limits

Successfully navigating your crypto transactions while adhering to MB Bank’s limits requires strategic planning:

- Track Your Limits: Regularly monitor your daily and monthly transaction limits to avoid any disruptions.

- Budget Your Transactions: Create a well-thought-out budget for your crypto activities; this helps remain within your financial means.

- Utilize Analytics Tools: Incorporate tools and apps that aid in tracking your transactions, ensuring efficient management.

Future of Crypto Regulations in Vietnam

The crypto landscape in Vietnam is anticipated to evolve further. Increased regulatory clarity and support from institutions like MB Bank will lead to a more secure trading environment. The government is also focusing on fostering innovation while protecting consumers. Here’s what to look for in the upcoming years:

- Enhanced Regulations: Anticipate the establishment of clearer frameworks for digital asset transactions.

- Increased Institutional Support: More banks will likely adopt crypto, broadening transaction capabilities.

- Consumer Protection Mechanisms: Focus will be placed on ensuring users have the necessary tools and information to protect their investments.

Conclusion

As the digital currency ecosystem matures, understanding the MB Bank crypto transaction limits becomes increasingly critical. Adopting best practices and staying informed about market trends in regards to security and compliance will ensure a positive experience in cryptocurrency trading. As a user, investing time in learning about transaction limits will not only enhance your trading experience but also add to your overall security ecosystem.

For more information on navigating cryptocurrency regulations and enhancing your trading skills, consider checking out hibt.com for additional resources.

This article was authored by Dr. Thang Nguyen, a blockchain security expert with over 10 publications in the field and a leading role in auditing well-known projects. Stay safe and informed in your crypto journey.